information given

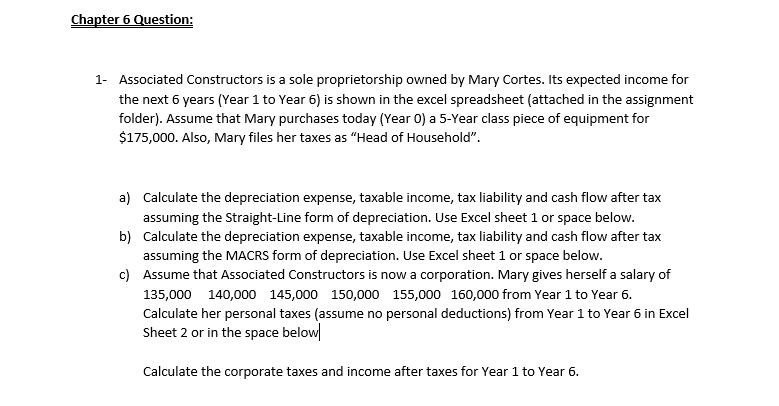

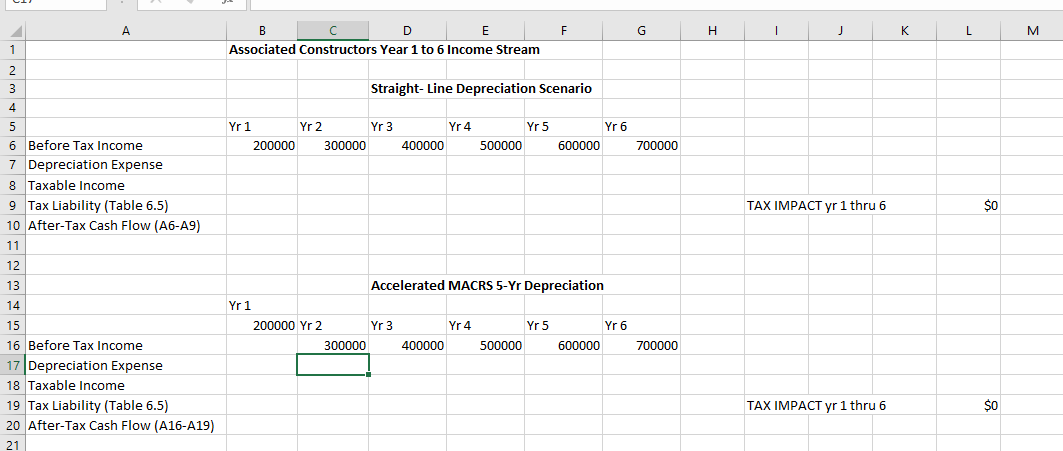

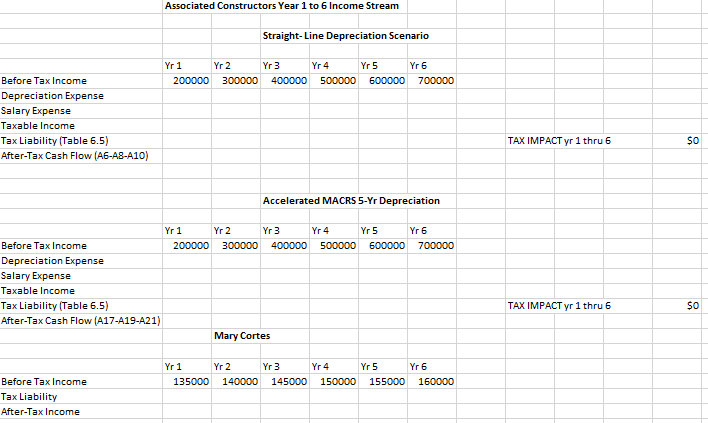

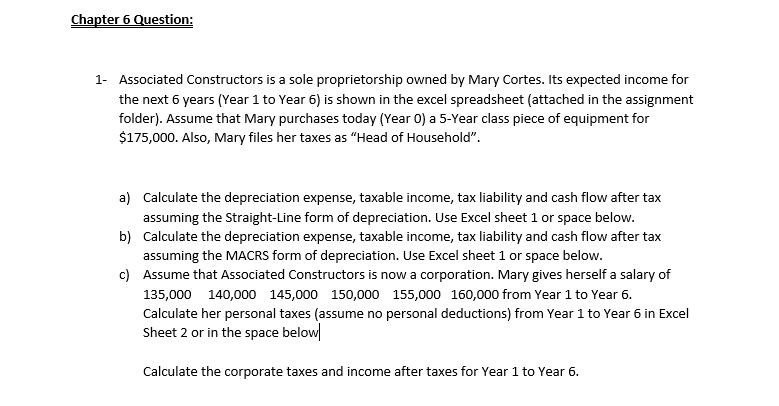

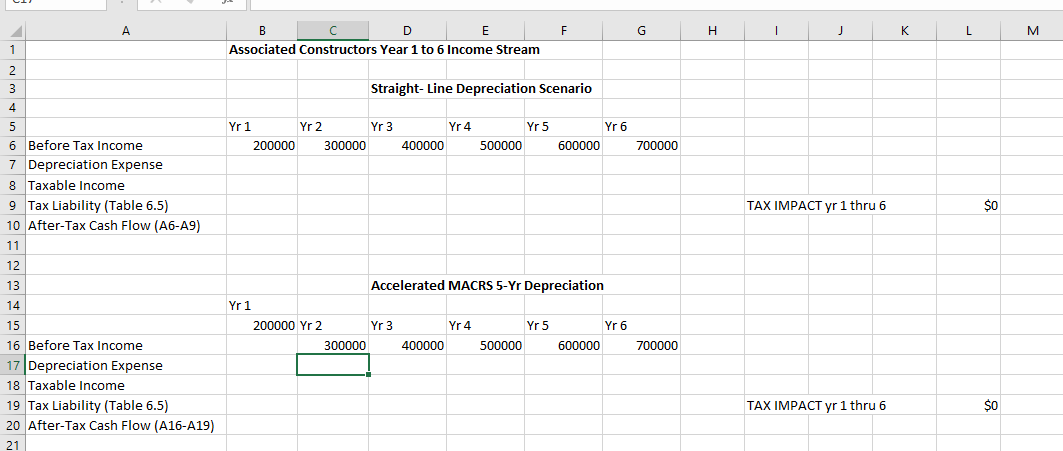

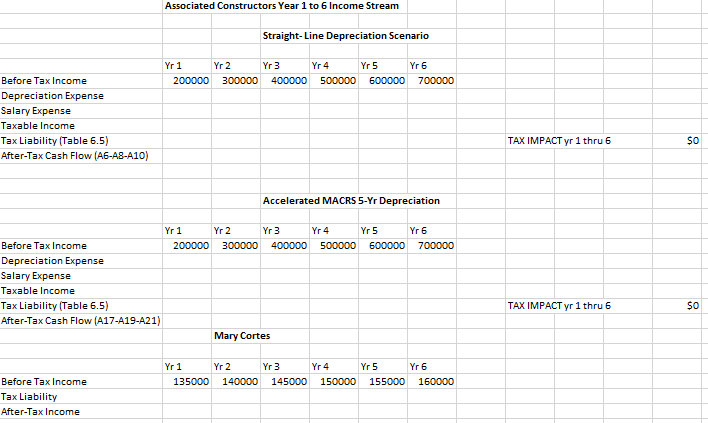

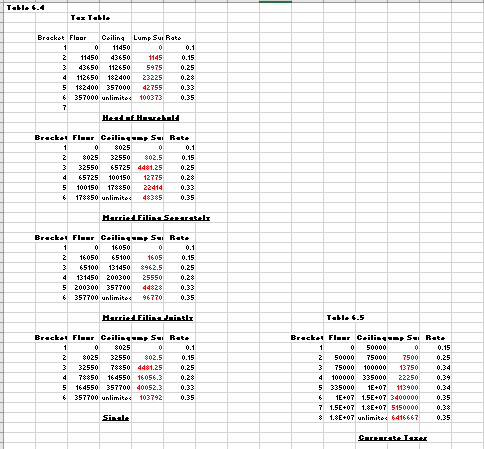

Chapter 6 Question: 1- Associated Constructors is a sole proprietorship owned by Mary Cortes. Its expected income for the next 6 years (Year 1 to Year 6) is shown in the excel spreadsheet (attached in the assignment folder). Assume that Mary purchases today (Year O) a 5-Year class piece of equipment for $175,000. Also, Mary files her taxes as "Head of Household". a) Calculate the depreciation expense, taxable income, tax liability and cash flow after tax assuming the Straight-Line form of depreciation. Use Excel sheet 1 or space below. b) Calculate the depreciation expense, taxable income, tax liability and cash flow after tax assuming the MACRS form of depreciation. Use Excel sheet 1 or space below. Assume that Associated Constructors is now a corporation. Mary gives herself a salary of 135,000 140,000 145,000 150,000 155,000 160,000 from Year 1 to Year 6. Calculate