Answered step by step

Verified Expert Solution

Question

1 Approved Answer

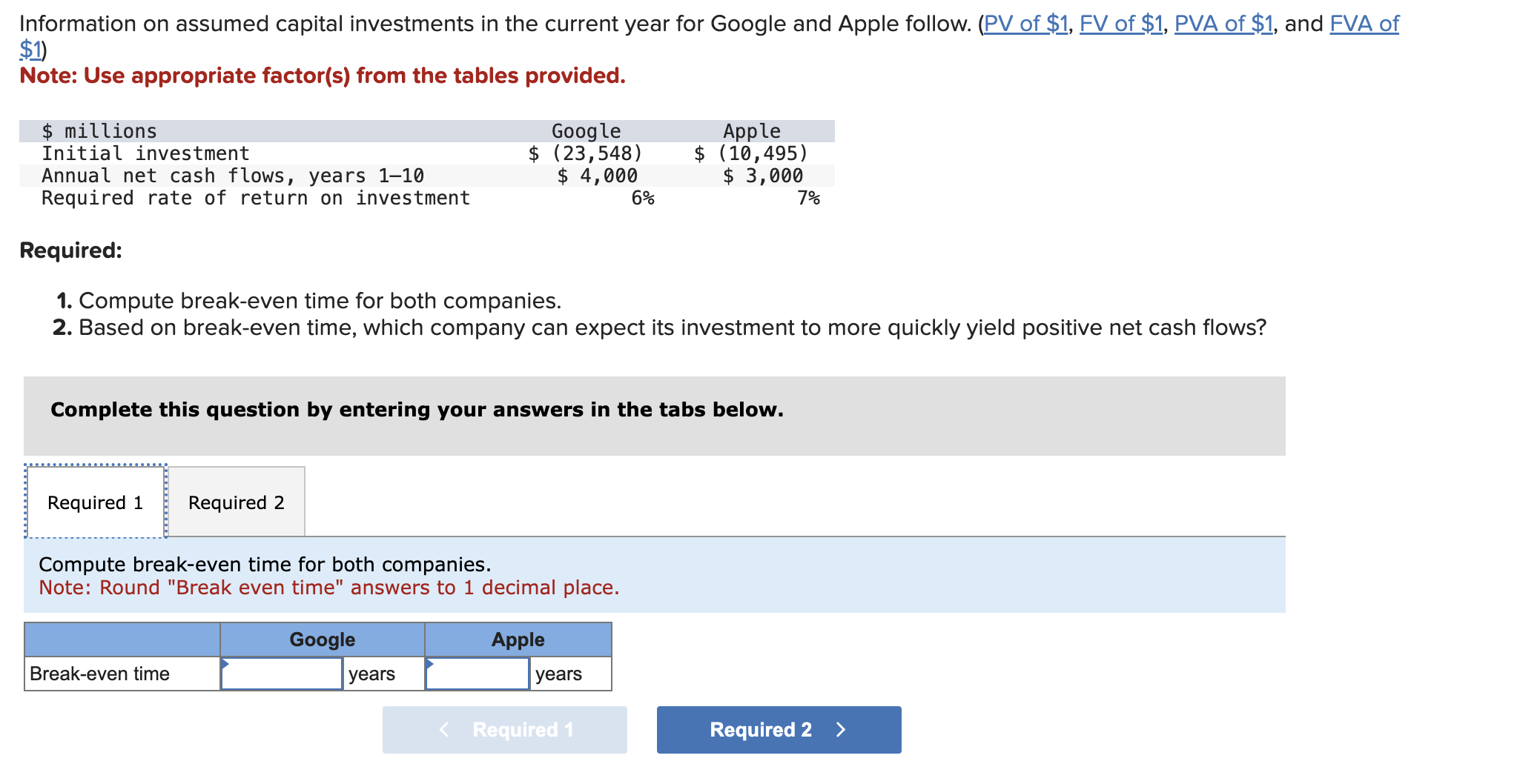

Initial investment $ ( 2 3 , 5 4 8 ) $ ( 1 0 , 4 9 5 ) Annual net cash flows, years

Initial investment $ $

Annual net cash flows, years $ $

Required rate of return on investment

Required:

Compute breakeven time for both companies.

Based on breakeven time, which company can expect its investment to more quickly yield positive net cash flows?Information on assumed capital investments in the current year for Google and Apple follow. PV of $ FV of $ PVA of $ and FVA of

$

Note: Use appropriate factors from the tables provided.

Required:

Compute breakeven time for both companies.

Based on breakeven time, which company can expect its investment to more quickly yield positive net cash flows?

Complete this question by entering your answers in the tabs below.

Compute breakeven time for both companies.

Note: Round "Break even time" answers to decimal place.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started