Answered step by step

Verified Expert Solution

Question

1 Approved Answer

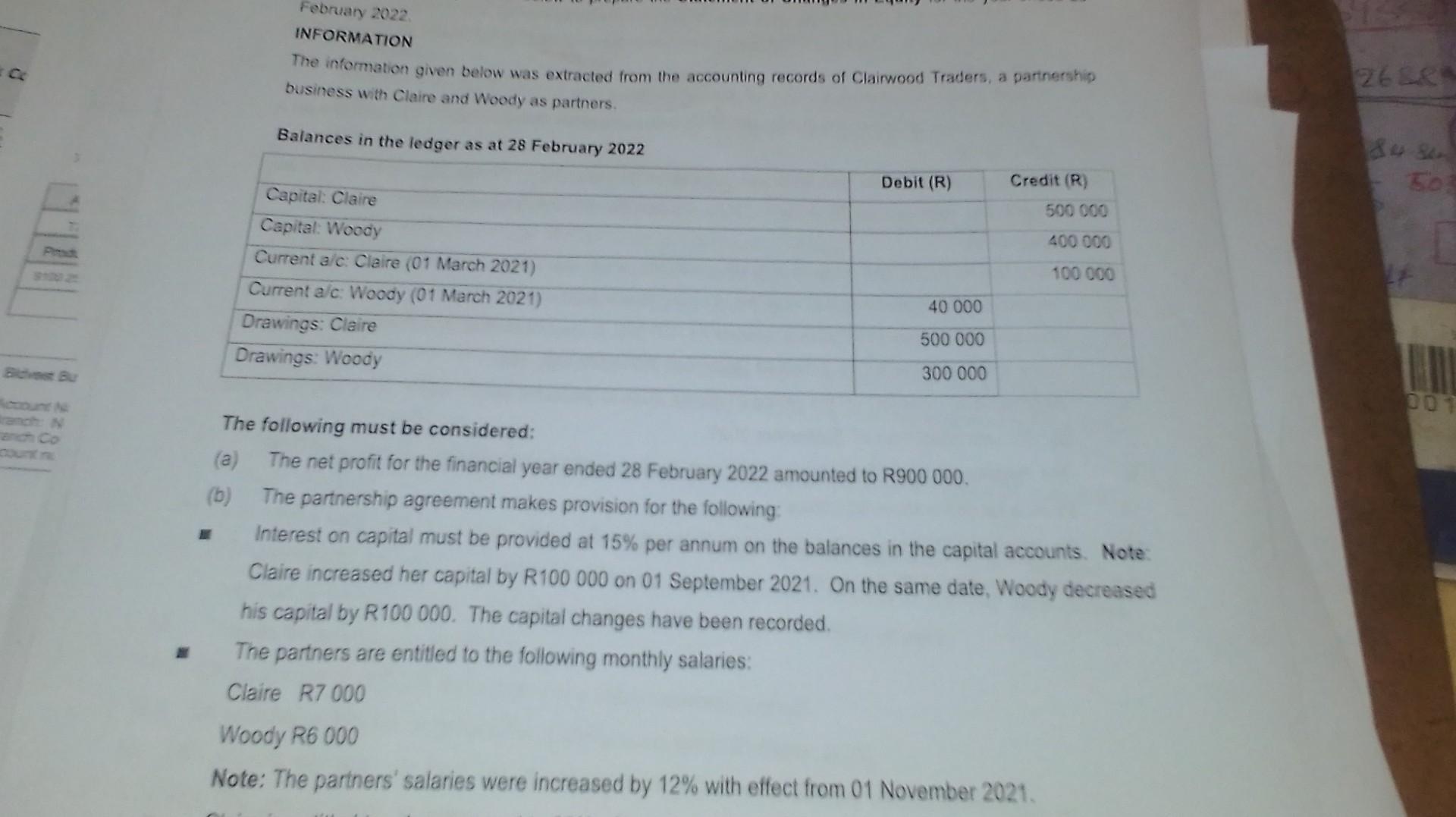

INFORMATION The information given below was extracted from the accounting records of Clairwood Traders, a partinership business with Claire and Woody as partners. Balances in

