Question

Information for Inforcart Budgets. Infocart produces technology software. The software sales for the next 5 months are projected to be: January 15,000 February 18,000 March

Information for Inforcart Budgets.

Infocart produces technology software. The software sales for the next 5 months are projected to be:

January 15,000

February 18,000

March 21,000

April 24,000

May 26,000

The following information pertains to the budget assumptions.

- Finished goods inventory on January 1 is expected to be 5000 units. The desired ending FGI for any month (except for the Dec 31 inventory as noted previously) is expected to be 17% of the following months sales.

- Data for materials used are:

Part A87 4 parts per unit $5.60 per part

Part D33 3 parts per unit $4.75 per part

Raw materials ending inventory is always budgeted to equal 22% of the following months

production needs.

On March 31, the ending inventory of A87 is expected to be 40,000 parts and for D33 is

expected to be 30,000 parts.

- Payments for Raw materials purchases are on the following schedules:

20% paid in the month of purchase and

80% in the month following purchase.

Accounts payable as of January 1 is $0.00.

- Direct labor used per harness is 1.5 hours at a rate of $15/hr.

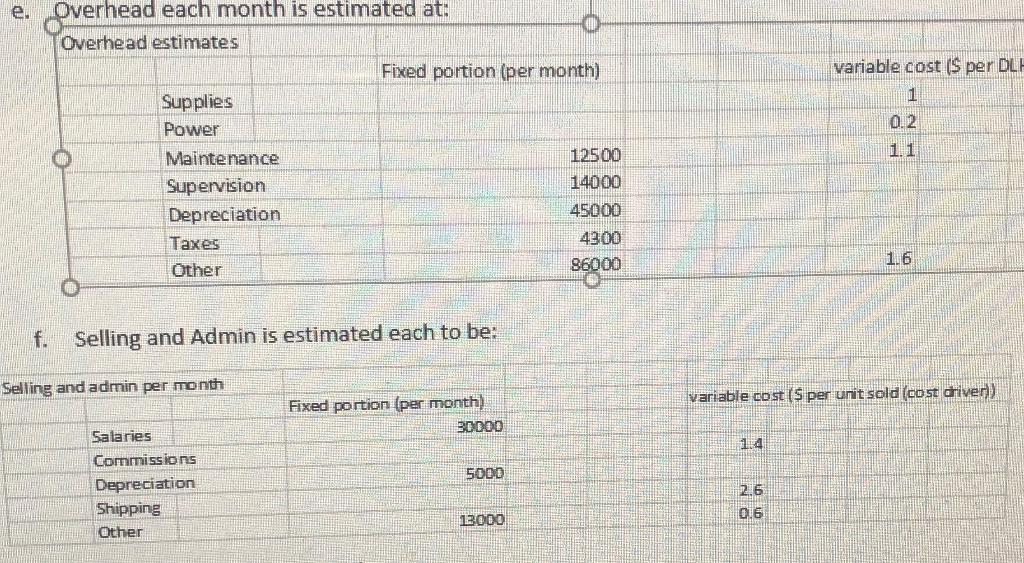

- Overhead each month is estimated at:

- Selling and Admin is estimated each to be:

- Selling price per software is $110.00.

- Sales are all on account. 40% of sales are collected in the month of sale and 60% in the month following the sale. Accounts receivable on January 1 is $30,000.

- February is a planned purchase of equipment for $435,000.

- Borrowings are at 6% per year interest, and borrowings are assumed to be at the beginning of the month required and at the end of the month of repayment. January 1 beginning cash is $10,000. Interest on borrowings is paid before any principal can be paid. To the extent possible, the company strives to repay any debt at the end of each month if there is cash available. Minimum cash balance at the end of any month is $10,000.

Prepare the following budget for each month of the first quarter and for the quarter in total. There should be no numbers directly keyed into any budget. Please ensure each budget is properly formatted so it can be pasted into excel.

All budgets should be formulae and cell references: there should be no Values directly keyed in any of your budgets. All the numbers in the cells should have algebraic formulae (eg use sum function), or the cells would have a cell reference to the data sheet (eg use =data!C5 to refer to the January sales volume).

1. Direct labor budget

2. Overhead budget

e Overhead each month is estimated at: Overhead estimates Fixed portion (per month) variable cost ($ per DL 1 02 Supplies Power Maintenance Supervision Depreciation Taxes Other 12500 14000 45000 4300 86000 f. Selling and Admin is estimated each to be: Selling and admin per month variable cost (S per unit sold (cost driver) Fixed portion (per month) 30000 14 500D Salaries Commissions Depreciation Shipping Other 2.6 13000 0.6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started