Question

Initial fixed capital investment is 1 000 000 ECU in both A and B projects to be selected. The useful life of project A

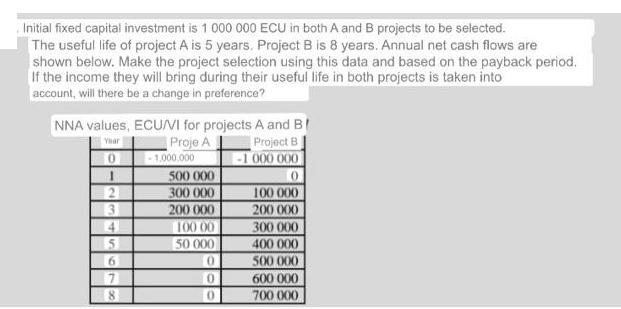

Initial fixed capital investment is 1 000 000 ECU in both A and B projects to be selected. The useful life of project A is 5 years, Project B is 8 years. Annual net cash flows are shown below. Make the project selection using this data and based on the payback period. If the income they will bring during their useful life in both projects is taken into account, will there be a change in preference? NNA values, ECU/VI for projects A and B Yhar Proje A Project B 0-1.000.000 -1 000 000 2 3 4 4567 7 8 500 000 300 000 200 000 100 00 50 000 0 0 0 100 000 200 000 300 000 400 000 500 000 600 000 700 000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine the payback period for each project we need to calculate the cumulative net cash flow f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

12th edition

978-0324597714, 324597711, 324597703, 978-8131518571, 8131518574, 978-0324597707

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App