Question

Ingram Dog Kennels had the following financial statistics for 2010: Long-term debt $400,000 (average rate of interest is 8%) Interest expense 35,000 Net income 48,000

Ingram Dog Kennels had the following financial statistics for 2010: Long-term debt $400,000 (average rate of interest is 8%) Interest expense 35,000 Net income 48,000 Income tax 46,000 Operating income 107,000 What is the times interest earned for 2010? a. 11.4 times b. 3.3 times c. 3.1 times d. 3.7 times e. none of the answers are correct ANS: D I know this is easy and answered but what did they do to get it

Applied Materials Inc. (Symbol: AMAT) has the following financial statistics: stock price = $19.08, market cap = $25.83 billion, beta = 0.3, dividend payout ratio = 23%, EPS = $1.10, Expected DPS = $0.24, analyst forecast of earnings growth rate = 12%. Based on the constant growth valuation model and using only the data provided, what expected rate of return is priced into the stock?

A.

12.01%

B.

13.26%

C.

35%

D.

None of the above

Expert Answer

Anonymous's Avatar

Anonymous answered thisWas this answer helpful?

Thumbs up inactive0Thumbs down inactive0

704 answers

According to constant growth dividend discount method,

P = D/ (r - g)

r = D / P + g = 0.24 / 19.08 + 0.12 = 13.26%

Answer B

Comment

Up next for you in Finance

NEED JUST THE ANSWERS

TO DOUBLE CHECK:

QUESTION 17 Applied

Materials Inc. (Symbol:

AMAT) has the following

financial statistics: stock

price = $19.08, market cap

= $25.83 billion, beta = 0.3,

dividend payout ratio = 2...

See answer

Flag this Question

Question 231 pts Soni

Manufacturing reports the

following capital structure:

Current liabilities

P100,000 Long-term

debt 400,000 Deferred

income taxes 10,000

Preferred stock 80,000 ...

See answer

See more questions for subjects you study

Questions viewed by other students

Q:

Applied Materials Inc. (Symbol: AMAT) has the following financial statistics: stock price = $19.08, market cap = $25.83 billion, beta = 0.3, dividend payout ratio = 23%, EPS = $1.10, Expected DPS = $0.24, analyst forecast of earnings growth rate = 12%. Suppose r = 16%. Based on the constant growth valuation model and using the data provided, calculate the stock price. A. $1...

A:

See answer

Q:

Applied Materials Inc. (Symbol: AMAT) has the following financial statistics: stock price = $19.08, market cap = $25.83 billion, beta = 0.3, dividend payout ratio = 23%, EPS = $1.10, Expected DPS = $0.24, analyst forecast of earnings growth rate = 12%. Suppose required rate of return, r = 16%. Based on the constant growth valuation model and using the data provided, calculate the...

A:

See answer

100% (1 rating)

Show more

Post a question

Answers from our experts for your tough homework questions

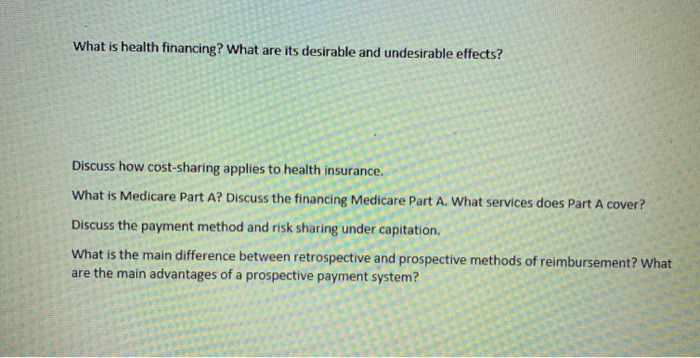

What is health financing? What are its desirable and undesirable effects? Discuss how cost-sharing applies to health insurance. What is Medicare Part A? Discuss the financing Medicare Part A. What services does Part A cover? Discuss the payment method and risk sharing under capitation. What is the main difference between retrospective and prospective methods of reimbursement? What are the main advantages of a prospective payment system?

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started