Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information regarding task 2: Client: Beach Vibes (Pty) Ltd (Beach Vibes) is a newly formed company. It started trading on 1 February 2022 with

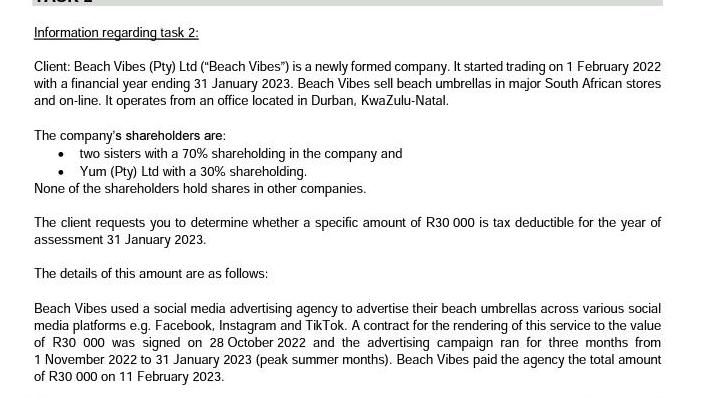

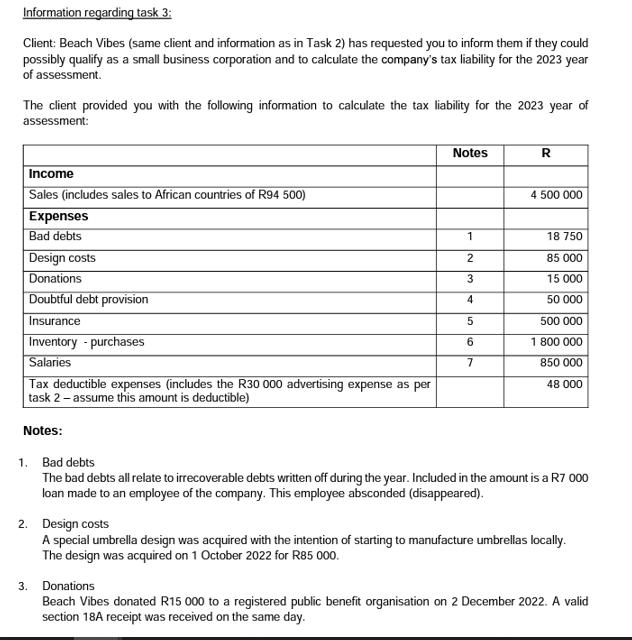

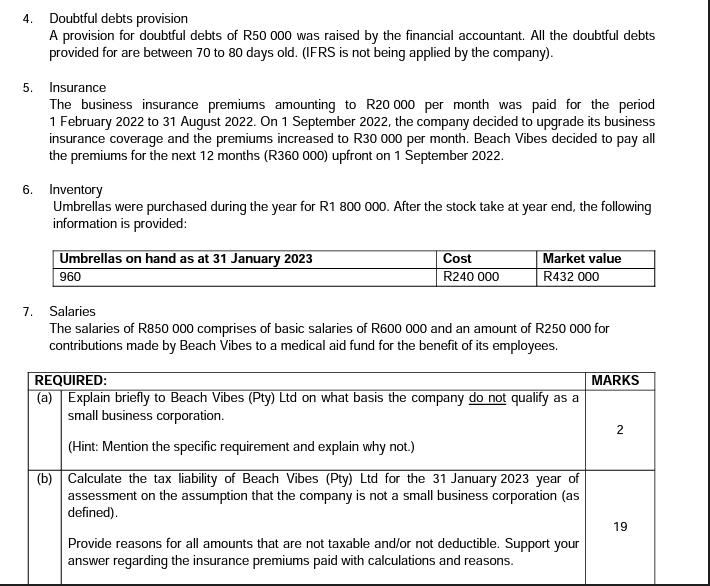

Information regarding task 2: Client: Beach Vibes (Pty) Ltd ("Beach Vibes") is a newly formed company. It started trading on 1 February 2022 with a financial year ending 31 January 2023. Beach Vibes sell beach umbrellas in major South African stores and on-line. It operates from an office located in Durban, KwaZulu-Natal. The company's shareholders are: two sisters with a 70% shareholding in the company and Yum (Pty) Ltd with a 30% shareholding. None of the shareholders hold shares in other companies. The client requests you to determine whether a specific amount of R30 000 is tax deductible for the year of assessment 31 January 2023. The details of this amount are as follows: Beach Vibes used a social media advertising agency to advertise their beach umbrellas across various social media platforms e.g. Facebook, Instagram and TikTok. A contract for the rendering of this service to the value of R30 000 was signed on 28 October 2022 and the advertising campaign ran for three months from 1 November 2022 to 31 January 2023 (peak summer months). Beach Vibes paid the agency the total amount of R30 000 on 11 February 2023. Information regarding task 3: Client: Beach Vibes (same client and information as in Task 2) has requested you to inform them if they could possibly qualify as a small business corporation and to calculate the company's tax liability for the 2023 year of assessment. The client provided you with the following information to calculate the tax liability for the 2023 year of assessment: Income Sales (includes sales to African countries of R94 500) Expenses Bad debts Design costs Donations Doubtful debt provision Insurance Inventory - purchases Salaries Tax deductible expenses (includes the R30 000 advertising expense as per task 2 - assume this amount is deductible) Notes: Notes 1 2 3 4 5 6 7 R 4 500 000 18 750 85 000 15 000 50 000 500 000 1 800 000 850 000 48 000 1. Bad debts The bad debts all relate to irrecoverable debts written off during the year. Included in the amount is a R7 000 loan made to an employee of the company. This employee absconded (disappeared). 2. Design costs A special umbrella design was acquired with the intention of starting to manufacture umbrellas locally. The design was acquired on 1 October 2022 for R85 000. 3. Donations Beach Vibes donated R15 000 to a registered public benefit organisation on 2 December 2022. A valid section 18A receipt was received on the same day. 4. Doubtful debts provision A provision for doubtful debts of R50 000 was raised by the financial accountant. All the doubtful debts provided for are between 70 to 80 days old. (IFRS is not being applied by the company). 5. Insurance The business insurance premiums amounting to R20 000 per month was paid for the period 1 February 2022 to 31 August 2022. On 1 September 2022, the company decided to upgrade its business insurance coverage and the premiums increased to R30 000 per month. Beach Vibes decided to pay all the premiums for the next 12 months (R360 000) upfront on 1 September 2022. 6. Inventory Umbrellas were purchased during the year for R1 800 000. After the stock take at year end, the following information is provided: Umbrellas on hand as at 31 January 2023 960 Cost R240 000 Market value R432 000 7. Salaries The salaries of R850 000 comprises of basic salaries of R600 000 and an amount of R250 000 for contributions made by Beach Vibes to a medical aid fund for the benefit of its employees. REQUIRED: (a) Explain briefly to Beach Vibes (Pty) Ltd on what basis the company do not qualify as a small business corporation. (Hint: Mention the specific requirement and explain why not.) (b) Calculate the tax liability of Beach Vibes (Pty) Ltd for the 31 January 2023 year of assessment on the assumption that the company is not a small business corporation (as defined). Provide reasons for all amounts that are not taxable and/or not deductible. Support your answer regarding the insurance premiums paid with calculations and reasons. MARKS 2 19

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a In order for Beach Vibes Pty Ltd to qualify as a small business corporation it needs to meet certain requirements as per the South African tax laws ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started