Initial Outlay (IO) 1. A company is considering purchasing a machine for $100,000. Shipping costs would be another $5,000. The project would require an

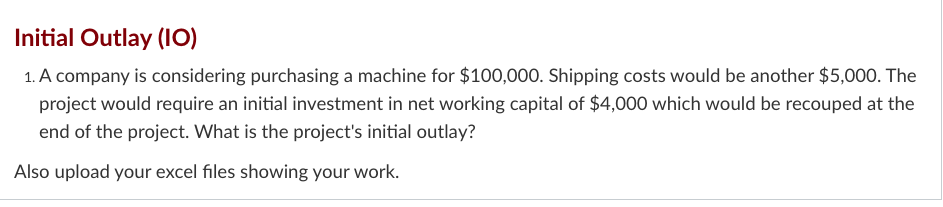

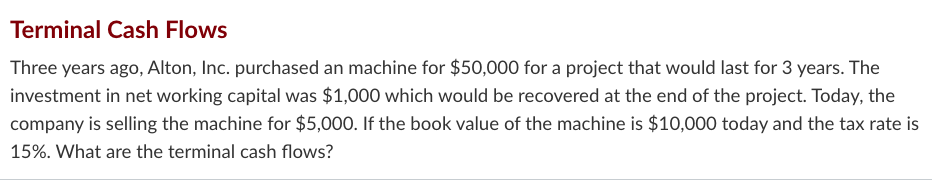

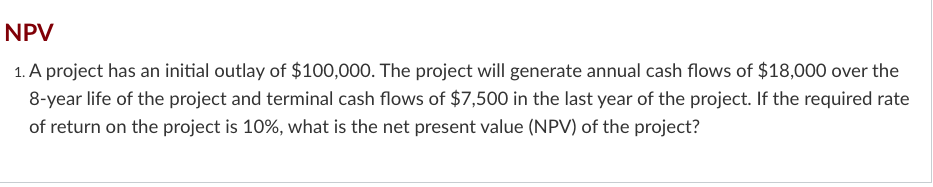

Initial Outlay (IO) 1. A company is considering purchasing a machine for $100,000. Shipping costs would be another $5,000. The project would require an initial investment in net working capital of $4,000 which would be recouped at the end of the project. What is the project's initial outlay? Also upload your excel files showing your work. Terminal Cash Flows Three years ago, Alton, Inc. purchased an machine for $50,000 for a project that would last for 3 years. The investment in net working capital was $1,000 which would be recovered at the end of the project. Today, the company is selling the machine for $5,000. If the book value of the machine is $10,000 today and the tax rate is 15%. What are the terminal cash flows? NPV 1. A project has an initial outlay of $100,000. The project will generate annual cash flows of $18,000 over the 8-year life of the project and terminal cash flows of $7,500 in the last year of the project. If the required rate of return on the project is 10%, what is the net present value (NPV) of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Initial Outlay IO Snapshot of cell reference Terminal Cash Flow T...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started