Question

Zavala Drilling Co. purchased machinery on December 31, 2018, paying $100,000 down and agreeing to pay the balance in four equal nstallments of $125,000

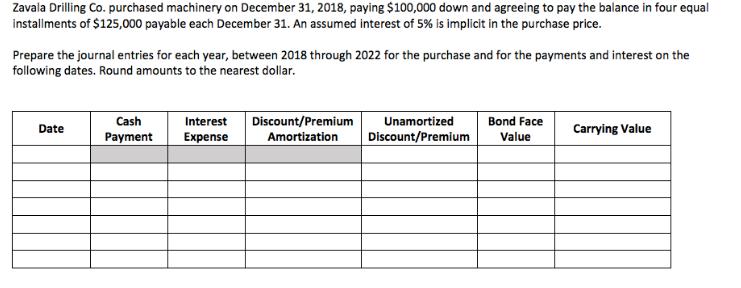

Zavala Drilling Co. purchased machinery on December 31, 2018, paying $100,000 down and agreeing to pay the balance in four equal nstallments of $125,000 payable each December 31. An assumed interest of 5% is implicit in the purchase price. Prepare the journal entries for each year, between 2018 through 2022 for the purchase and for the payments and interest on the following dates. Round amounts to the nearest dollar. Discount/Premium Unamortized Discount/Premium Cash Interest Bond Face Date Carrying Value Payment Expense Amortization Value

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

DATE DETAILS DEBIT CREDIT 31Dec18 Machinery Cash Liability Payable 543244 100000 443244 31Dec19I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting IFRS

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

3rd edition

1119372933, 978-1119372936

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App