Question

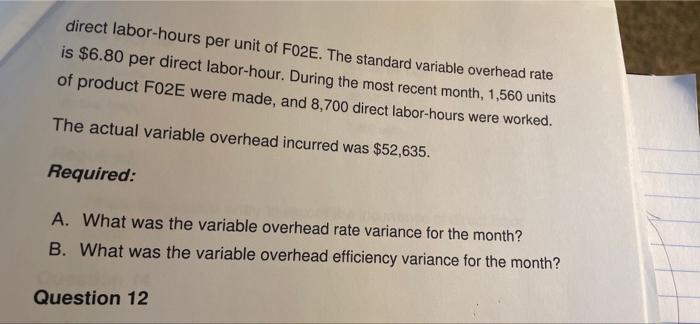

ing income? Question 11 Shawl Corporation's varialble overhead is applied on the basis of direct labor-hours. The siandard cost card for product F02E specifies

ing income? Question 11 Shawl Corporation's varialble overhead is applied on the basis of direct labor-hours. The siandard cost card for product F02E specifies 5.5 2021 Penn Foster Managerial Accounting (v3) : Lesson 5: Page 8 Inc. direct labor-hours per unit of F02E. The standard variable overhead rate is $6.80 per direct labor-hour. During the most recent month, 1,560 units of product F02E were made, and 8,700 direct labor-hours were worked. The actual variable overhead incurred was $52,635. Required: A. What was the variable overhead rate variance for the month? B. What was the variable overhead efficiency variance for the month? Question 12

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

page 1 Answer Actual ate pen housr incurred Acdual voriable oven head incursiedActcal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

11th Edition

9780538480901, 9781111525774, 538480890, 538480904, 1111525773, 978-0538480895

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App