Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ings Review View Acrobat 2 Tell me AaBbC | AaBbCcDdEe AaBbCcDdE Heading 1 Normal No Spacing 3. 10 marks Prosper Pty Ltd current capital

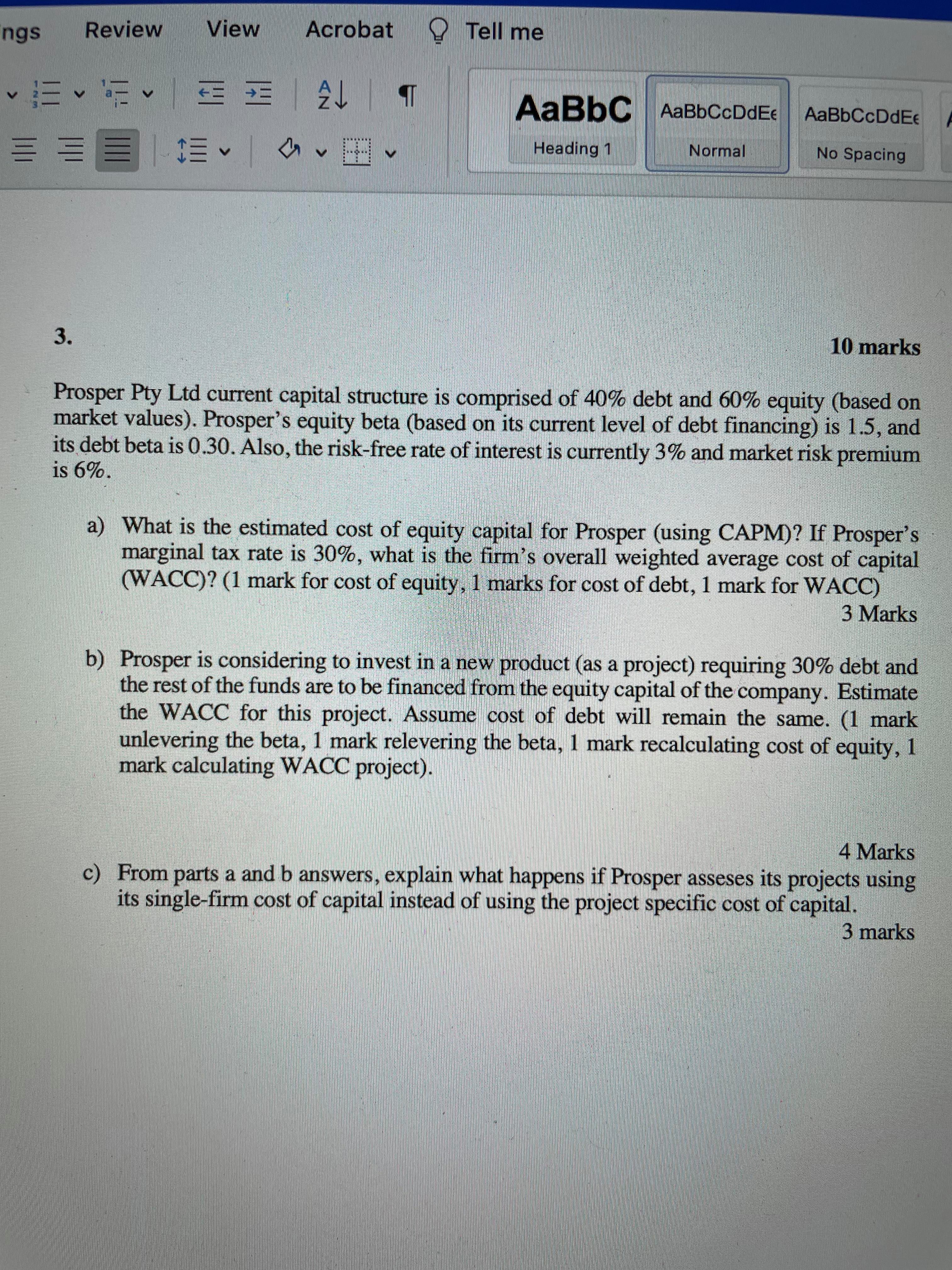

ings Review View Acrobat 2 Tell me AaBbC | AaBbCcDdEe AaBbCcDdE Heading 1 Normal No Spacing 3. 10 marks Prosper Pty Ltd current capital structure is comprised of 40% debt and 60% equity (based on market values). Prosper's equity beta (based on its current level of debt financing) is 1.5, and its debt beta is 0.30. Also, the risk-free rate of interest is currently 3% and market risk premium is 6%. a) What is the estimated cost of equity capital for Prosper (using CAPM)? If Prosper's marginal tax rate is 30%, what is the firm's overall weighted average cost of capital (WACC)? (1 mark for cost of equity, 1 marks for cost of debt, 1 mark for WACC) 3 Marks b) Prosper is considering to invest in a new product (as a project) requiring 30% debt and the rest of the funds are to be financed from the equity capital of the company. Estimate the WACC for this project. Assume cost of debt will remain the same. (1 mark unlevering the beta, 1 mark relevering the beta, 1 mark recalculating cost of equity, 1 mark calculating WACC project). 4 Marks c) From parts a and b answers, explain what happens if Prosper asseses its projects using its single-firm cost of capital instead of using the project specific cost of capital. 3 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part a Cost of Equity and WACC a Cost of Equity Ke We can use the CAPM formula to estimate the cost of equity capital Ke RiskFree Rate Beta Market Ris...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started