Answered step by step

Verified Expert Solution

Question

1 Approved Answer

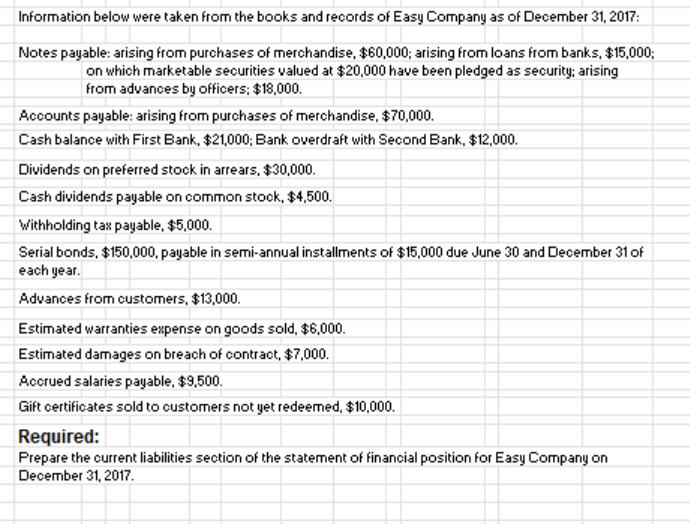

Information below were taken from the books and records of Easy Company as of December 31, 2017: Notes payable: arising from purchases of merchandise,

Information below were taken from the books and records of Easy Company as of December 31, 2017: Notes payable: arising from purchases of merchandise, $60,000; arising from loans from banks, $15,000; on which marketable securities valued at $20,000 have been pledged as security; arising from advances by officers: $18,000. Accounts payable: arising from purchases of merchandise, $70,000. Cash balance with First Bank, $21,000; Bank overdraft with Second Bank, $12,000. Dividends on preferred stock in arrears, $30,000. Cash dividends payable on common stock, $4,500. Withholding tax payable, $5,000. Serial bonds, $150,000, payable in semi-annual installments of $15,000 due June 30 and December 31 of each year. Advances from customers, $13,000. Estimated warranties expense on goods sold, $6,000. Estimated damages on breach of contract, $7,000. Accrued salaries payable, $9,500. Gift certificates sold to customers not yet redeemed, $10,000. Required: Prepare the current liabilities section of the statement of financial position for Easy Company on December 31, 2017.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the current liabilities section of the statement of financial position also known as the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started