Question

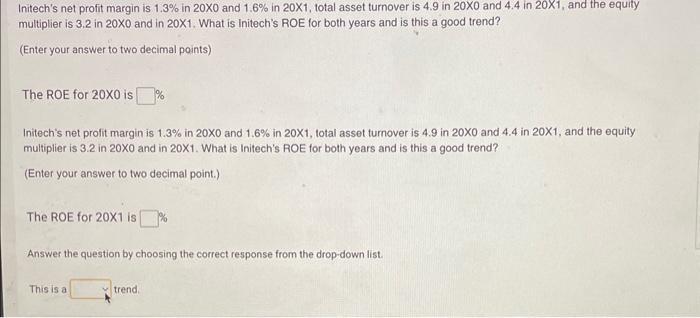

Initech's net profit margin is 1.3% in 20X0 and 1.6% in 20X1, total asset turnover is 4.9 in 20X0 and 4.4 in 20X1, and

Initech's net profit margin is 1.3% in 20X0 and 1.6% in 20X1, total asset turnover is 4.9 in 20X0 and 4.4 in 20X1, and the equity multiplier is 3.2 in 20X0 and in 20X1. What is Initech's ROE for both years and is this a good trend? (Enter your answer to two decimal points) The ROE for 20X0 is % Initech's net profit margin is 1.3% in 20X0 and 1.6% in 20X1, total asset turnover is 4.9 in 20X0 and 4.4 in 20X1, and the equity multiplier is 3.2 in 20X0 and in 20X1. What is Initech's ROE for both years and is this a good trend? (Enter your answer to two decimal point.) The ROE for 20X1 is Answer the question by choosing the correct response from the drop-down list. This is a trend.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Return on Equity ROE we can use the DuPont formula ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Project Finance in Theory and Practice

Authors: Stefano Gatti

2nd edition

978-9382291589, 123919460, 978-0124157538, 978-0123919465

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App