her personal taxes (assume no personal deductions) from Year 1 to Year 6 in Excel Sheet 2 or in the space below Calculate the corporate taxes and income after taxes for Year 1 to Year 6. F G H I B C D E Associated Constructors Year 1 to 6 Income Stream K L M Straight-Line Depreciation Scenario Yr 6 Yr1 Yr 2 Yr3 200000 300000 Yr4 400000 Yr 5 500000 600000 700000 6 Before Tax Income 7 Depreciation Expense 8 Taxable income 9 Tax Liability (Table 6.5) 10 After-Tax Cash Flow (A6-A9) TAX IMPACT yr 1 thru 6 Accelerated MACRS 5-Yr Depreciation Yr 1 200000 Yr 2 Vr2 Yr 3 Yr 6 Yr 4 400000 Yr 5 500000 600000 700000 16 Before Tax Income 17 Depreciation Expense 18 Taxable income 19 Tax Liability (Table 6.5) 20 After-Tax Cash Flow (A16-A19) 21 TAX IMPACT yr 1 thru 6 Associated Constructors Year 1 to 6 Income Stream Straight-Line Depreciation Scenario Yr1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 200000 300000 400000 500000 600000 700000 Before Tax Income Depreciation Expense Salary Expense Taxable income Tax Liability (Table 6.5) After-Tax Cash Flow (A6-A8-A10) TAX IMPACT yr 1 thru 6 $0 Accelerated MACRS 5-Yr Depreciation Yr 1 Yr 2 Yr 3 Yr 4 Yr 5 Yr 6 Before Tax Income 200000 