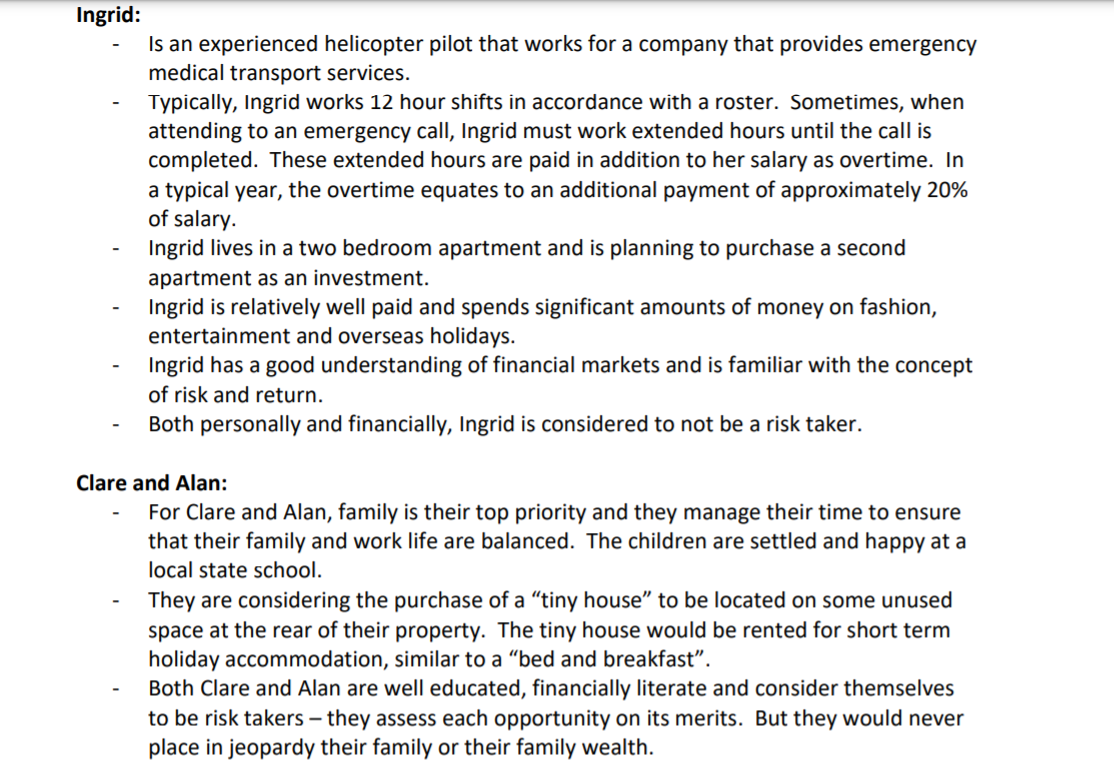

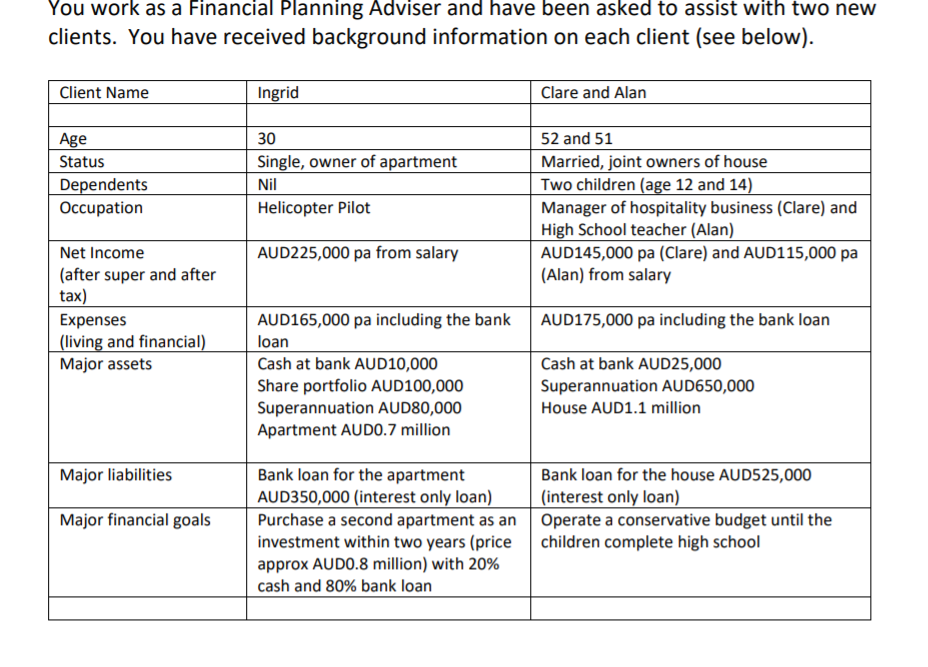

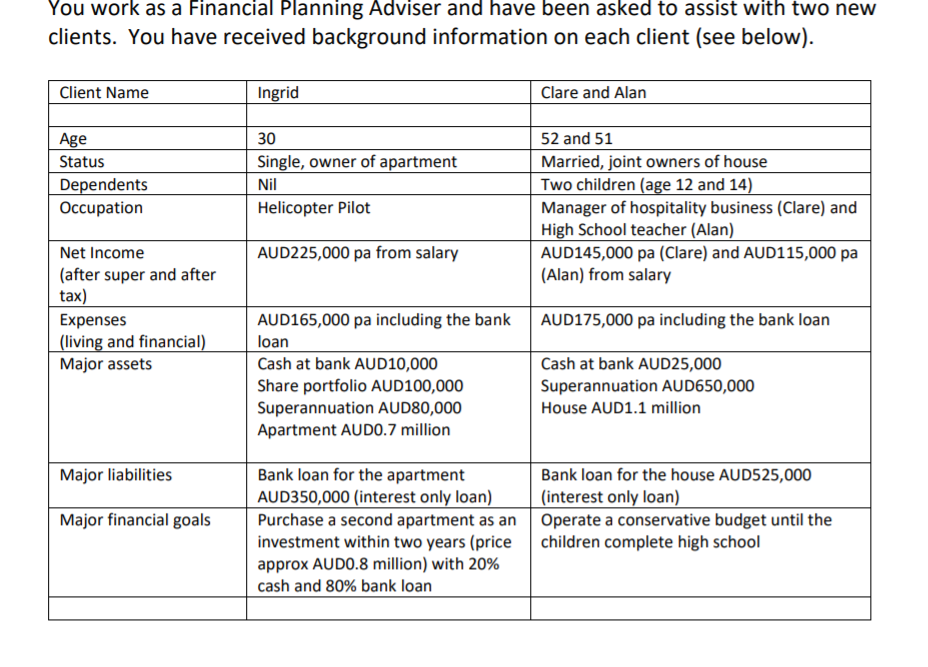

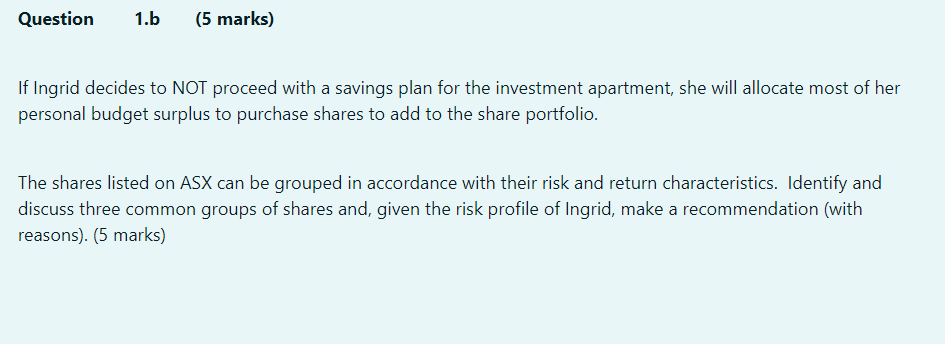

Ingrid: Is an experienced helicopter pilot that works for a company that provides emergency medical transport services. Typically, Ingrid works 12 hour shifts in accordance with a roster. Sometimes, when attending to an emergency call, Ingrid must work extended hours until the call is completed. These extended hours are paid in addition to her salary as overtime. In a typical year, the overtime equates to an additional payment of approximately 20% of salary. Ingrid lives in a two bedroom apartment and is planning to purchase a second apartment as an investment. Ingrid is relatively well paid and spends significant amounts of money on fashion, entertainment and overseas holidays. Ingrid has a good understanding of financial markets and is familiar with the concept of risk and return. Both personally and financially, Ingrid is considered to not be a risk taker. - Clare and Alan: For Clare and Alan, family is their top priority and they manage their time to ensure that their family and work life are balanced. The children are settled and happy at a local state school. They are considering the purchase of a tiny house to be located on some unused space at the rear of their property. The tiny house would be rented for short term holiday accommodation, similar to a bed and breakfast. Both Clare and Alan are well educated, financially literate and consider themselves to be risk takers they assess each opportunity on its merits. But they would never place in jeopardy their family or their family wealth. You work as a Financial Planning Adviser and have been asked to assist with two new clients. You have received background information on each client (see below). Client Name Ingrid Clare and Alan Age Status Dependents Occupation 30 Single, owner of apartment Nil Helicopter Pilot 52 and 51 Married, joint owners of house Two children (age 12 and 14) Manager of hospitality business (Clare) and High School teacher (Alan) AUD145,000 pa (Clare) and AUD115,000 pa (Alan) from salary AUD225,000 pa from salary Net Income (after super and after tax) Expenses (living and financial) Major assets AUD175,000 pa including the bank loan AUD165,000 pa including the bank loan Cash at bank AUD10,000 Share portfolio AUD 100,000 Superannuation AUD80,000 Apartment AUDO.7 million Cash at bank AUD25,000 Superannuation AUD650,000 House AUD1.1 million Major liabilities Major financial goals Bank loan for the apartment Bank loan for the house AUD525,000 AUD350,000 (interest only loan) (interest only loan) Purchase a second apartment as an Operate a conservative budget until the investment within two years (price children complete high school approx AUDO.8 million) with 20% cash and 80% bank loan Question 1.b (5 marks) If Ingrid decides to NOT proceed with a savings plan for the investment apartment, she will allocate most of her personal budget surplus to purchase shares to add to the share portfolio. The shares listed on ASX can be grouped in accordance with their risk and return characteristics. Identify and discuss three common groups of shares and, given the risk profile of Ingrid, make a recommendation (with reasons). (5 marks) Ingrid: Is an experienced helicopter pilot that works for a company that provides emergency medical transport services. Typically, Ingrid works 12 hour shifts in accordance with a roster. Sometimes, when attending to an emergency call, Ingrid must work extended hours until the call is completed. These extended hours are paid in addition to her salary as overtime. In a typical year, the overtime equates to an additional payment of approximately 20% of salary. Ingrid lives in a two bedroom apartment and is planning to purchase a second apartment as an investment. Ingrid is relatively well paid and spends significant amounts of money on fashion, entertainment and overseas holidays. Ingrid has a good understanding of financial markets and is familiar with the concept of risk and return. Both personally and financially, Ingrid is considered to not be a risk taker. - Clare and Alan: For Clare and Alan, family is their top priority and they manage their time to ensure that their