Input the following information accordingly:

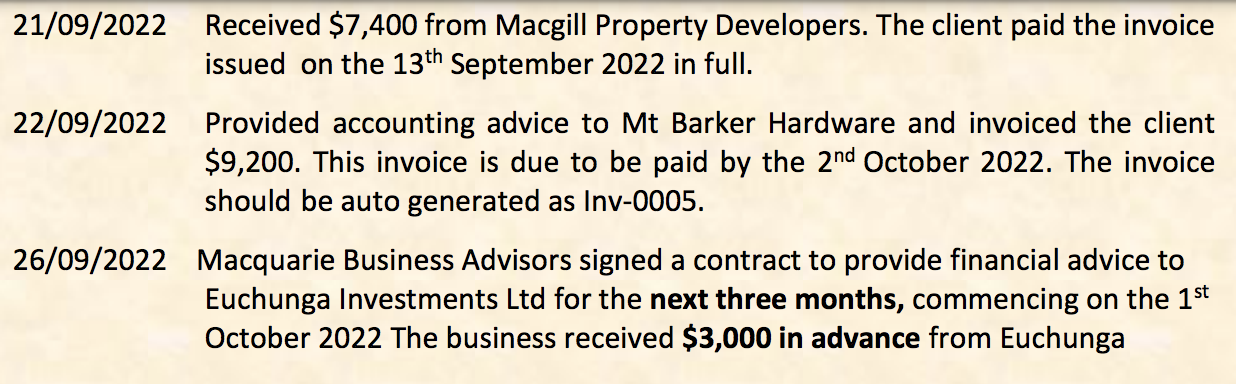

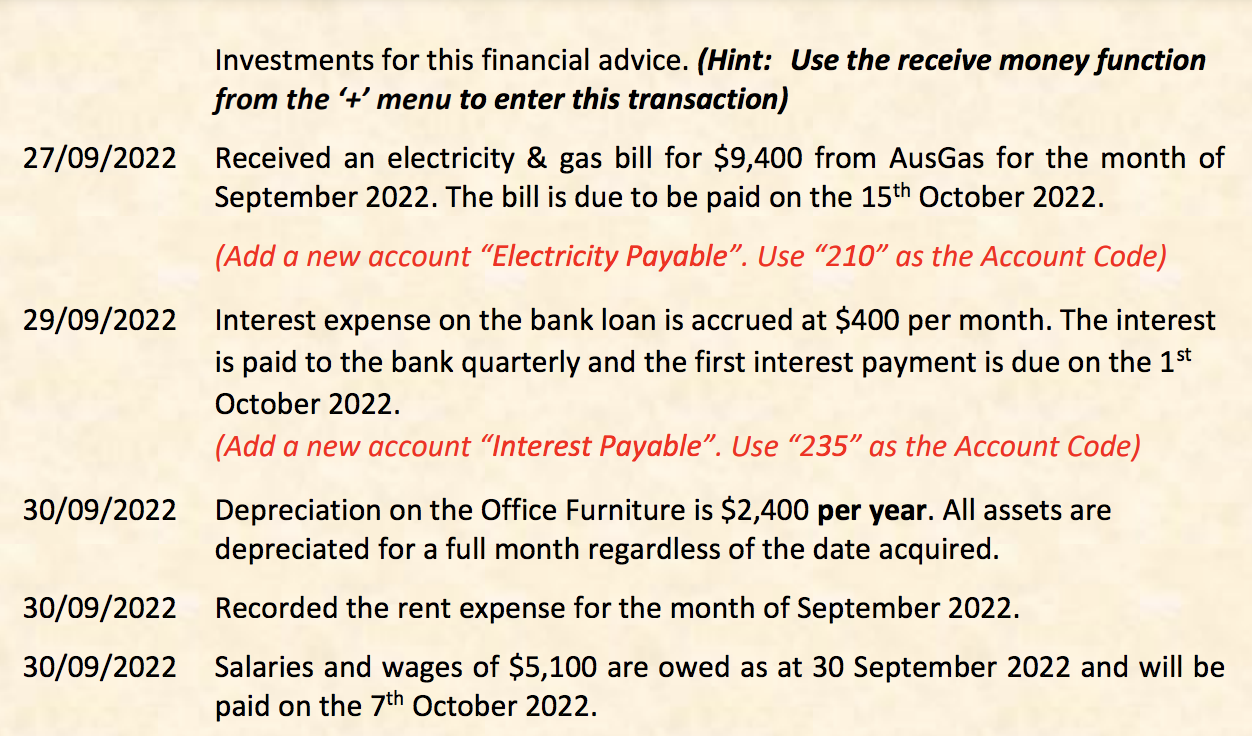

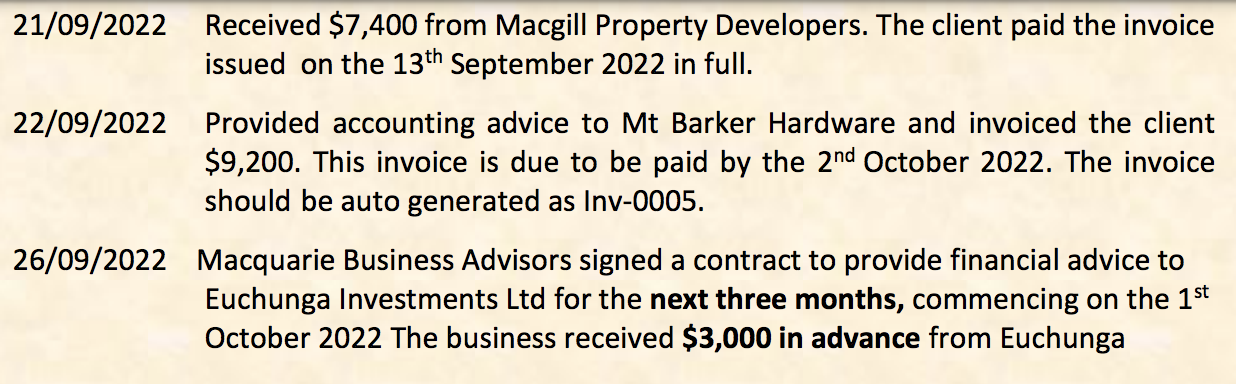

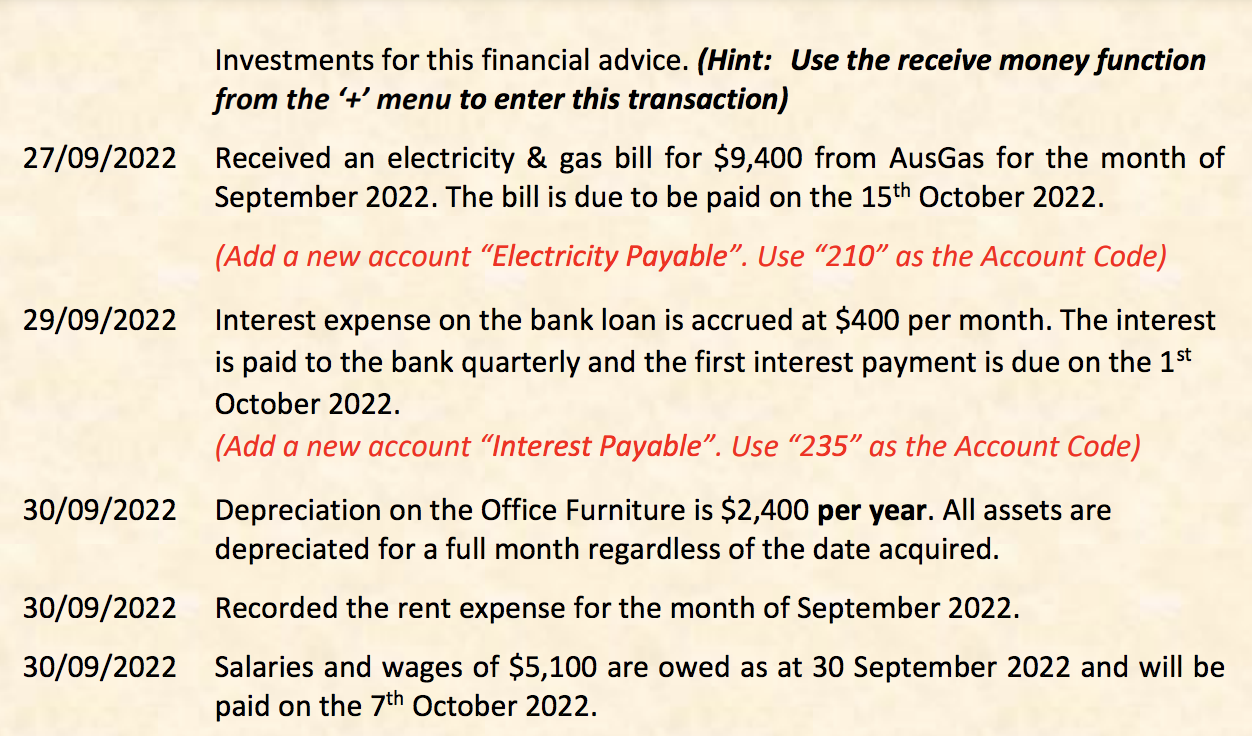

21/09/2022 Received $7,400 from Macgill Property Developers. The client paid the invoice issued on the 13th September 2022 in full. 22/09/2022 Provided accounting advice to Mt Barker Hardware and invoiced the client $9,200. This invoice is due to be paid by the 2nd October 2022 . The invoice should be auto generated as Inv-0005. 26/09/2022 Macquarie Business Advisors signed a contract to provide financial advice to Euchunga Investments Ltd for the next three months, commencing on the 1st October 2022 The business received $3,000 in advance from Euchunga Investments for this financial advice. (Hint: Use the receive money function from the ' + ' menu to enter this transaction) 27/09/2022 Received an electricity \& gas bill for $9,400 from AusGas for the month of September 2022 . The bill is due to be paid on the 15th October 2022. (Add a new