300000 400000 500000 600000 700000 Depreciation Expense Salary Expense Taxable income Tax Liability (Table 6.5) After-Tax Cash Flow (A17-A19-A21) Mary Cortes TAX IMPACT yr 1 thru 6 SO Yr 1 Yr 2 Yr 3 Yr 4 135000 140000 145000 150000 Yr 5 155000 Yr 6 160000 Before Tax Income Tax Liability After-Tax Income Bracket Floor Ceiling Lump Sui Rate 1 0 11450 11450 43650 1145 0.15 43650 112650 5975 0.25 112650 182400 23225 0.28 5 182400 357000 42755 0.33 357000 unlimites 100373 0.35 Hvik E Floor Ceilis S Ratt 3 8025 32550 802.5 32550 65725 4481.25 65725 100 150 12775 100150 170850 22414 178850 unlimites 48385 0.15 0.25 0.28 5 0.35 HarriaFillal cka! Fleur Ceiling IDS Rate O 16050 16050 65100 1605 0.15 3 65100 131450 8962.5 0.25 131450 20030025550 0.28 5 200300 357700 44828 0.33 357700 unlimites 96770 0.35 Harris FHLit Table 4.5 Fleur Ceiling S Rate 0.15 0.25 32550 802.5 78850 4481.25 78850 164550 16056.3 164550 357700 40052.3 57700 unlimited 103792 3 4 Ceilingsps Rate 0 500000 0 .15 50000 75000 7500 0.25 75000 100000 13750 0.34 100000 335000 22250 0.39 335000 1E+07 113900 0.34 1E+07 1.5E+07 3400000 0.35 1.5E+07 1.8E+07 5150000 0.38 1.8E+07 unlimites 6416667 0.35 0.33 5 7 8 C e Luxe