Answered step by step

Verified Expert Solution

Question

1 Approved Answer

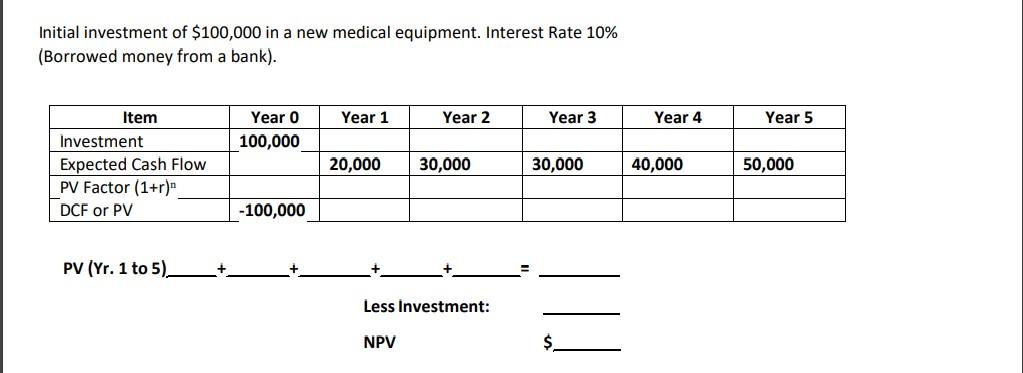

Initial investment of $100,000 in a new medical equipment. Interest Rate 10% (Borrowed money from a bank). Item Investment Expected Cash Flow PV Factor

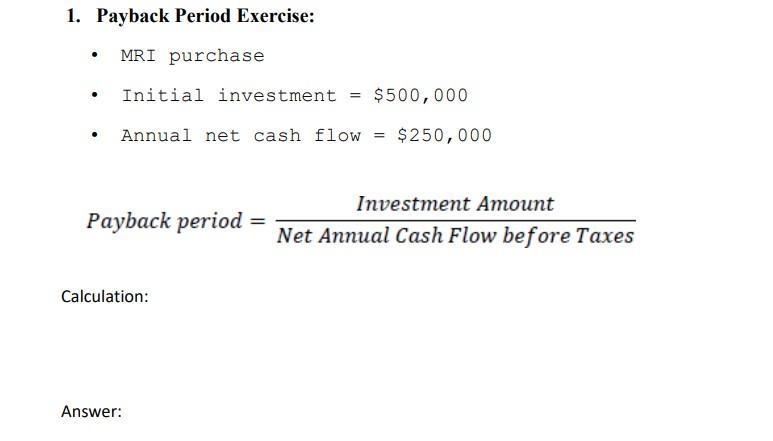

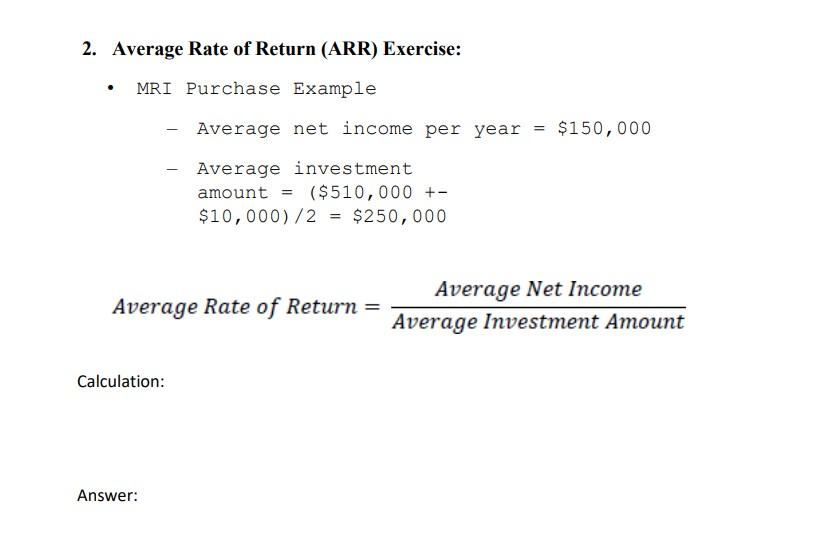

Initial investment of $100,000 in a new medical equipment. Interest Rate 10% (Borrowed money from a bank). Item Investment Expected Cash Flow PV Factor (1+r) DCF or PV PV (Yr. 1 to 5) + Year 0 100,000 -100,000 Year 1 20,000 Year 2 30,000 Less Investment: NPV Year 3 30,000 $ Year 4 40,000 Year 5 50,000 1. Payback Period Exercise: MRI purchase . . . Initial investment = Annual net cash flow Payback period = Calculation: Answer: $500,000 = $250,000 Investment Amount Net Annual Cash Flow before Taxes 2. Average Rate of Return (ARR) Exercise: MRI Purchase Example . Average Rate of Return = Calculation: Average net income per year Average investment amount = ($510,000 +- $10,000)/2 = $250,000 Answer: = $150,000 Average Net Income Average Investment Amount

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Net Present Value NPV is a financial metric used to evaluate the profitability of an investment or p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started