Question

Information relating to 2019 activities: Net income for 2019 was: $ 1,300,000 Cash dividends were declared and paid in 2019. Equipment was sold in 2019

Information relating to 2019 activities:

Net income for 2019 was: $ 1,300,000

Cash dividends were declared and paid in 2019.

Equipment was sold in 2019 resulting in a gain of $400,000

The equipment originally cost $ 1,000,000

and has a book value of $ 860,000

A long-term investment was sold for $ 150,000 cash in 2019

There were no other transactions affecting long-term investments in 2019.

No patents were purchased or sold this year.

The company acquired land worth $ 500,000 (included in PP&E) in exchange for common stock with a value of $ 500,000

Prepare the Statement of Cash Flows in good form using the INDIRECT method

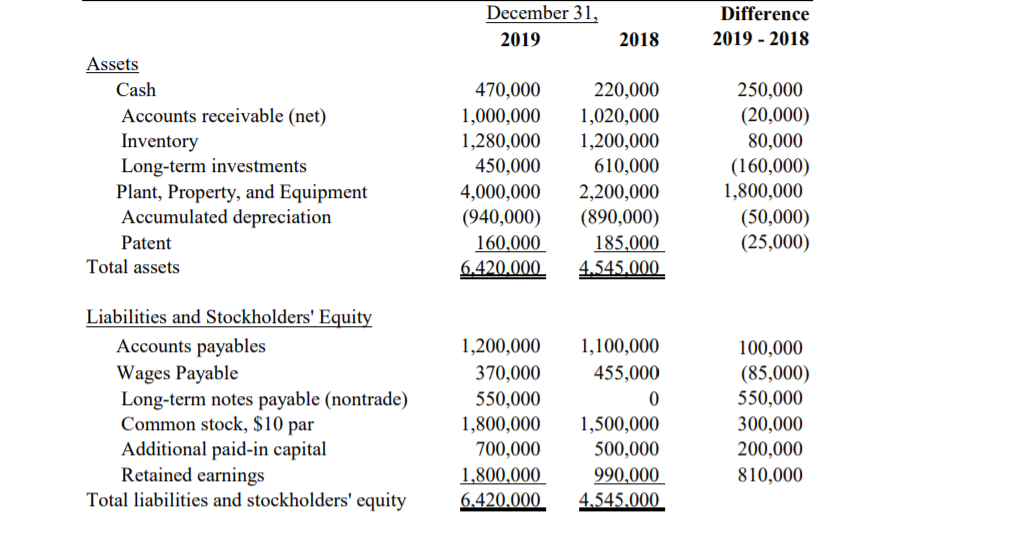

December 31, 2019 Difference 2019 - 2018 2018 Assets Cash Accounts receivable (net) Inventory Long-term investments Plant, Property, and Equipment Accumulated depreciation Patent Total assets 470,000 1,000,000 1,280,000 450,000 4,000,000 (940,000) 160,000 6.420.000 220,000 1,020,000 1,200,000 610,000 2,200,000 (890,000) 185,000 4.545.000 250,000 (20,000) 80,000 (160,000) 1,800,000 (50,000) (25,000) 1,100,000 455,000 Liabilities and Stockholders' Equity Accounts payables Wages Payable Long-term notes payable (nontrade) Common stock, $10 par Additional paid-in capital Retained earnings Total liabilities and stockholders' equity 1,200,000 370,000 550,000 1,800,000 700,000 1,800,000 6.420,000 100,000 (85,000) 550,000 300,000 200,000 810,000 1,500,000 500,000 990,000 4,545,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started