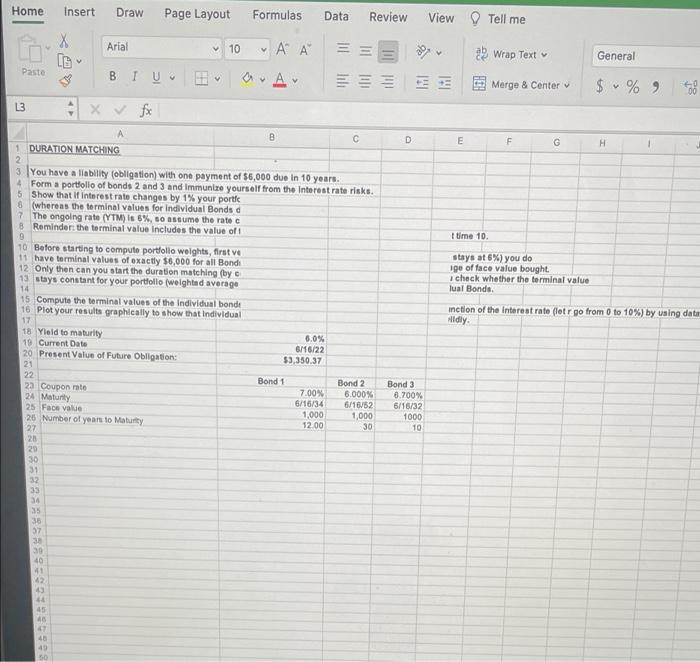

Insert. Draw Page Layout Arial 10 BIU a A L3 X fx A B 1 DURATION MATCHING 2 3 You have a liability (obligation) with one payment of $6,000 due in 10 years. 4 5 8 Form a portfolio of bonds 2 and 3 and Immunize yourself from the Interest rate risks. Show that if interest rate changes by 1% your portic (whereas the terminal values for individual Bonds d The ongoing rate (YTM) is 6%, so assume the rate c Reminder: the terminal value includes the value of 1 7 8 9 10 Before starting to compute portfolio weights, first ve 11 have terminal values of exactly $6,000 for all Bondi 12 Only then can you start the duration matching (by e 13 stays constant for your portfolio (weighted average 14 15 Compute the terminal values of the individual bond 16 Plot your results graphically to show that Individual 17 18 Yield to maturity 19 Current Date 6.0% 6/16/22 $3,350.37 20 Present Value of Future Obligation: 21 22 23 Coupon rate 7.00% 24 Maturity 6/16/34 25 Face value 1,000 26 Number of years to Maturity 12.00 27 28 29 Home Paste 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 45 49 50 Formulas Data A A Bond 1 Bond 2 Review View 6.000% 6/16/52 1,000 30 ilil D Bond 31 6.700% 6/16/32 1000 10 Tell me 2 Wrap Text Merge & Center F G General $%98 H E t time 10. stays at 6%) you do ige of face value bought check whether the terminal value Jual Bonds. inction of the Interest rate (let r go from 0 to 10%) by using data lidly. Insert. Draw Page Layout Arial 10 BIU a A L3 X fx A B 1 DURATION MATCHING 2 3 You have a liability (obligation) with one payment of $6,000 due in 10 years. 4 5 8 Form a portfolio of bonds 2 and 3 and Immunize yourself from the Interest rate risks. Show that if interest rate changes by 1% your portic (whereas the terminal values for individual Bonds d The ongoing rate (YTM) is 6%, so assume the rate c Reminder: the terminal value includes the value of 1 7 8 9 10 Before starting to compute portfolio weights, first ve 11 have terminal values of exactly $6,000 for all Bondi 12 Only then can you start the duration matching (by e 13 stays constant for your portfolio (weighted average 14 15 Compute the terminal values of the individual bond 16 Plot your results graphically to show that Individual 17 18 Yield to maturity 19 Current Date 6.0% 6/16/22 $3,350.37 20 Present Value of Future Obligation: 21 22 23 Coupon rate 7.00% 24 Maturity 6/16/34 25 Face value 1,000 26 Number of years to Maturity 12.00 27 28 29 Home Paste 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 45 49 50 Formulas Data A A Bond 1 Bond 2 Review View 6.000% 6/16/52 1,000 30 ilil D Bond 31 6.700% 6/16/32 1000 10 Tell me 2 Wrap Text Merge & Center F G General $%98 H E t time 10. stays at 6%) you do ige of face value bought check whether the terminal value Jual Bonds. inction of the Interest rate (let r go from 0 to 10%) by using data lidly