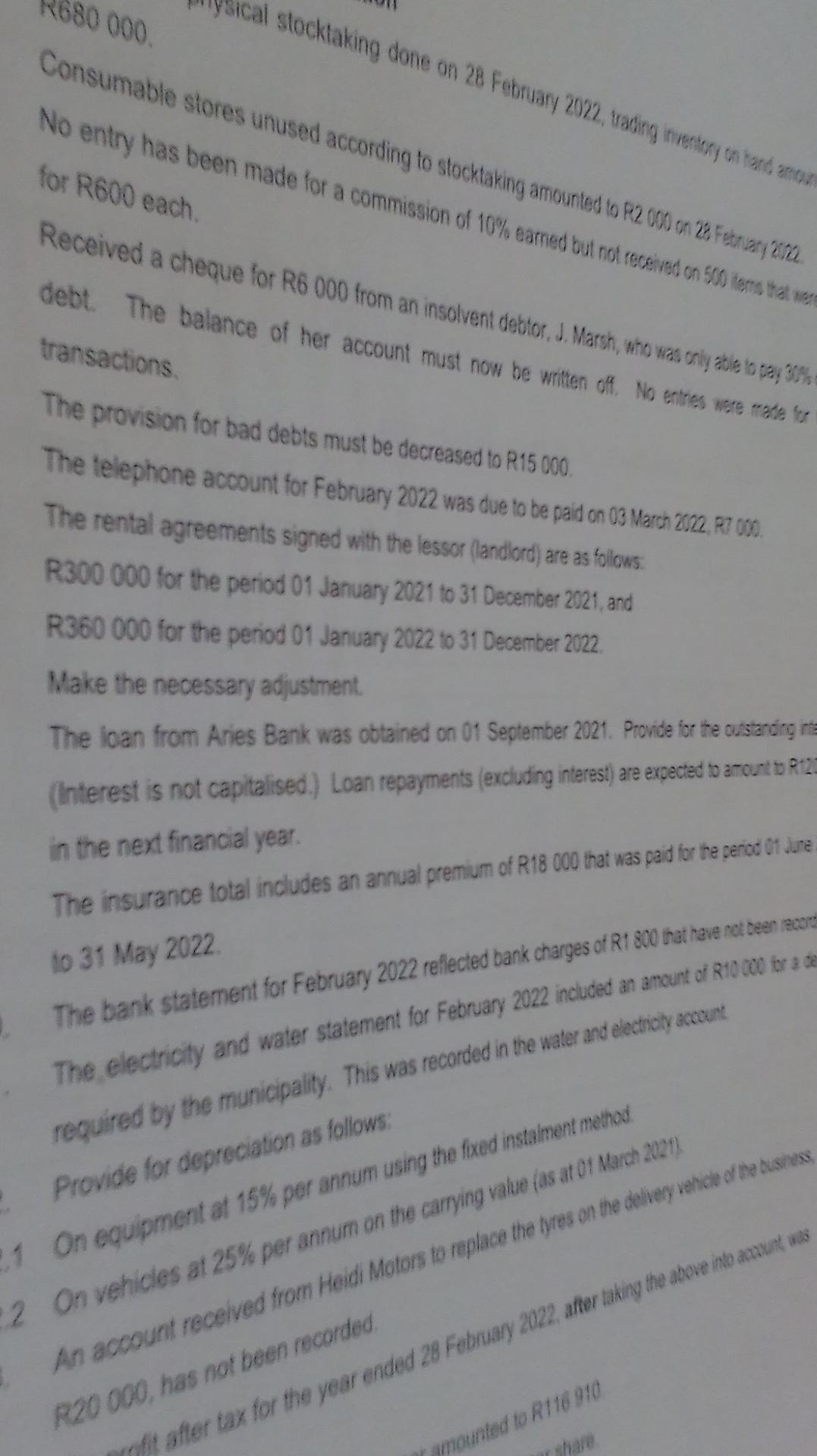

INFORMATION The information given below was extracted from the accounting records of Clairwood Traders, a partinership business with Claire and Woody as partners. Balances in The following must be considered: (a) The net profit for the financial year ended 28 February 2022 amounted to R900000. (b) The partnership agreement makes provision for the following: Interest on capital must be provided at 15% per annum on the balances in the capital accounts. Note: Claire increased her capital by R100 000 on 01 September 2021 . On the same date, Woody decreased his capital by R100000. The capital changes have been recorded. The partners are entitled to the following monthly salaries: Claire R7 000 Woody R6 000 Note: The pariners' salaries were increased by 12% with effect from 01 November 2021. R680000 R300 000 for the period 01 January 2021 to 31060 . Make the necessary adjustment. The loan from Aries Bank was obtained on 01 September 2021. Provide to te te wistarding in in the next financial year. The insurance total includes an annual premium of R18 000 that was pard tor the gerico of use to 31 May 2022. The bank statement for February 2022 reflected bank charges of R1 800 out hare cot been necors The electricity and water statement for February 2022 incluced an anount of R10coo to a 20 Provide for deprecition as follows: on equipment at 15% per annum using the fxed instalment method An account recelved trom Hedi Motos R20000, has not been recorded. INFORMATION The information given below was extracted from the accounting records of Clairwood Traders, a partinership business with Claire and Woody as partners. Balances in The following must be considered: (a) The net profit for the financial year ended 28 February 2022 amounted to R900000. (b) The partnership agreement makes provision for the following: Interest on capital must be provided at 15% per annum on the balances in the capital accounts. Note: Claire increased her capital by R100 000 on 01 September 2021 . On the same date, Woody decreased his capital by R100000. The capital changes have been recorded. The partners are entitled to the following monthly salaries: Claire R7 000 Woody R6 000 Note: The pariners' salaries were increased by 12% with effect from 01 November 2021. R680000 R300 000 for the period 01 January 2021 to 31060 . Make the necessary adjustment. The loan from Aries Bank was obtained on 01 September 2021. Provide to te te wistarding in in the next financial year. The insurance total includes an annual premium of R18 000 that was pard tor the gerico of use to 31 May 2022. The bank statement for February 2022 reflected bank charges of R1 800 out hare cot been necors The electricity and water statement for February 2022 incluced an anount of R10coo to a 20 Provide for deprecition as follows: on equipment at 15% per annum using the fxed instalment method An account recelved trom Hedi Motos R20000, has not been recorded

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started