Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Information The current employee earns a salary of $35,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $6,200.

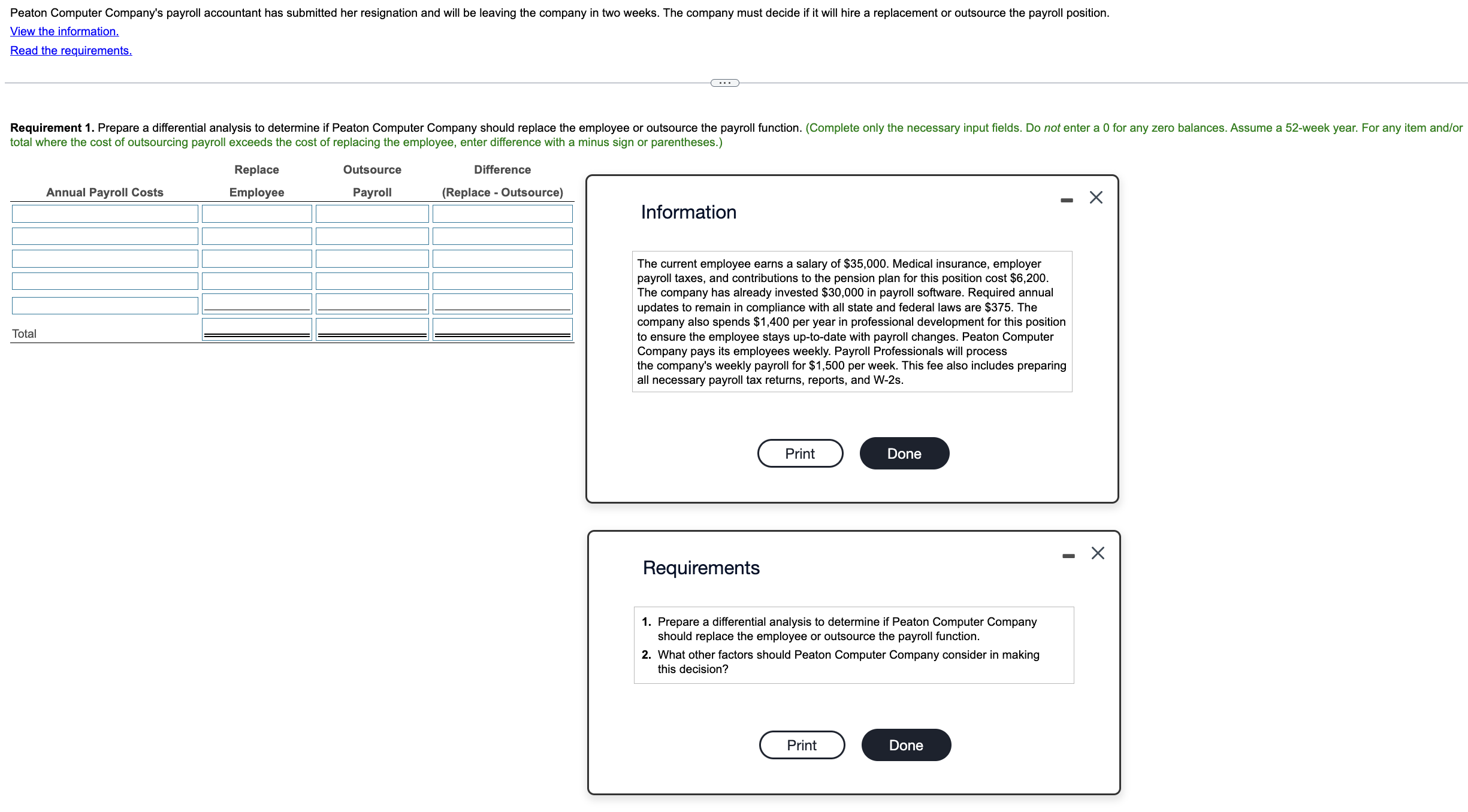

Information The current employee earns a salary of $35,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $6,200. The company has already invested $30,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $375. The company also spends $1,400 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. Peaton Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,500 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. Requirements 1. Prepare a differential analysis to determine if Peaton Computer Company should replace the employee or outsource the payroll function. 2. What other factors should Peaton Computer Company consider in making this decision

Information The current employee earns a salary of $35,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $6,200. The company has already invested $30,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $375. The company also spends $1,400 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. Peaton Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,500 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W-2s. Requirements 1. Prepare a differential analysis to determine if Peaton Computer Company should replace the employee or outsource the payroll function. 2. What other factors should Peaton Computer Company consider in making this decision Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started