Question

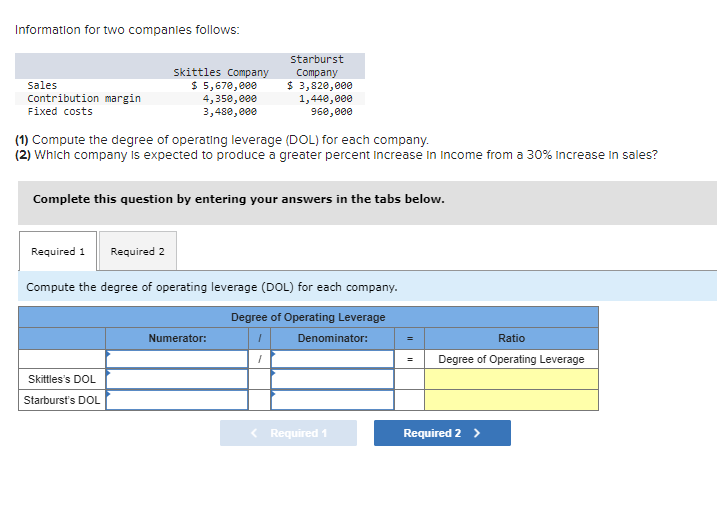

Information for two companies follows: Skittles Company Sales Contribution margin Fixed costs $ 5,670,000 4,350,000 3,480,000 Starburst Company $ 3,820,000 1,440,000 960,000 (1) Compute

Information for two companies follows: Skittles Company Sales Contribution margin Fixed costs $ 5,670,000 4,350,000 3,480,000 Starburst Company $ 3,820,000 1,440,000 960,000 (1) Compute the degree of operating leverage (DOL) for each company. (2) Which company is expected to produce a greater percent increase in income from a 30% Increase in sales? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the degree of operating leverage (DOL) for each company. Skittles's DOL Starburst's DOL Degree of Operating Leverage Numerator: Denominator: = = Ratio Degree of Operating Leverage < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

2nd edition

978-1119036357, 1119036356, 1118338413, 1118334264, 978-1118338414, 978-1118334263

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App