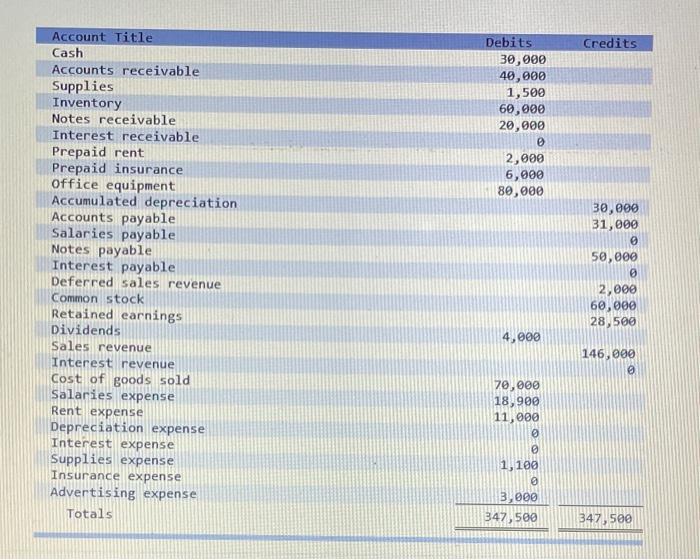

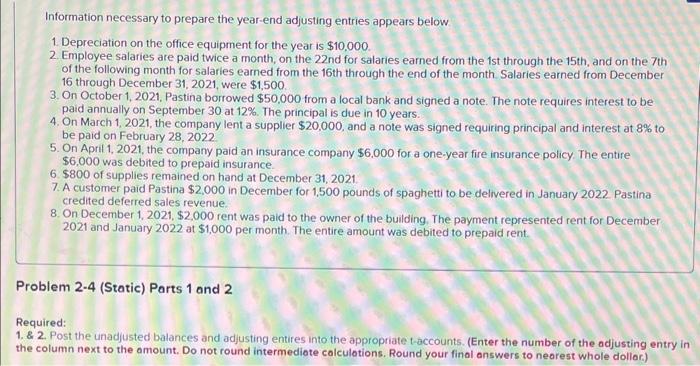

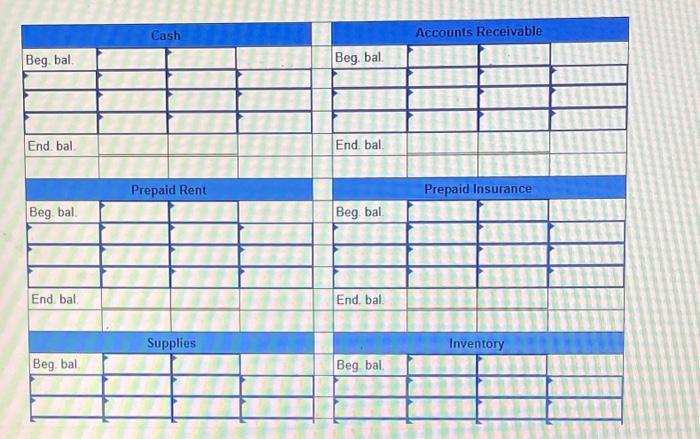

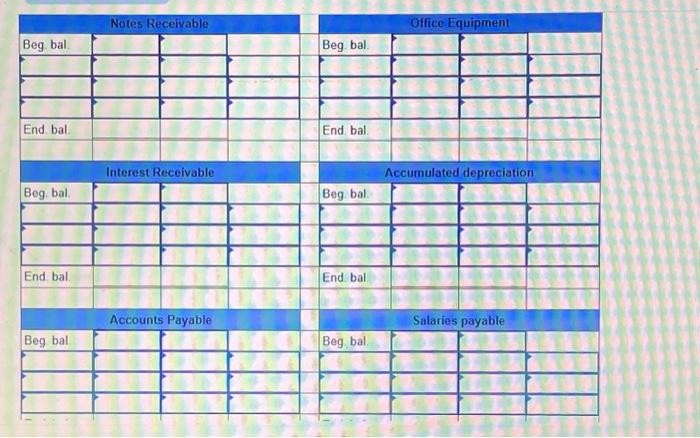

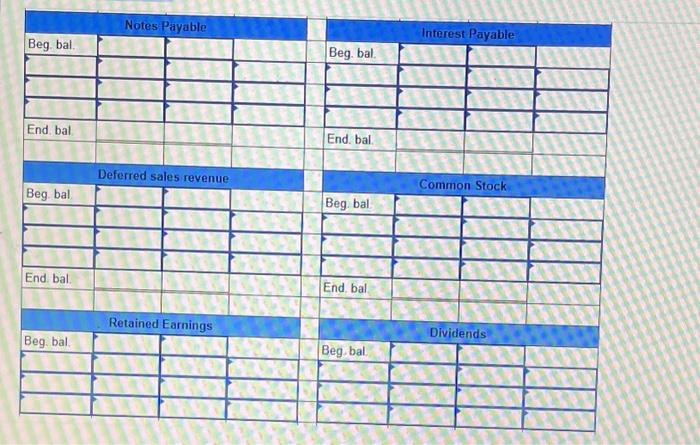

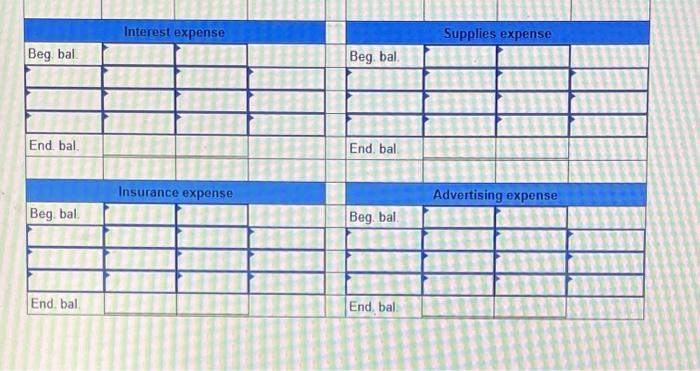

Information necessary to prepare the year-end adjusting entries appears below 1. Depreciation on the office equipment for the year is $10,000. 2. Employee salaries are paid twice a month, on the 22 nd for salaries earned from the 1st through the 15 th, and on the 7 th of the following month for salaries earned from the 16 th through the end of the month. Salaries earned from December 16 through December 31 , 2021, were $1,500. 3. On October 1, 2021. Pastina borrowed $50,000 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. 4. On March 1, 2021, the company lent a supplier $20,000, and a note was signed requiring principal and interest at 8% to be paid on February 28, 2022 5. On April 1, 2021, the company paid an insurance company $6,000 for a one-year fire insurance policy. The entire $6,000 was debited to prepaid insurance. 6. $800 of supplies remained on hand at December 31, 2021. 7. A customer paid Pastina $2,000 in December for 1,500 pounds of spaghetti to be delivered in January 2022 . Pastina credited deferred sales revenue. 8. On December 1, 2021, \$2,000 rent was paid to the owner of the building. The payment represented rent for December 2021 and January 2022 at $1,000 per month. The entire amount was debited to prepaid rent. Problem 2-4 (Static) Parts 1 and 2 Required: 1. \& 2. Post the unadjusted balances and adjusting entires into the appropriate t-accounts. (Enter the number of the adjusting entry in the column next to the amount. Do not round intermediote calculotions. Round your final answers to neorest whole dollar.) \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline Beg. bal. & \multicolumn{3}{|c|}{ Notes Receivable } & & & & & \end{tabular} \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline Beg. bal. Notes Payable & & & & & & & \end{tabular} Salaries expense \begin{tabular}{|l|l|l|l|} \hline Beg. bal. & & & \\ \hline & & & \\ \hline & & & \\ \hline End. bal & & & \\ \hline & & & \\ \hline \end{tabular} Depreciation expense \begin{tabular}{|l|l|l|l|l|l|l|} \hline Beg. bal. & & & & & & \end{tabular}