Question

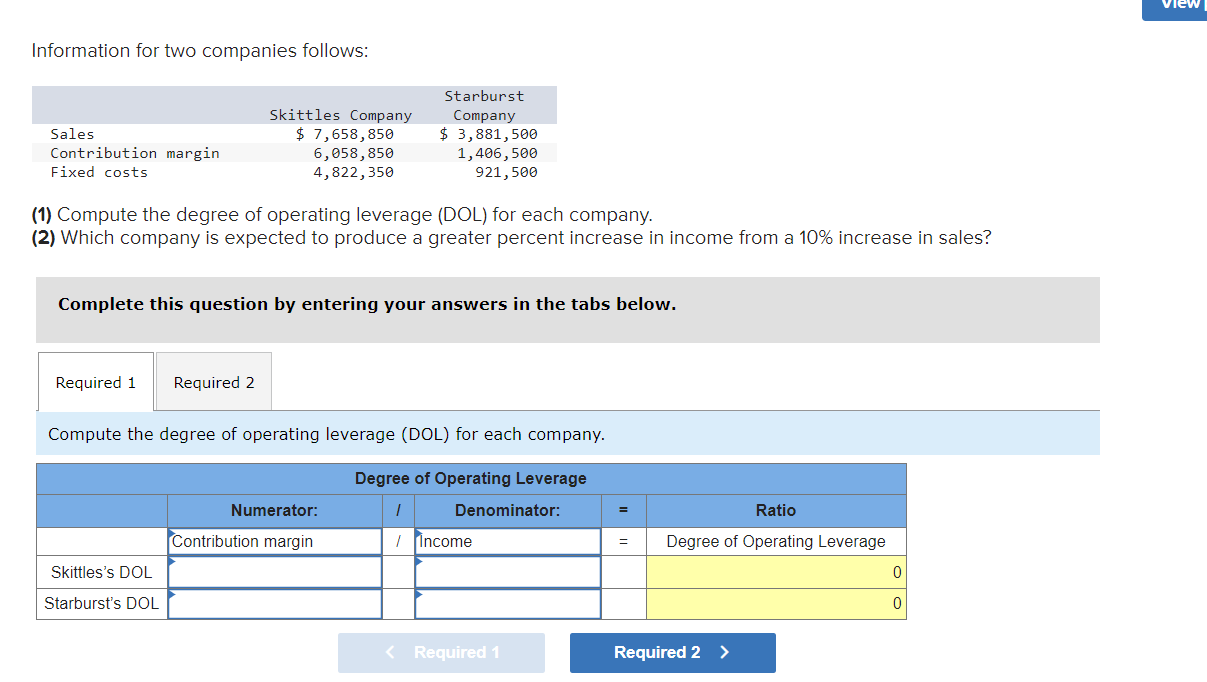

Information for two companies follows: Skittles Company Sales Contribution margin Fixed costs $ 7,658,850 6,058,850 4,822,350 Starburst Company $ 3,881,500 1,406,500 921,500 (1) Compute

Information for two companies follows: Skittles Company Sales Contribution margin Fixed costs $ 7,658,850 6,058,850 4,822,350 Starburst Company $ 3,881,500 1,406,500 921,500 (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 10% increase in sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the degree of operating leverage (DOL) for each company. Degree of Operating Leverage Numerator: Denominator: Contribution margin / Income Skittles's DOL Starburst's DOL = Ratio = Degree of Operating Leverage 0 0 < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial and Managerial Accounting

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

5th edition

9780133851281, 013385129x, 9780134077321, 133866297, 133851281, 9780133851298, 134077326, 978-0133866292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App