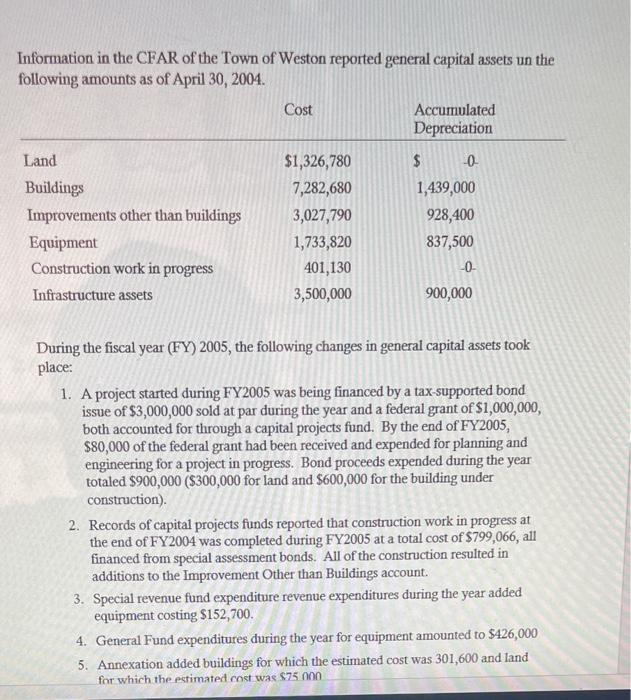

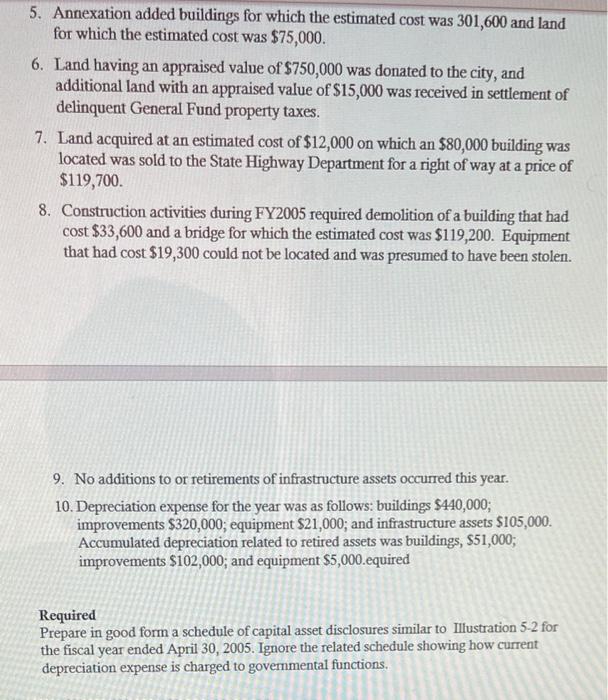

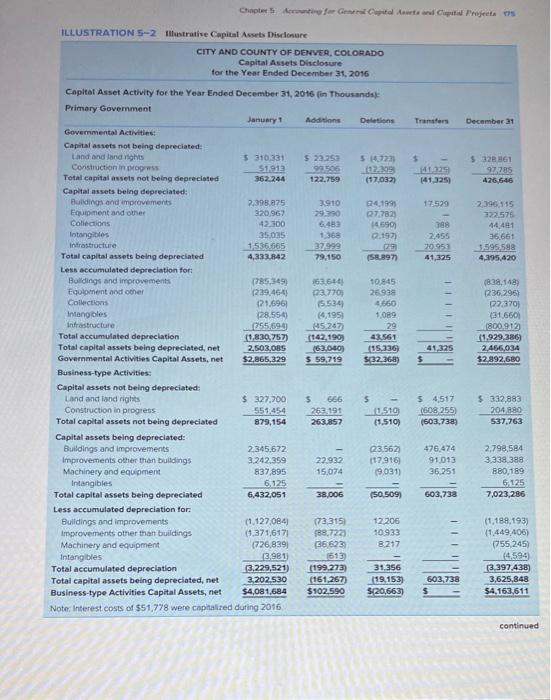

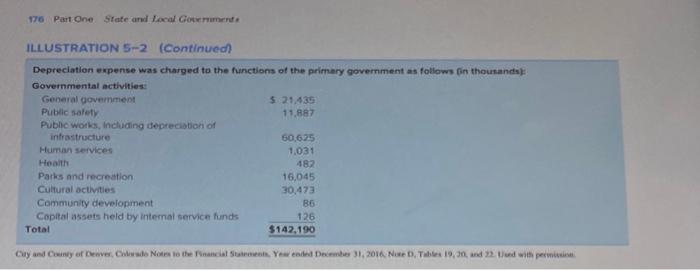

Information in the CFAR of the Town of Weston reported general capital assets un the following amounts as of April 30, 2004. Cost Accumulated Depreciation Land $1,326,780 $ 0 Buildings 7,282,680 1,439,000 Improvements other than buildings 3,027,790 928,400 Equipment 1,733,820 837,500 Construction work in progress 401,130 LO Infrastructure assets 3,500,000 900,000 During the fiscal year (FY) 2005, the following changes in general capital assets took place: 1. A project started during FY2005 was being financed by a tax-supported bond issue of $3,000,000 sold at par during the year and a federal grant of $1,000,000, both accounted for through a capital projects fund. By the end of FY2005, $80,000 of the federal grant had been received and expended for planning and engineering for a project in progress. Bond proceeds expended during the year totaled $900,000 ($300,000 for land and $600,000 for the building under construction) 2. Records of capital projects funds reported that construction work in progress at the end of FY2004 was completed during FY2005 at a total cost of $799,066, all financed from special assessment bonds. All of the construction resulted in additions to the Improvement Other than Buildings account. 3. Special revenue fund expenditure revenue expenditures during the year added equipment costing $152,700. 4. General Fund expenditures during the year for equipment amounted to $426,000 5. Annexation added buildings for which the estimated cost was 301,600 and land for which the estimated cost was $75.000 5. Annexation added buildings for which the estimated cost was 301,600 and land for which the estimated cost was $75,000. 6. Land having an appraised value of $750,000 was donated to the city, and additional land with an appraised value of $15,000 was received in settlement of delinquent General Fund property taxes. 7. Land acquired at an estimated cost of $12,000 on which an $80,000 building was located was sold to the State Highway Department for a right of way at a price of $119,700. 8. Construction activities during FY2005 required demolition of a building that had cost $33,600 and a bridge for which the estimated cost was $119,200. Equipment that had cost $19,300 could not be located and was presumed to have been stolen. 9. No additions to or retirements of infrastructure assets occurred this year. 10. Depreciation expense for the year was as follows: buildings $440,000; improvements $320,000; equipment $21,000; and infrastructure assets $105,000. Accumulated depreciation related to retired assets was buildings, S51,000; improvements $102,000; and equipment $5,000.equired Required Prepare in good form a schedule of capital asset disclosures similar to Illustration 5-2 for the fiscal year ended April 30, 2005. Ignore the related schedule showing how current depreciation expense is charged to governmental functions. Chapter 5 fort Aucted Projectes Transfers December 21 $ 141.17 (41.3259 $3261 97.785 426,646 17.529 388 