Answered step by step

Verified Expert Solution

Question

1 Approved Answer

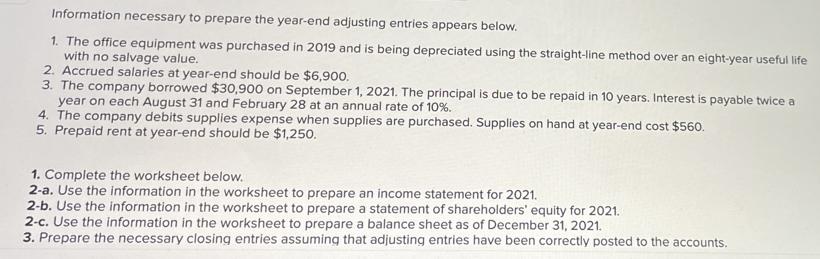

Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2019 and is being depreciated using the

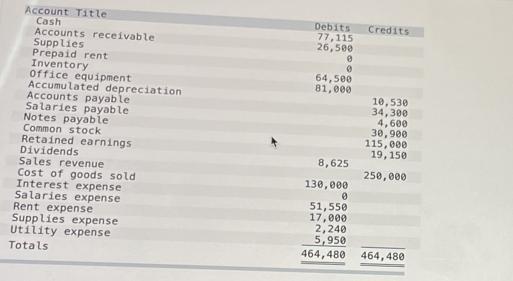

Information necessary to prepare the year-end adjusting entries appears below. 1. The office equipment was purchased in 2019 and is being depreciated using the straight-line method over an eight-year useful life with no salvage value. 2. Accrued salaries at year-end should be $6,900. 3. The company borrowed $30,900 on September 1, 2021. The principal is due to be repaid in 10 years. Interest is payable twice a year on each August 31 and February 28 at an annual rate of 10%. 4. The company debits supplies expense when supplies are purchased. Supplies on hand at year-end cost $560. 5. Prepaid rent at year-end should be $1,250. 1. Complete the worksheet below. 2-a. Use the information in the worksheet to prepare an income statement for 2021. 2-b. Use the information in the worksheet to prepare a statement of shareholders' equity for 2021. 2-c. Use the information in the worksheet to prepare a balance sheet as of December 31, 2021. 3. Prepare the necessary closing entries assuming that adjusting entries have been correctly posted to the accounts. Account Title Cash Accounts receivable Supplies Prepaid rent Inventory Office equipment Accumulated depreciation Accounts payable Salaries payable Notes payable Common stock Retained earnings Dividends Sales revenue Cost of goods sold Interest expense Salaries expense Rent expense Supplies expense Utility expense Totals Debits 77,115 26,500 0 0 64,500 81,000 8,625 130,000 0 51,550 17,000 Credits 10,530 34,300 4,600 30,900 115,000 19, 150 250,000 2,240 5,950 464,480 464, 480

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Complete the worksheet Account Title Trial Balance Adjustments Adjusted Trial Balance Cash 77115 771...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started