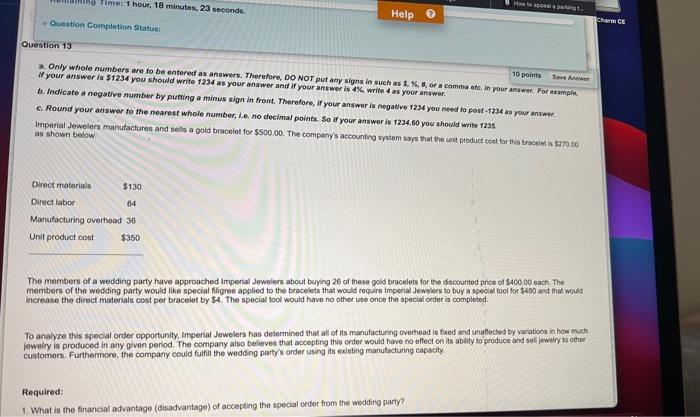

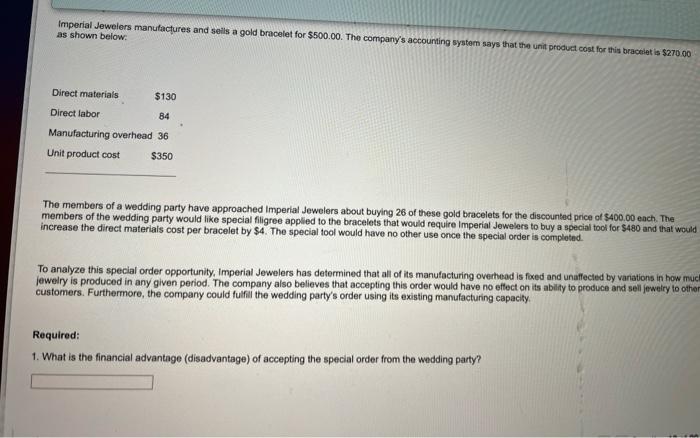

Ing met 1 hour, 18 minutes, 23 seconds How to Help Question Completion Status: Charm CE Question 13 10 points Severwer Only whole numbers are to be entered as answers. Therefore, DO NOT put any signs in such as $. %.or a comma ete in your answer. For example If your answer is $1234 you should write 1234 as your answer and if your answer is 4%, write 4 as your answer 1. Indicate a negative number by putting a minus sign in front. Therefore, if your answer is negative 1234 you need to post-1234 as your answer c. Round your answer to the nearest whole number, Le no decimal points. So if your answer is 1234.60 you should write 1235 Imperial Jewelers manufactures and sells a gold bracelet for $500.00. The company's accounting system says that the unit product cost for his bracelet is 5270.00 s shown below Direct materials $130 Direct labor 84 Manufacturing overhead 36 Unit product cost $350 The members of a wedding party have approached Imperial Jewelers about buying 26 of these gold bracelets for the discounted price of $400.00 each The members of the wedding party would like special filigree applied to the bracelets that would require Imperial Jewelers to buy a special tool for $480 and that would increase the direct materials cost per bracelet by $4. The special tool would have no other use once the special order is completed To analyze this special order opportunity, Imperial Jewelers has determined that all of its manufacturing overhead is foed and unattected by variations in how much jewelry is produced in any given period. The company also believes that accepting this order would have no effect on its ablity to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing manufacturing capacity Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party? Imperial Jewelers manufactures and sells a gold bracelet for $500.00. The company's accounting system says that the unit product cost for this bracelet is $270.00 as shown below: Direct materials $130 Direct labor 84 Manufacturing overhead 36 Unit product cost $350 The members of a wedding party have approached Imperial Jewelers about buying 26 of these gold bracelets for the discounted price of $400.00 each. The members of the wedding party would like special filigree applied to the bracelets that would require Imperial Jewelers to buy a special tool for $480 and that would increase the direct materials cost per bracelet by $4. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that all of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing manufacturing capacity Required: 1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party