Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inka Oil has been searching for ways to diversify in a more sustainable direction. One of their chemical engineers has developed a new way to

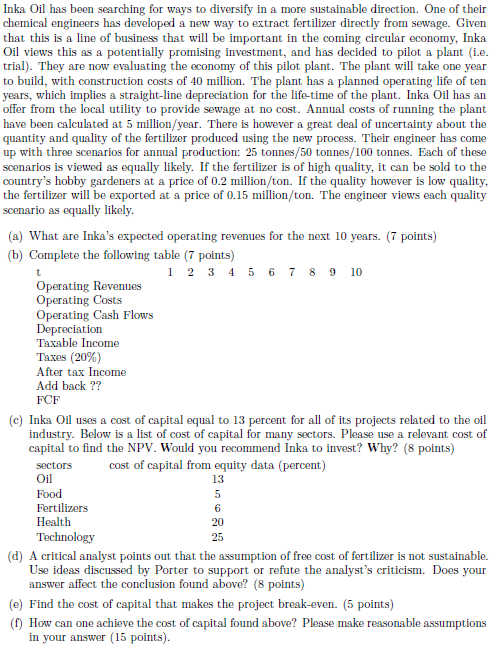

Inka Oil has been searching for ways to diversify in a more sustainable direction. One of their chemical engineers has developed a new way to extract fertilizer directly from sewage. Given that this is a line of business that will be important in the coming circular economy, Inka Oil views this as a potentially promising investment, and has decided to pilot a plant (i.e. trial). They are now evaluating the economy of this pilot plant. The plant will take one year to build, with construction costs of 40 million. The plant has a planned operating life of ten years, which implies a straight-line depreciation for the life-time of the plant. Inka Oil has an offer from the local utility to provide sewage at no cost. Annual costs of running the plant have been calculated at 5 million/year. There is however a great deal of uncertainty about the quantity and quality of the fertilizer produced using the new process. Their engineer has come up with three scenarios for annual production: 25 tonnes/50 tonnes/100 tonnes. Each of these scenarios is viewed as equally likely. If the fertilizer is of high quality, it can be sold to the country's hobby gardeners at a price of 0.2 million/ton. If the quality however is low quality, the fertilizer will be exported at a price of 0.15 million/ton. The engineer views each quality scenario as equally likely. (a) What are Inka's expected operating revenues for the next 10 years. ( 7 points) (b) Complete the following table ( 7 points) (c) Inka Oil uses a cost of capital equal to 13 percent for all of its projects related to the oil industry. Below is a list of cost of capital for many sectors. Please use a relevant cost of capital to find the NPV. Would you recommend Inka to invest? Why? (8 points) ) (d) A critical analyst points out that the assumption of free cost of fertilizer is not sustainable. Use ideas discussed by Porter to support or refute the analyst's criticism. Does your answer affect the conclusion found above? (8 points) (e) Find the cost of capital that makes the project break-even. (5 points) (f) How can one achieve the cost of capital found above? Please make reasonable assumptions in your answer (15 points). Inka Oil has been searching for ways to diversify in a more sustainable direction. One of their chemical engineers has developed a new way to extract fertilizer directly from sewage. Given that this is a line of business that will be important in the coming circular economy, Inka Oil views this as a potentially promising investment, and has decided to pilot a plant (i.e. trial). They are now evaluating the economy of this pilot plant. The plant will take one year to build, with construction costs of 40 million. The plant has a planned operating life of ten years, which implies a straight-line depreciation for the life-time of the plant. Inka Oil has an offer from the local utility to provide sewage at no cost. Annual costs of running the plant have been calculated at 5 million/year. There is however a great deal of uncertainty about the quantity and quality of the fertilizer produced using the new process. Their engineer has come up with three scenarios for annual production: 25 tonnes/50 tonnes/100 tonnes. Each of these scenarios is viewed as equally likely. If the fertilizer is of high quality, it can be sold to the country's hobby gardeners at a price of 0.2 million/ton. If the quality however is low quality, the fertilizer will be exported at a price of 0.15 million/ton. The engineer views each quality scenario as equally likely. (a) What are Inka's expected operating revenues for the next 10 years. ( 7 points) (b) Complete the following table ( 7 points) (c) Inka Oil uses a cost of capital equal to 13 percent for all of its projects related to the oil industry. Below is a list of cost of capital for many sectors. Please use a relevant cost of capital to find the NPV. Would you recommend Inka to invest? Why? (8 points) ) (d) A critical analyst points out that the assumption of free cost of fertilizer is not sustainable. Use ideas discussed by Porter to support or refute the analyst's criticism. Does your answer affect the conclusion found above? (8 points) (e) Find the cost of capital that makes the project break-even. (5 points) (f) How can one achieve the cost of capital found above? Please make reasonable assumptions in your answer (15 points)

