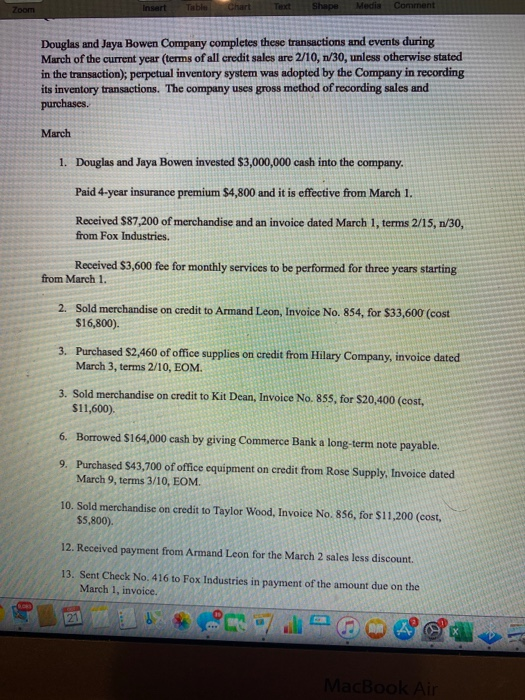

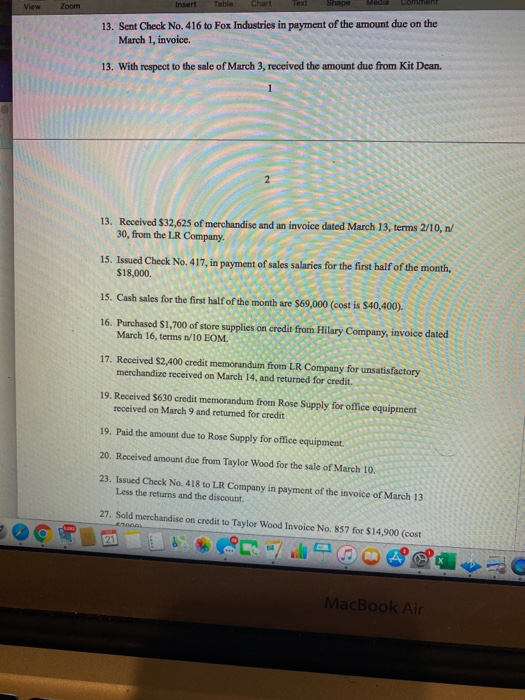

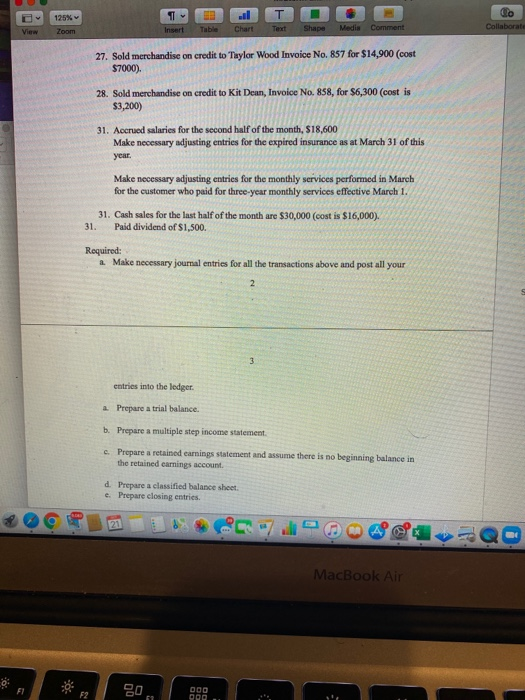

Insert Table Chart Text Shape Media Comment Douglas and Jaya Bowen Company completes these transactions and events during March of the current year (terms of all credit sales are 2/10, 1/30, unless otherwise stated in the transaction); perpetual inventory system was adopted by the Company in recording its inventory transactions. The company uses gross method of recording sales and purchases. March 1. Douglas and Jaya Bowen invested $3,000,000 cash into the company. Paid 4-year insurance premium $4,800 and it is effective from March 1. Received $87,200 of merchandise and an invoice dated March 1, terms 2/15, 1/30, from Fox Industries. Received $3,600 fee for monthly services to be performed for three years starting from March 1. 2. Sold merchandise on credit to Armand Leon, Invoice No. 854, for $33,600 (cost $16,800). 3. Purchased $2,460 of office supplies on credit from Hilary Company, invoice dated March 3, terms 2/10, EOM. 3. Sold merchandise on credit to Kit Dean, Invoice No. 855, for $20,400 (cost, $11,600) 6. Borrowed $164,000 cash by giving Commerce Bank a long-term note payable. 9. Purchased $43,700 of office equipment on credit from Rose Supply, Invoice dated March 9, terms 3/10, EOM. 10. Sold merchandise on credit to Taylor Wood, Invoice No. 856, for $11,200 (cost, $5,800) 12. Received payment from Armand Leon for the March 2 sales less discount. 13. Sent Check No. 416 to Fox Industries in payment of the amount due on the March 1, invoice. de MacBook Air View Zoom Insert Table Shape 13. Sent Check No. 416 to Fox Industries in payment of the amount due on the March 1, invoice. 13. With respect to the sale of March 3, received the amount due from Kit Dean. 13. Received $32,625 of merchandise and an invoice dated March 13, terms 2/10, r/ 30, from the LR Company. 15. Issued Check No. 417, in payment of sales salaries for the first half of the month, $18,000 15. Cash sales for the first half of the month are $69,000 (cost is $40,400). 16. Purchased $1,700 of store supplies on credit from Hilary Company, invoice dated March 16, terms 1/10 EOM. 17. Received $2,400 credit memorandum from LR Company for unsatisfactory merchandize received on March 14, and returned for credit. 19. Received $630 credit memorandum from Rose Supply for office equipment received on March 9 and returned for credit 19. Paid the amount due to Rose Supply for office equipment. 20. Received amount due from Taylor Wood for the sale of March 10. 23. Issued Check No. 418 to LR Company in payment of the invoice of March 13 Less the returns and the discount 27. Sold merchandise on credit to Taylor Wood Invoice No. 857 for $14,900 (cost 21 MacBook Air 125% T il T lo Collaborate View Zoom Insert Table Chart Text Shape Media Comment 27. Sold merchandise on credit to Taylor Wood Invoice No. 857 for $14,900 (cost $7000). 28. Sold merchandise on credit to Kit Dean, Invoice No. 858, for $6,300 (cost is $3,200) 31. Accrued salaries for the second half of the month, $18,600 Make necessary adjusting entries for the expired insurance as at March 31 of this year. Make necessary adjusting entries for the monthly services performed in March for the customer who paid for three-year monthly services effective March 1. 31. Cash sales for the last half of the month are $30,000 (cost is $16,000). Paid dividend of $1,500. 31. Required: a. Make necessary journal entries for all the transactions above and post all your 2 3 entries into the ledger a Prepare a trial balance. b. Prepare a multiple step income statement c. Prepare a retained earnings statement and assume there is no beginning balance in the retained earnings account. d. Prepare a classified balance sheet e. Prepare closing entries. 20 MacBook Air F1 DPP 3 entries into the ledger. a. Prepare a trial balance. b. Prepare a multiple step income statement. c. Prepare a retained earnings statement and assume there is no beginning balance in the retained earnings account. d. Prepare a classified balance sheet. e. Prepare closing entries. f. Prepare a post-closing trial balance. 21 MacBook Air