Answered step by step

Verified Expert Solution

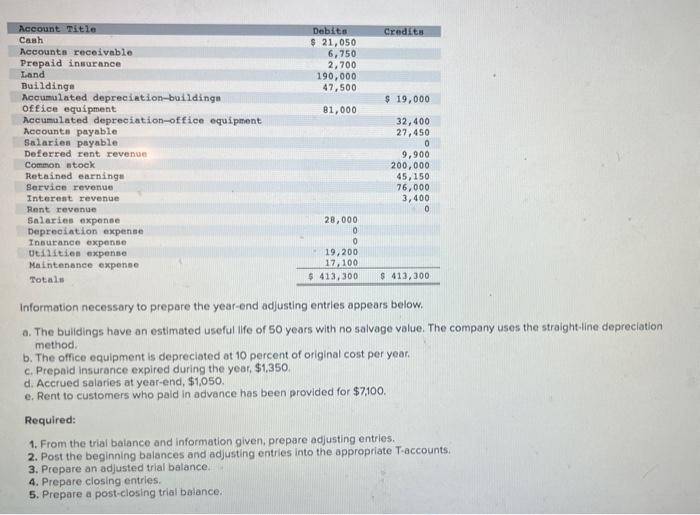

Question

1 Approved Answer

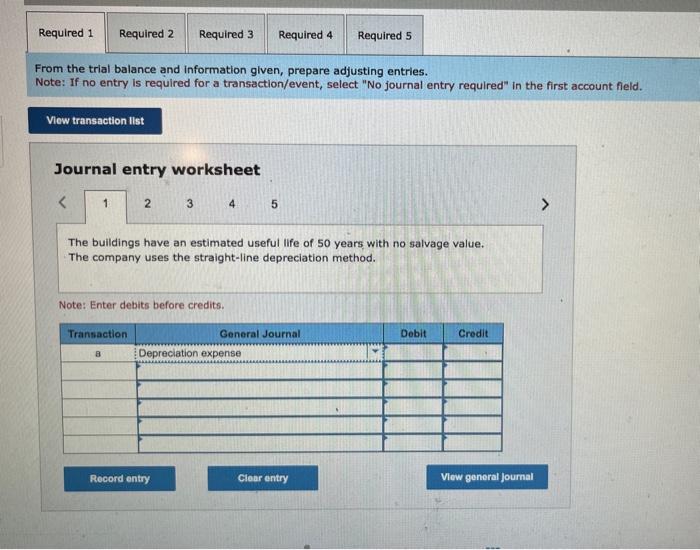

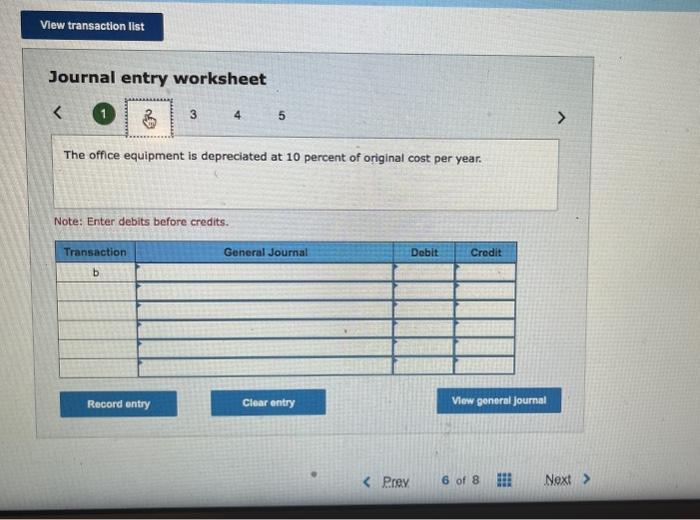

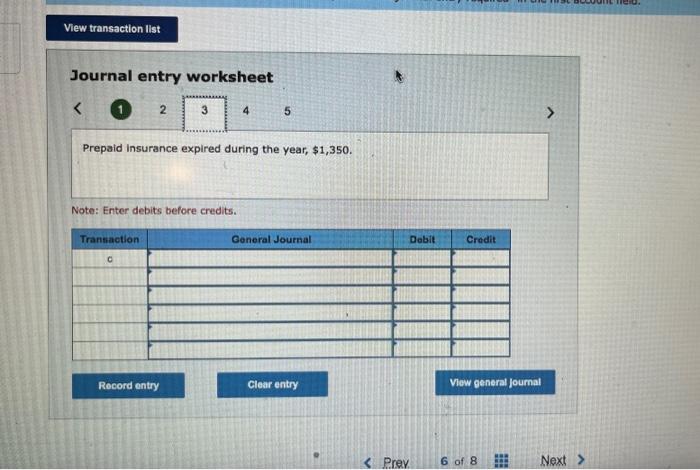

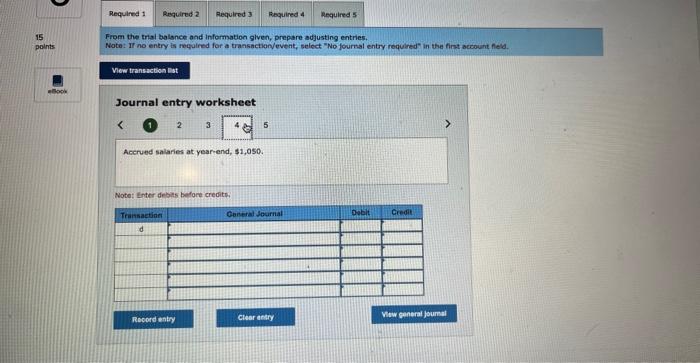

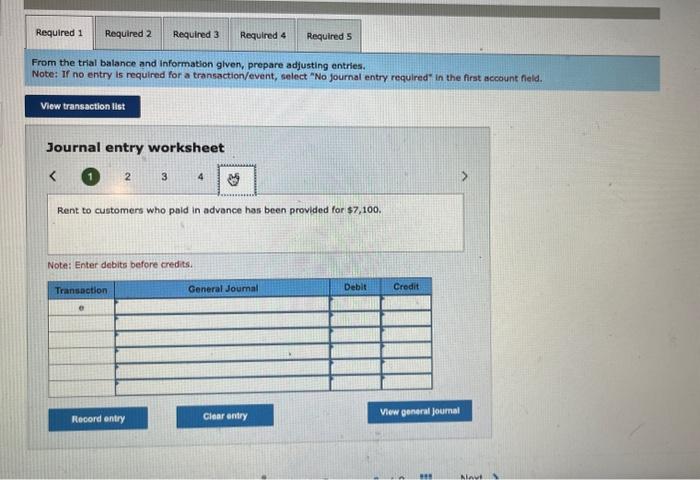

Information necessary to prepare the year-end adjusting entries appears below. a. The bulidings have an estimated useful life of 50 years with no salvage value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started