Inka Oil has been searching for ways to diversify in a more sustainable direction. One of their chemical engineers has developed a new way to extract fertilizer directly from sewage. Given that this is a line of business that will be important in the coming circular economy, Inka Oil views this as a potentially promising investment, and has decided to pilot a plant (i.e. trial). They are now evaluating the economy of this pilot plant. The plant will take one year to build, with construction costs of 40 million. The plant has a planned operating life of ten years, which implies a straight-line depreciation for the life-time of the plant. Inka Oil has an offer from the local utility to provide sewage at no cost. Annual costs of running the plant have been calculated at 5 million/year. There is however a great deal of uncertainty about the quantity and quality of the fertilizer produced using the new process. Their engineer has come up with three scenarios for annual production: 25 tonnes/50 tonnes/100 tonnes. Each of these scenarios is viewed as equally likely. If the fertilizer is of high quality, it can be sold to the country's hobby gardeners at a price of 0.2 million/ton. If the quality however is low quality, the fertilizer will be exported at a price of 0.15 million/ton. The engineer views each quality scenario as equally likely. (a) What are Inka's expected operating revenues for the next 10 years. ( 7 points) (b) Complete the following table ( 7 points) (c) Inka Oil uses a cost of capital equal to 13 percent for all of its projects related to the oil industry. Below is a list of cost of capital for many sectors. Please use a relevant cost of capital to find the NPV. Would you recommend Inka to invest? Why? (8 points) ) (d) A critical analyst points out that the assumption of free cost of fertilizer is not sustainable. Use ideas discussed by Porter to support or refute the analyst's criticism. Does your answer affect the conclusion found above? (8 points) (e) Find the cost of capital that makes the project break-even. (5 points) (f) How can one achieve the cost of capital found above? Please make reasonable assumptions in your answer (15 points). Inka Oil has been searching for ways to diversify in a more sustainable direction. One of their chemical engineers has developed a new way to extract fertilizer directly from sewage. Given that this is a line of business that will be important in the coming circular economy, Inka Oil views this as a potentially promising investment, and has decided to pilot a plant (i.e. trial). They are now evaluating the economy of this pilot plant. The plant will take one year to build, with construction costs of 40 million. The plant has a planned operating life of ten years, which implies a straight-line depreciation for the life-time of the plant. Inka Oil has an offer from the local utility to provide sewage at no cost. Annual costs of running the plant have been calculated at 5 million/year. There is however a great deal of uncertainty about the quantity and quality of the fertilizer produced using the new process. Their engineer has come up with three scenarios for annual production: 25 tonnes/50 tonnes/100 tonnes. Each of these scenarios is viewed as equally likely. If the fertilizer is of high quality, it can be sold to the country's hobby gardeners at a price of 0.2 million/ton. If the quality however is low quality, the fertilizer will be exported at a price of 0.15 million/ton. The engineer views each quality scenario as equally likely. (a) What are Inka's expected operating revenues for the next 10 years. ( 7 points) (b) Complete the following table ( 7 points) (c) Inka Oil uses a cost of capital equal to 13 percent for all of its projects related to the oil industry. Below is a list of cost of capital for many sectors. Please use a relevant cost of capital to find the NPV. Would you recommend Inka to invest? Why? (8 points) ) (d) A critical analyst points out that the assumption of free cost of fertilizer is not sustainable. Use ideas discussed by Porter to support or refute the analyst's criticism. Does your answer affect the conclusion found above? (8 points) (e) Find the cost of capital that makes the project break-even. (5 points) (f) How can one achieve the cost of capital found above? Please make reasonable assumptions in your answer (15 points) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started