Question

Inland Steel has two profit centers: Ingots and Stainless Steel. These profit centers rely on services supplied by two service departments: electricity and water. The

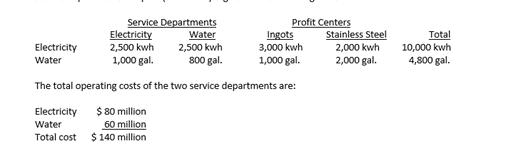

Inland Steel has two profit centers: Ingots and Stainless Steel. These profit centers rely on services supplied by two service departments: electricity and water. The profit centers' consumption of the service departments' outputs (in millions) is given in the following table:

Required: Service department costs are allocated to profit centers using the step-down method. Water is the first service department allocated.

Compute the total cost of allocated service department costs for each of the profit centers using the step-down allocation method. [12 points]

Service Departments Profit Centers Electricity Water Ingots Stainless Steel Electricity 2,500 kwh 2,500 kwh 3,000 kwh 2,000 kwh Water 1,000 gal. 800 gal. 1,000 gal. 2,000 gal. The total operating costs of the two service departments are: Electricity $80 million Water 60 million Total cost $140 million Total 10,000 kwh 4,800 gal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To allocate service department costs using the stepdown method we start with the department that pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started