Answered step by step

Verified Expert Solution

Question

1 Approved Answer

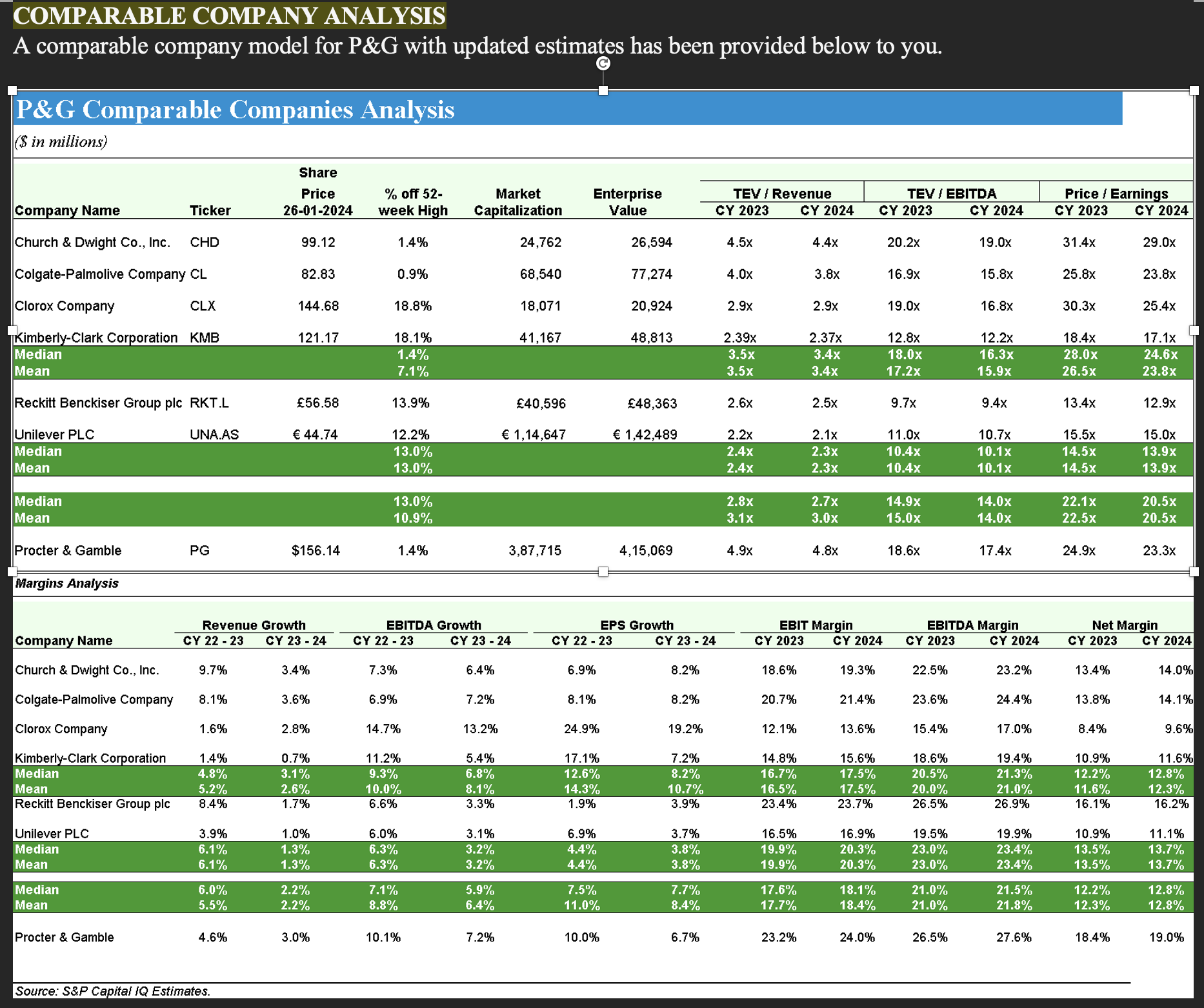

Insert one or two paragraphs analyzing P&G compared to other companies based on revenue, P / E and / or EBITDA ( and any other

Insert one or two paragraphs analyzing P&G compared to other companies based on revenue, PE andor EBITDA and any other relevant industry metric and what valuation your company should have based on comparable companies. Why are most research analysts valuing your company based on revenue, PE andor EBITDA and any other relevant industry metric See research reports to answer the questions below:

Why should P&G trade on PE or TEVEBITDA ratio only and not on an average of TEVRevenue TEVEBITDA and PE ratio or more weightage to PE ratio? For example: Banks do not trade on TEVEBITDA or TEVRevenue multiple since there is no concept of enterprise value in a Bank.

Why did you pick any year actual, expected or expected as the year to value P&G or an average of all three years or two years or one year to value your company?

Why is P&G trading at a premiumdiscount to all the comparable companies or a select group of comparable companies and why are you taking that particular multiple to value your company?

Why is P&G trading at a premiumdiscount to Unilever and is that discount or premium justified going forward?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started