Answered step by step

Verified Expert Solution

Question

1 Approved Answer

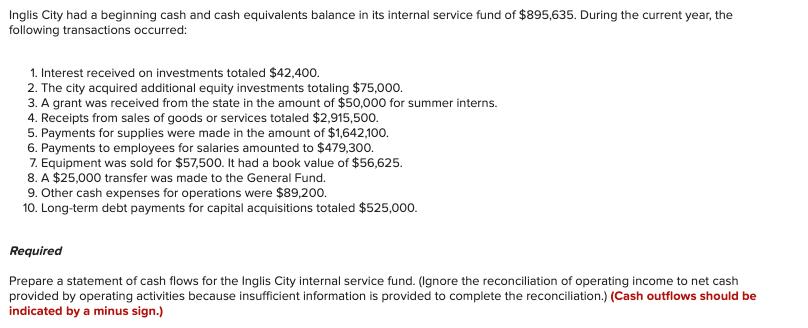

Inglis City had a beginning cash and cash equivalents balance in its internal service fund of $895,635. During the current year, the following transactions

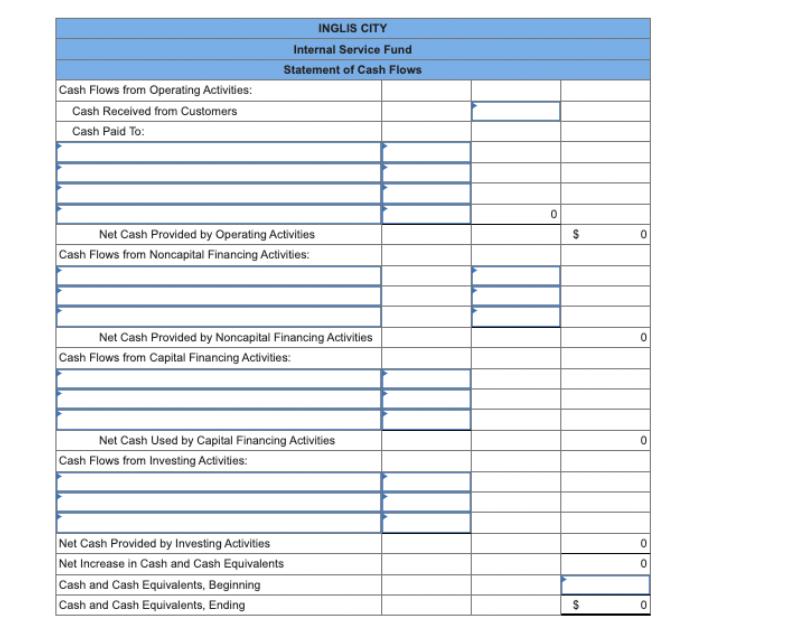

Inglis City had a beginning cash and cash equivalents balance in its internal service fund of $895,635. During the current year, the following transactions occurred: 1. Interest received on investments totaled $42,400. 2. The city acquired additional equity investments totaling $75,000. 3. A grant was received from the state in the amount of $50,000 for summer interns. 4. Receipts from sales of goods or services totaled $2,915,500. 5. Payments for supplies were made in the amount of $1,642,100. 6. Payments to employees for salaries amounted to $479,300. 7. Equipment was sold for $57,500. It had a book value of $56,625. 8. A $25,000 transfer was made to the General Fund. 9. Other cash expenses for operations were $89,200. 10. Long-term debt payments for capital acquisitions totaled $525,000. Required Prepare a statement of cash flows for the Inglis City internal service fund. (Ignore the reconciliation of operating income to net cash provided by operating activities because insufficient information is provided to complete the reconciliation.) (Cash outflows should be indicated by a minus sign.) Cash Flows from Operating Activities: Cash Received from Customers Cash Paid To: INGLIS CITY Internal Service Fund Statement of Cash Flows Net Cash Provided by Operating Activities Cash Flows from Noncapital Financing Activities: Net Cash Provided by Noncapital Financing Activities Cash Flows from Capital Financing Activities: Net Cash Used by Capital Financing Activities Cash Flows from Investing Activities: Net Cash Provided by Investing Activities Net Increase in Cash and Cash Equivalents Cash and Cash Equivalents, Beginning Cash and Cash Equivalents, Ending 0 $ 0 0 0 0 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started