account "Electricity Payable". Use "210" as the Account Code) 29/09/2022 Interest expense on the bank loan is accrued at $400 per month. The interest is paid to the bank quarterly and the first interest payment is due on the 1st October 2022. (Add a new account "Interest Payable". Use "235" as the Account Code) 30/09/2022 Depreciation on the Office Furniture is $2,400 per year. All assets are depreciated for a full month regardless of the date acquired. 30/09/2022 Recorded the rent expense for the month of September 2022. 30/09/2022 Salaries and wages of $5,100 are owed as at 30 September 2022 and will be paid on the 7th October 2022 . 21/09/2022 Received $7,400 from Macgill Property Developers. The client paid the invoice issued on the 13th September 2022 in full. 22/09/2022 Provided accounting advice to Mt Barker Hardware and invoiced the client $9,200. This invoice is due to be paid by the 2nd October 2022 . The invoice should be auto generated as Inv-0005. 26/09/2022 Macquarie Business Advisors signed a contract to provide financial advice to Euchunga Investments Ltd for the next three months, commencing on the 1st October 2022 The business received $3,000 in advance from Euchunga Investments for this financial advice. (Hint: Use the receive money function from the ' + ' menu to enter this transaction) 27/09/2022 Received an electricity \& gas bill for $9,400 from AusGas for the month of September 2022 . The bill is due to be paid on the 15th October 2022. (Add a new account "Electricity Payable". Use "210" as the Account Code) 29/09/2022 Interest expense on the bank loan is accrued at $400 per month. The interest is paid to the bank quarterly and the first interest payment is due on the 1st October 2022. (Add a new account "Interest Payable". Use "235" as the Account Code) 30/09/2022 Depreciation on the Office Furniture is $2,400 per year. All assets are depreciated for a full month regardless of the date acquired. 30/09/2022 Recorded the rent expense for the month of September 2022. 30/09/2022 Salaries and wages of $5,100 are owed as at 30 September 2022 and will be paid on the 7th October 2022