2.455 20.953 41.325 2,396,115 322575 44.481 36.661 1595598 4,395420 ILLUSTRATION 5-2 Tistrative Capital Assets Disclosure CITY AND COUNTY OF DENVER, COLORADO Capital Assets Disclosure for the Year Ended December 31, 2016 Capital Asset Activity for the Year Ended December 31, 2016 (in Thousands Primary Government January 1 Additions Delations Governmental Activities: Capital assets not being depreciated: Land and land rights $310.331 $ 22.753 5 4.723 Construction in progress 51.913 90505 12.30 Total capital assets not being depreciated 362.244 122,759 (17.032 Capital assets being depreciated: Buildings and improvements 2,398.875 3.910 04.1999 Equipment and other 320,967 29.390 027.782 Collections 42.300 6.482 145901 Intangibles 35035 1.36 12.197) Infrastructure 1536.665 37999 29 Total capital assets being depreciated 4,333,842 79,150 (58.897) Less accumulated depreciation for: Buildings and improvements 1785.349) 163 644 10,845 Equipment and other 1239.464) 23.770 25938 Collections 121.696 5634 4660 Intangibles (28.554) 4.195 1.089 Infrastructure 255,694 45.247 29 Total accumulated depreciation (1.830,757) 1142.199 42,561 Total capital assets being depreciated, net 2,503,OBS 163.040) (15.336 Governmental Activities Capital Assets, net $2,865,329 $ 59,719 S32 368) Business-type Activities: Capital assets not being depreciated: Land and land rights $ 327,700 5 666 Construction in progress 551.454 263191 0510 Total capital assets not being depreciated 879,154 263.857 (1,510) Capital assets being depreciated: Buildings and improvements 2345,672 23.562 Improvements other than buildings 3.242.359 22932 (17.916) Machinery and equipment 837,895 15.074 19,031) Intangibles 6.125 Total capital assets being depreciated 6,432,051 38,006 (50.509 Less accumulated depreciation for Buildings and improvements (1.127.084 (73.315 12.206 improvements other than buildings (1.371.6171 988,7223 10.933 Machinery and equipment (726,839) 36.623 8.217 Intangibles 3.981 1513 Total accumulated depreciation (3,229,521) (199.273 31.356 Total capital assets being depreciated, net 3.202.530 (161.267) 119,153) Business-type Activities Capital Assets, net $4,081,684 $102.590 $ 20,663) Note: Interest costs of $51,778 were capitalized during 2016 1838,148 1236.296) 22.370) (31.660) (800.912 (1.929,386) 2.466,034 $2.892,680 41 325 54.517 (608 255) (503,738) $ 332,883 204.8.80 537.763 476,474 91013 36.251 2,798,584 3.338 388 880.189 6125 7,023,286 603,738 11,188,193) 11.449,406) (755 245) (4.594 3.397.438 3,625,848 $4.163.611 603,738 continued 176 Part One State and Local Government ILLUSTRATION 5-2 (Continued Depreciation expense was charged to the functions of the primary government as follows in thousands Governmental activities: General government $21.435 Public safety 11.887 Public works, including depreciation of infrastructure 60,625 Human Services 1,031 Health 482 Parks and recreation 16,045 Cultural activities 30,473 Community development B6 Capital assets held by internal service funds 126 Total $142,190 Cry and City of Denver, Close Notes to the ancial States. Yew ended December 31, 2016 Ne Tables 19.30and 2. Uued with permis