Answered step by step

Verified Expert Solution

Question

1 Approved Answer

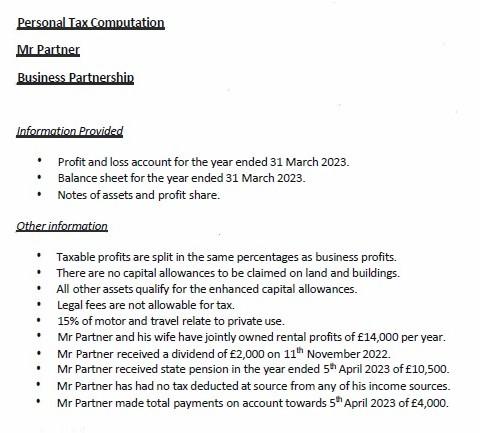

Information Provided - Profit and loss account for the year ended 31 March 2023. - Balance sheet for the year ended 31 March 2023. -

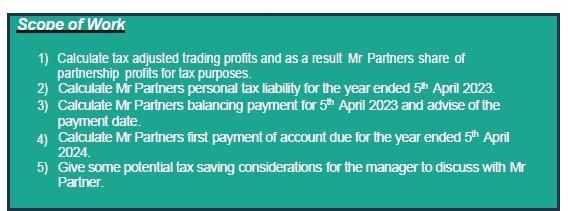

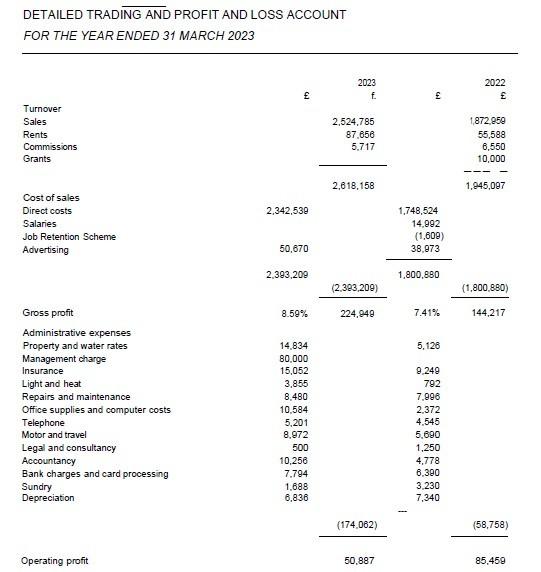

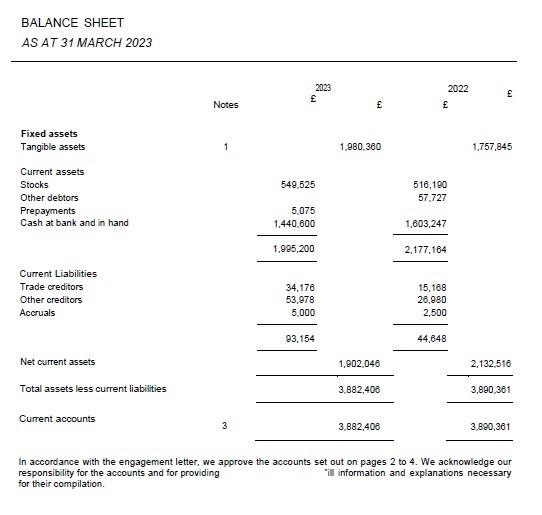

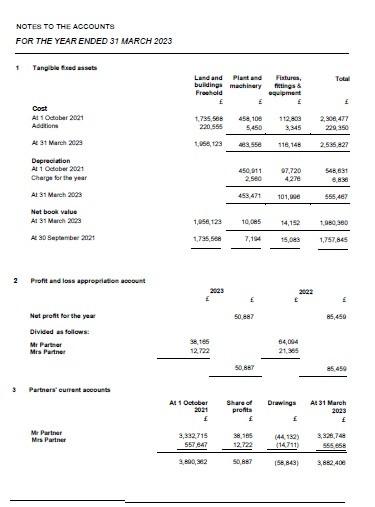

Information Provided - Profit and loss account for the year ended 31 March 2023. - Balance sheet for the year ended 31 March 2023. - Notes of assets and profit share. Otherinformation - Taxable profits are split in the same percentages as business profits. - There are no capital allowances to be claimed on land and buildings. - All other assets qualify for the enhanced capital allowances. - Legal fees are not allowable for tax. - 15% of motor and travel relate to private use. - Mr Partner and his wife have jointly owned rental profits of 14,000 per year. - Mr Partner received a dividend of 2,000 on 11th November 2022. - Mr Partner received state pension in the year ended 5th April 2023 of 10,500. - Mr Partner has had no tax deducted at source from any of his income sources. - Mr Partner made total payments on account towards 5th April 2023 of 4,000. Scope of Work 1) Calculate tax adjusted trading profits and as a result Mr Partners share of partnership profits for tax purposes. 2) Calculate Mr Partners personal tax liability for the year ended 5th April 2023. 3) Calculate Mr Partners balancing payment for 5th April 2023 and advise of the payment date. 4) Calculate Mr Partners first payment of account due for the year ended 5th April 2024. 5) Give some potential tax saving considerations for the manager to discuss with Mr Partner. DETAILED TRADING AND PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 31 MARCH 2023 \begin{tabular}{|c|c|c|c|c|} \hline & & 2023 & & 2022 \\ \hline & & f. & & \\ \hline \multicolumn{5}{|l|}{ Turnover } \\ \hline Sales & & 2,524,785 & & 1,872,850 \\ \hline Rents & & 87,656 & & 55,588 \\ \hline Commissions & & 5,717 & & 6,550 \\ \hline \multirow[t]{3}{*}{ Grants } & & & & 10,000 \\ \hline & & & & --- \\ \hline & & 2,618,158 & & 1,245,097 \\ \hline \multicolumn{5}{|l|}{ Cost of sales } \\ \hline Direct costs & 2,342,539 & & 1,748,524 & \\ \hline Salaries & & & 14,992 & \\ \hline Job Retention Scheme & & & (1,609) & \\ \hline \multirow[t]{3}{*}{ Advertising } & 50,670 & & 38,973 & \\ \hline & 2,393,209 & & 1,800,880 & \\ \hline & & (2,393,209) & & (1,800,890) \\ \hline Gross profit & 8.59% & 224,949 & 7.41% & 144,217 \\ \hline \multicolumn{5}{|l|}{ Administrative expenses } \\ \hline Property and water rates & 14,834 & & 5,126 & \\ \hline Management charge & 80,000 & & & \\ \hline Insurance & 15,052 & & 9,249 & \\ \hline Light and heat & 3,855 & & 792 & \\ \hline Repairs and maintenance & 8.480 & & 7,996 & \\ \hline Office supplies and computer costs & 10,584 & & 2,372 & \\ \hline Telephone & 5,201 & & 4,545 & \\ \hline Motor and travel & 8,972 & & 5,690 & \\ \hline Legal and consultancy & 500 & & 1,250 & \\ \hline Accountancy & 10,256 & & 4,778 & \\ \hline Bank charges and card processing & 7,794 & & 6,390 & \\ \hline Sundry & 1,688 & & 3.230 & \\ \hline \multirow{3}{*}{ Depreciation } & 6,836 & & 7,340 & \\ \hline & & & - & \\ \hline & & (174,062) & & (58,758) \\ \hline Operating profit & & 50,887 & & 85,459 \\ \hline \end{tabular} In accordance with the engagement letter, we approve the accounts set out on pages 2 to 4 . We acknowledge our responsibility for the accounts and for providing "iil information and explanations necessary for their compilation. NOTES TO THE ACCOUNTS FOR THE YEAR ENDED 31 MARCH 2023 1 Tangble fied asats Cost At 1 Cetabar 2021 Abdations Ac 31 Marth 2029 Depreciation At 1 Oestaber 2021 Charge for the year At 31 March 2003 Net book value At 31 Mareh 2003 A2 30 Septenber 2021 2 Profit and loss appropriatlee acooset Net preft for the yea: Divided as follows: Mr Parthet Mra Paitnet 3 Partners' eurract aseouns Mr Partnar Nrs Partner \begin{tabular}{|c|c|c|c|} \hline \begin{tabular}{l} Latd and \\ buildingi \\ Freeleld \end{tabular} & \begin{tabular}{c} Piact and \\ machinary \end{tabular} & & Total \\ \hline & E & & f \\ \hline 1,735,506 & 45a,106 & 112,8009 & 2,300,47 \\ \hline 270.555 & 5,450 & 3,345 & 209.350 \\ \hline \multirow[t]{4}{*}{1,068,129} & a83.55e & 116,148 & 2,536,827 \\ \hline & 450,011 & 07,720 & 54B,65t \\ \hline & 2,560 & 4,2 & 6,830 \\ \hline & 453,471 & 101,000 & 555,467 \\ \hline 1,056,123 & 10,085 & 14,152 & 1,960,960 \\ \hline 1,795,568 & 7,194 & 15,0es & 1,757,845 \\ \hline \end{tabular} z . 50.887 \begin{tabular}{l} 38,165 \\ 12722 \\ \hline \end{tabular} 3022 t E 85,450 85,450 85.450 S0. 867 64,004 27,365 s0,8s7 25.459 \begin{tabular}{l} 54,004 \\ \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline 36,165 & \multirow[b]{2}{*}{50.867} & 64,004 & \multirow[b]{2}{*}{85450} \\ \hline & & & \\ \hline \begin{tabular}{r} At 1 Oeteber \\ 2021 \end{tabular} & \begin{tabular}{c} 8hare of \\ profits \end{tabular} & Drawings & A. 31Nareh \\ \hline i & f & f & f \\ \hline 3,532715 & 38,165 & (44,132) & 3,3281,748 \\ \hline 557 EA? & 12722 & \begin{tabular}{c} (44,152) \\ (14711) \end{tabular} & ses058 \\ \hline 9cog3x2 & 50,867 & 158.848 & 3.802408 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started