family and work life are balanced. The children are settled and happy at a local state school. They are considering the purchase of a tiny house to be located on some unused space at the rear of their property. The tiny house would be rented for short term holiday accommodation, similar to a bed and breakfast. Both Clare and Alan are well educated, financially literate and consider themselves to be risk takers they assess each opportunity on its merits. But they would never place in jeopardy their family or their family wealth. You work as a Financial Planning Adviser and have been asked to assist with two new clients. You have received background information on each client (see below). Client Name Ingrid Clare and Alan Age Status Dependents Occupation 30 Single, owner of apartment Nil Helicopter Pilot 52 and 51 Married, joint owners of house Two children (age 12 and 14) Manager of hospitality business (Clare) and High School teacher (Alan) AUD145,000 pa (Clare) and AUD115,000 pa (Alan) from salary AUD225,000 pa from salary Net Income (after super and after tax) Expenses (living and financial) Major assets AUD175,000 pa including the bank loan AUD165,000 pa including the bank loan Cash at bank AUD10,000 Share portfolio AUD 100,000 Superannuation AUD80,000 Apartment AUDO.7 million Cash at bank AUD25,000 Superannuation AUD650,000 House AUD1.1 million Major liabilities Major financial goals Bank loan for the apartment Bank loan for the house AUD525,000 AUD350,000 (interest only loan) (interest only loan) Purchase a second apartment as an Operate a conservative budget until the investment within two years (price children complete high school approx AUDO.8 million) with 20% cash and 80% bank loan Question 1.b (5 marks) If Ingrid decides to NOT proceed with a savings plan for the investment apartment, she will allocate most of her personal budget surplus to purchase shares to add to the share portfolio. The shares listed on ASX can be grouped in accordance with their risk and return characteristics. Identify and discuss three common groups of shares and, given the risk profile of Ingrid, make a recommendation (with reasons)