Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information on a prospective investment for Wells Financial Services is given Loan Funds Available Investment Income (% of previous period's investment) Maximum Investment Payroll

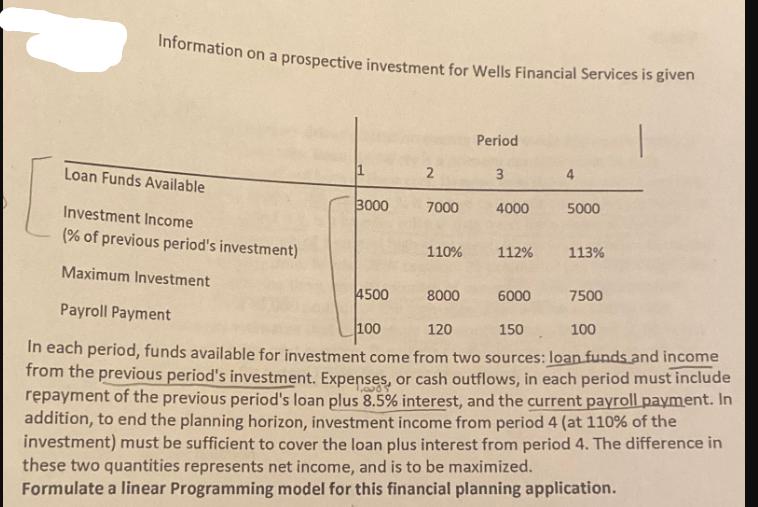

Information on a prospective investment for Wells Financial Services is given Loan Funds Available Investment Income (% of previous period's investment) Maximum Investment Payroll Payment Period 1 2 3 3000 7000 4000 5000 110% 112% 113% 4500 8000 6000 7500 100 120 150 100 In each period, funds available for investment come from two sources: loan funds and income from the previous period's investment. Expenses, or cash outflows, in each period must include repayment of the previous period's loan plus 8.5% interest, and the current payroll payment. In addition, to end the planning horizon, investment income from period 4 (at 110% of the investment) must be sufficient to cover the loan plus interest from period 4. The difference in these two quantities represents net income, and is to be maximized. Formulate a linear Programming model for this financial planning application.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started