Information

Parts to be completed

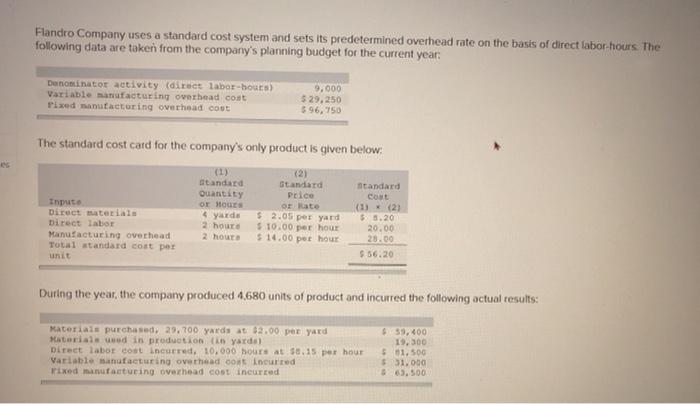

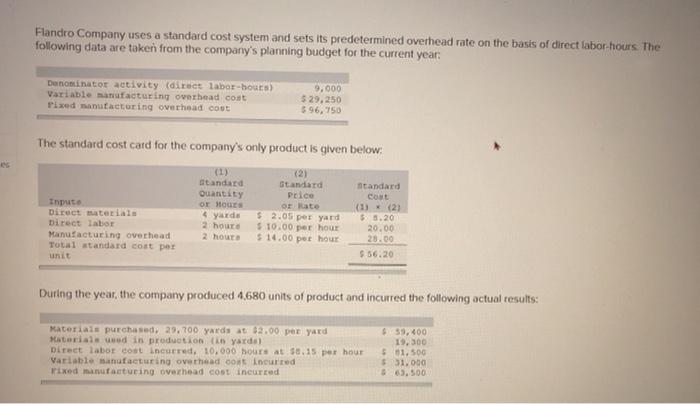

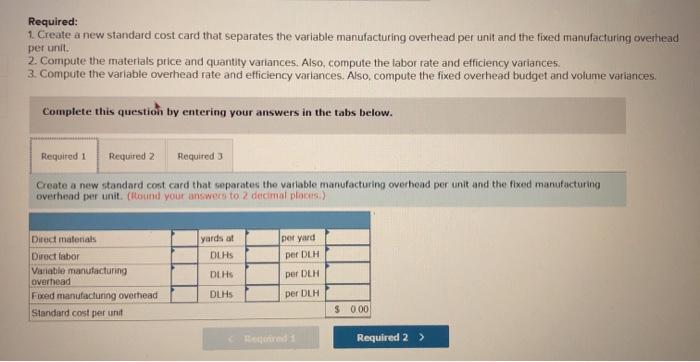

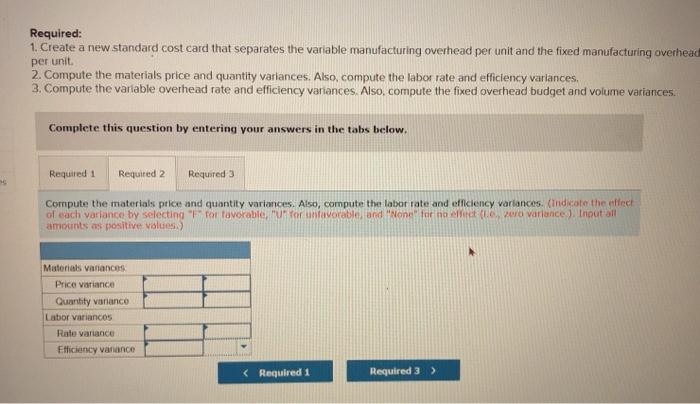

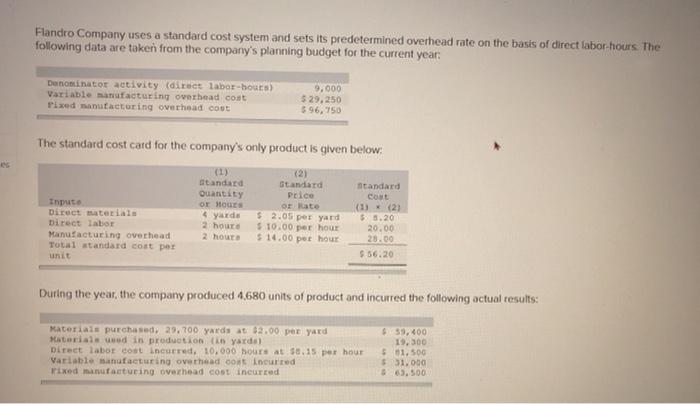

Flandro Company uses a standard cost system and sets its predetermined overhead rate on the basis of direct labor hours. The following data are taken from the company's planning budget for the current year Denominator activity (direct labor-bours) Variable manufacturing overhead cost fixed manufacturing ovechead cout 9,000 $29.250 $ 96,750 The standard cost card for the company's only product is given below: Inpute Direct materials Direct labor Manufacturing overhead Total standard cost per standard Quantity or Hours 4 yanda 2 hours 2 hour Standard Price o late S2.05 per yard $10.00 per hour $14.00 per hour standard Coat (1) (2) $5.20 20.00 28.00 $ 56.20 During the year, the company produced 4,680 units of product and incurred the following actual results: Materiais purchased. 29. 100 yards a $2.00 per yard Materiale din production in yards) Direct labor cost incurred, 10.000 hours at 58.15 per hour Variable Banofacturing overhead oot incurred mixed manufatturing overhead cost incurred $ 39, 400 19,300 $31.500 $31.000 Required: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. 3. Compute the variable overhead rate and efficiency varlances. Also, compute the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. (Round your answers to 2 decimal poons.) per yard Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Standard cost per unit yards at DLHS DEHS per DEH per DLH DLHS Der DLH $ 0.00 Required 2 > Required: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances 3. Compute the variable overhead rate and efficiency variances. Also, compute the fixed overhead budget and volume variances. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. (Indicate the effect of each variance by selecting for favorable, or unfavorable, and "Non for noe vero variance Input all amounts as positive values.) Materials variances Price variance Quantity variance Labor variances Rate variance Ffliciency vanance