Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Innovations Bhd is a technology company that designs, manufactures, and sells cutting-edge electronic devices. The company also provides software solutions and services. It operates

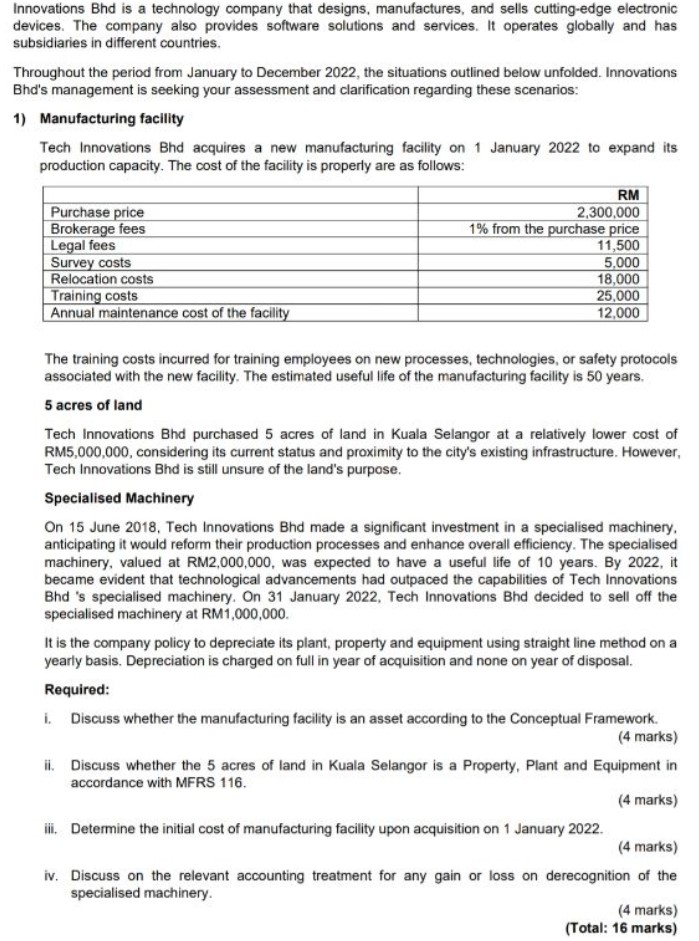

Innovations Bhd is a technology company that designs, manufactures, and sells cutting-edge electronic devices. The company also provides software solutions and services. It operates globally and has subsidiaries in different countries. Throughout the period from January to December 2022, the situations outlined below unfolded. Innovations Bhd's management is seeking your assessment and clarification regarding these scenarios: 1) Manufacturing facility Tech Innovations Bhd acquires a new manufacturing facility on 1 January 2022 to expand its production capacity. The cost of the facility is properly are as follows: Purchase price Brokerage fees Legal fees Survey costs Relocation costs Training costs Annual maintenance cost of the facility RM 2,300,000 1% from the purchase price 11,500 5,000 18,000 25,000 12,000 The training costs incurred for training employees on new processes, technologies, or safety protocols associated with the new facility. The estimated useful life of the manufacturing facility is 50 years. 5 acres of land Tech Innovations Bhd purchased 5 acres of land in Kuala Selangor at a relatively lower cost of RM5,000,000, considering its current status and proximity to the city's existing infrastructure. However, Tech Innovations Bhd is still unsure of the land's purpose. Specialised Machinery On 15 June 2018, Tech Innovations Bhd made a significant investment in a specialised machinery. anticipating it would reform their production processes and enhance overall efficiency. The specialised machinery, valued at RM2,000,000, was expected to have a useful life of 10 years. By 2022, it became evident that technological advancements had outpaced the capabilities of Tech Innovations Bhd 's specialised machinery. On 31 January 2022, Tech Innovations Bhd decided to sell off the specialised machinery at RM1,000,000. It is the company policy to depreciate its plant, property and equipment using straight line method on a yearly basis. Depreciation is charged on full in year of acquisition and none on year of disposal. Required: i. Discuss whether the manufacturing facility is an asset according to the Conceptual Framework. (4 marks) ii. Discuss whether the 5 acres of land in Kuala Selangor is a Property, Plant and Equipment in accordance with MFRS 116. (4 marks) iii. Determine the initial cost of manufacturing facility upon acquisition on 1 January 2022. (4 marks) iv. Discuss on the relevant accounting treatment for any gain or loss on derecognition of the specialised machinery. (4 marks) (Total: 16 marks)

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

i According to the Conceptual Framework an asset is defined as a resource controlled by an entity as a result of past events and from which future eco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started