Question

Ingenuity Corporation has been quite successful since its inception three years ago. It is now poised to enter high growth supported by several strong project

Ingenuity Corporation has been quite successful since its inception three years ago. It is now poised to enter high growth supported by several strong project opportunities which the company needs to fund. It must now decide how to fund the projects. The corporate finance department has been charged with evaluating project returns and recommending the best capital structure to fund them. Ingenuity Corp. plans to pursue all three projects being evaluated. Evaluate the returns for each project and determine the best capital structure to support its high growth plans.

Determine Ingenuitys current WACC and its potential WACC under each the three funding scenarios.

Calculate and prepare a table showing the NPV, IRR, and Payback metrics for each of the projects utilizing the company WACC for funding scenario.

Which funding option should the corporate finance department recommend? Why?

Show excel formulas please!

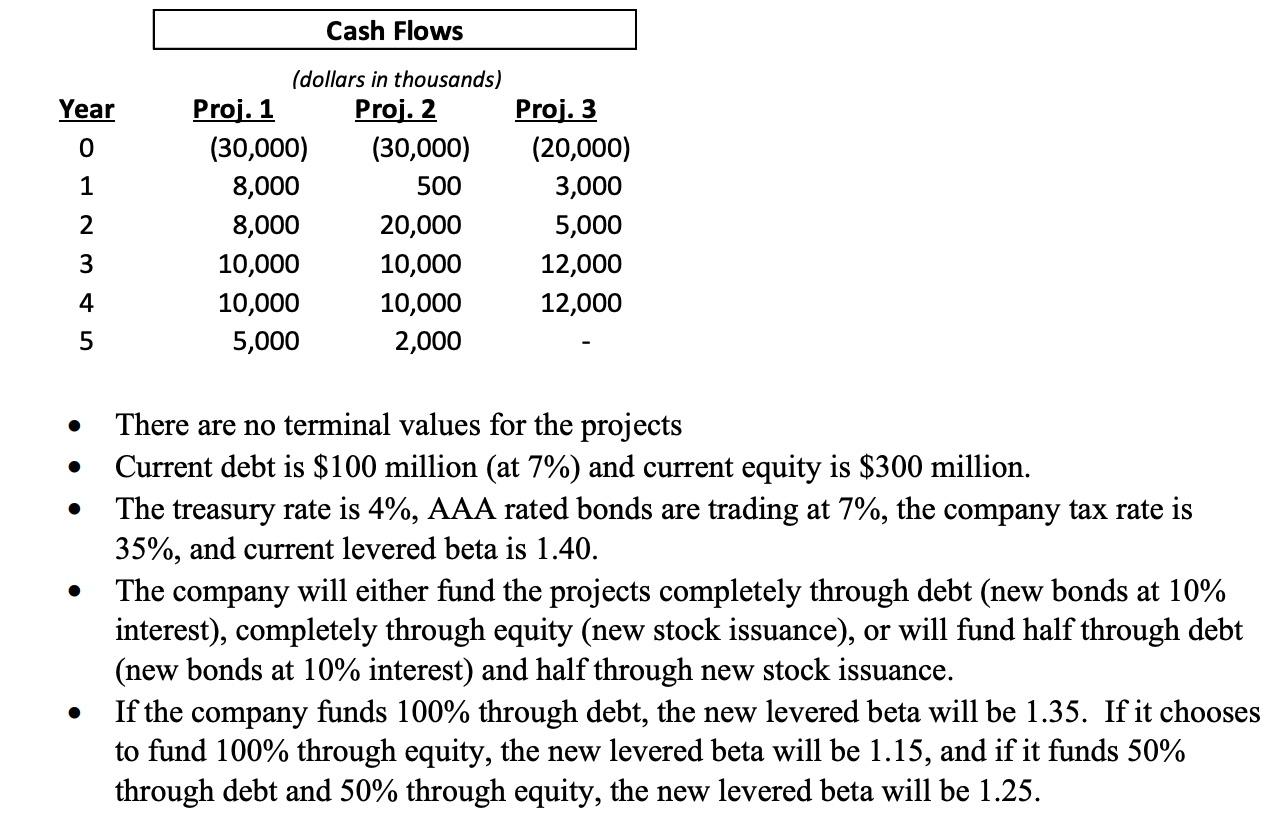

Cash Flows Year 0 1 (dollars in thousands) Proj. 1 Proj. 2 (30,000) (30,000) 8,000 500 8,000 20,000 10,000 10,000 10,000 10,000 5,000 2,000 Proj. 3 (20,000) 3,000 5,000 12,000 12,000 2 3 4 5 . There are no terminal values for the projects Current debt is $100 million (at 7%) and current equity is $300 million. The treasury rate is 4%, AAA rated bonds are trading at 7%, the company tax rate is 35%, and current levered beta is 1.40. The company will either fund the projects completely through debt (new bonds at 10% interest), completely through equity (new stock issuance), or will fund half through debt (new bonds at 10% interest) and half through new stock issuance. If the company funds 100% through debt, the new levered beta will be 1.35. If it chooses to fund 100% through equity, the new levered beta will be 1.15, and if it funds 50% through debt and 50% through equity, the new levered beta will be 1.25. Cash Flows Year 0 1 (dollars in thousands) Proj. 1 Proj. 2 (30,000) (30,000) 8,000 500 8,000 20,000 10,000 10,000 10,000 10,000 5,000 2,000 Proj. 3 (20,000) 3,000 5,000 12,000 12,000 2 3 4 5 . There are no terminal values for the projects Current debt is $100 million (at 7%) and current equity is $300 million. The treasury rate is 4%, AAA rated bonds are trading at 7%, the company tax rate is 35%, and current levered beta is 1.40. The company will either fund the projects completely through debt (new bonds at 10% interest), completely through equity (new stock issuance), or will fund half through debt (new bonds at 10% interest) and half through new stock issuance. If the company funds 100% through debt, the new levered beta will be 1.35. If it chooses to fund 100% through equity, the new levered beta will be 1.15, and if it funds 50% through debt and 50% through equity, the new levered beta will be 1.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started