Question

INFINITY is a company that focuses on building high-quality computers for customers. Our mission is to build the most convenient, accessible, and superior computer that

INFINITY is a company that focuses on building high-quality computers for customers. Our mission is to build the most convenient, accessible, and superior computer that will allow you to go above and beyond. We work hard day in and day out to accomplish our goal. All the decisions that we make are based on our mission. For example, we produce 2 different types of computers. A desktop model that is focused to target the Costcutter segment in the market and provides our customers with a convenient and accessible device. Our second model is a laptop, which was designed to target the Traveler segment, which is a superior computer that can be easy to travel with and work outside of the office.

Our main goal is to provide our customers with high-quality products at the lowest price possible. Taking into consideration our customers' needs and wants we can design products that meet those demands. Additionally, we are constantly looking for ways to improve our product to satisfy our customers. Our next focus as a company is our employees. We make sure that our employees are getting the best compensation for their hard work. Without them we wouldn't be able to be in the market. Our company strives to be the leading company in the market. To achieve this goal, we analyze the current market and study our competitors before we make decisions. This way we are making everything possible to be a step ahead of their company and make better decisions for our future.

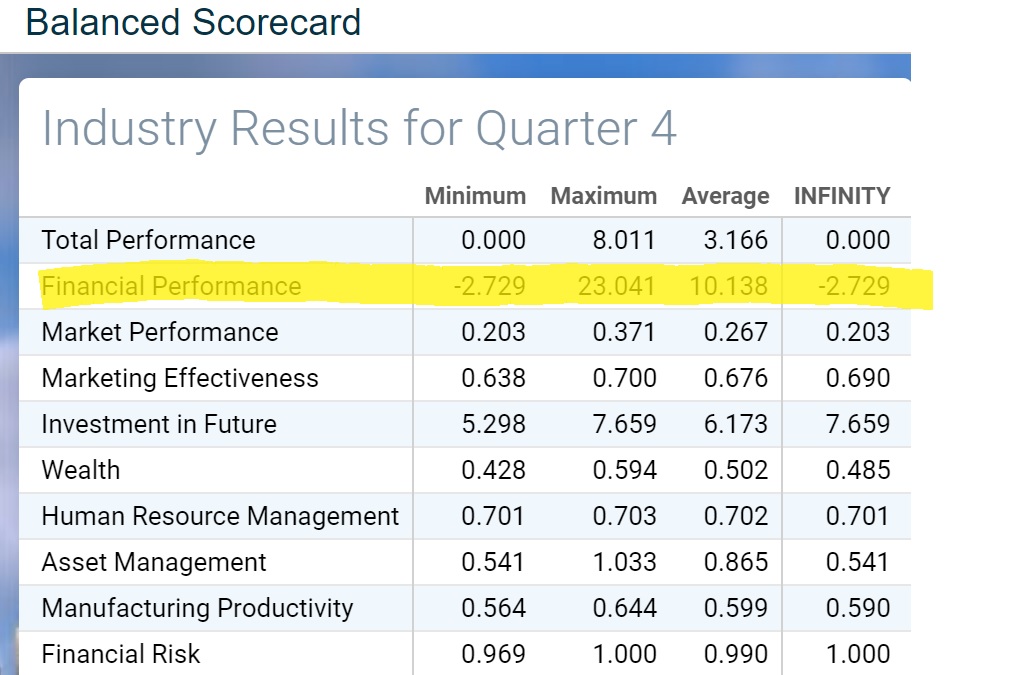

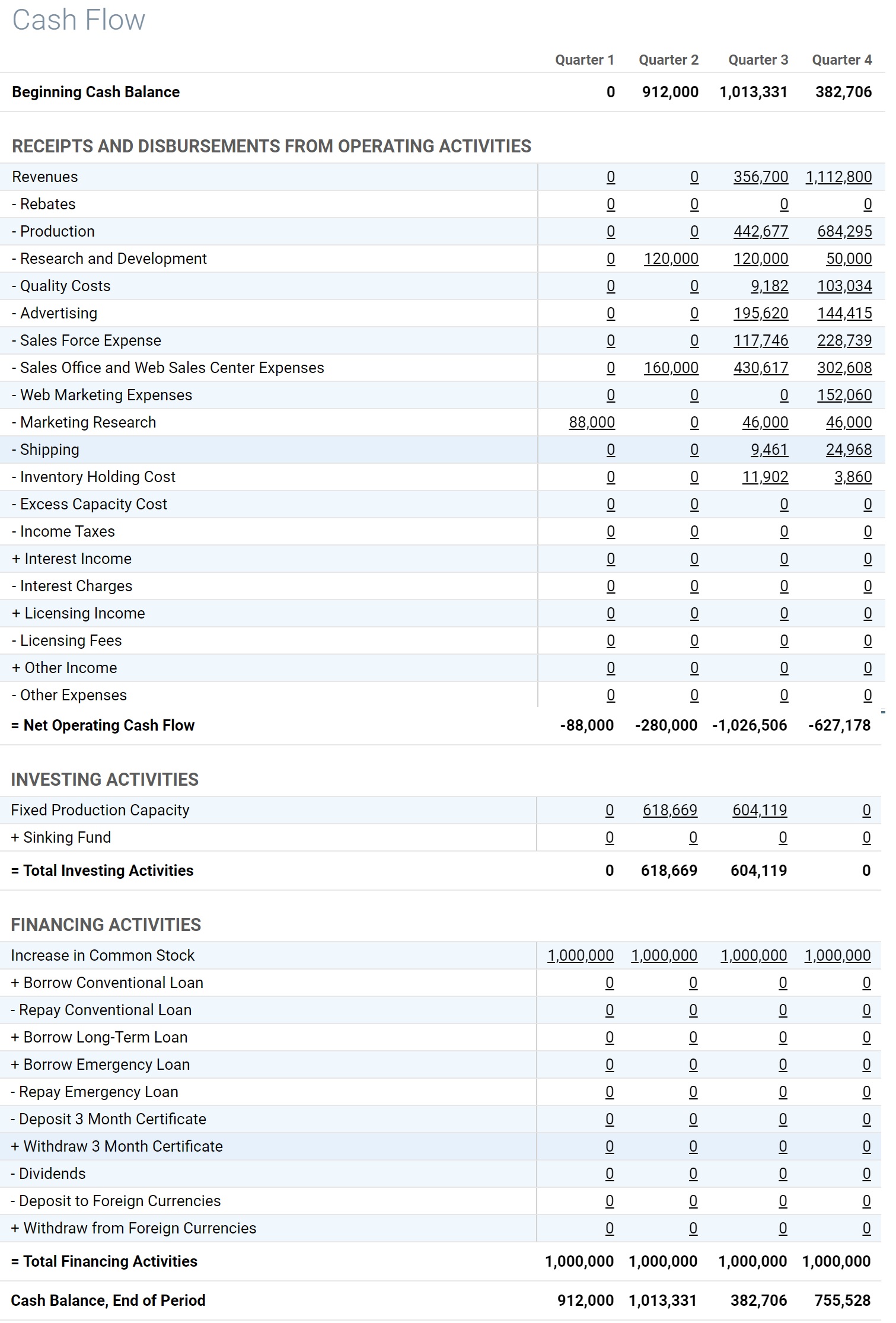

Using the cause-and-effect framework provided by the Kaplan and Norton version of the balanced scorecard, analyze the performance of the company INFINITY for quarter #4 and explain the successes and failures from the financial perspective

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started