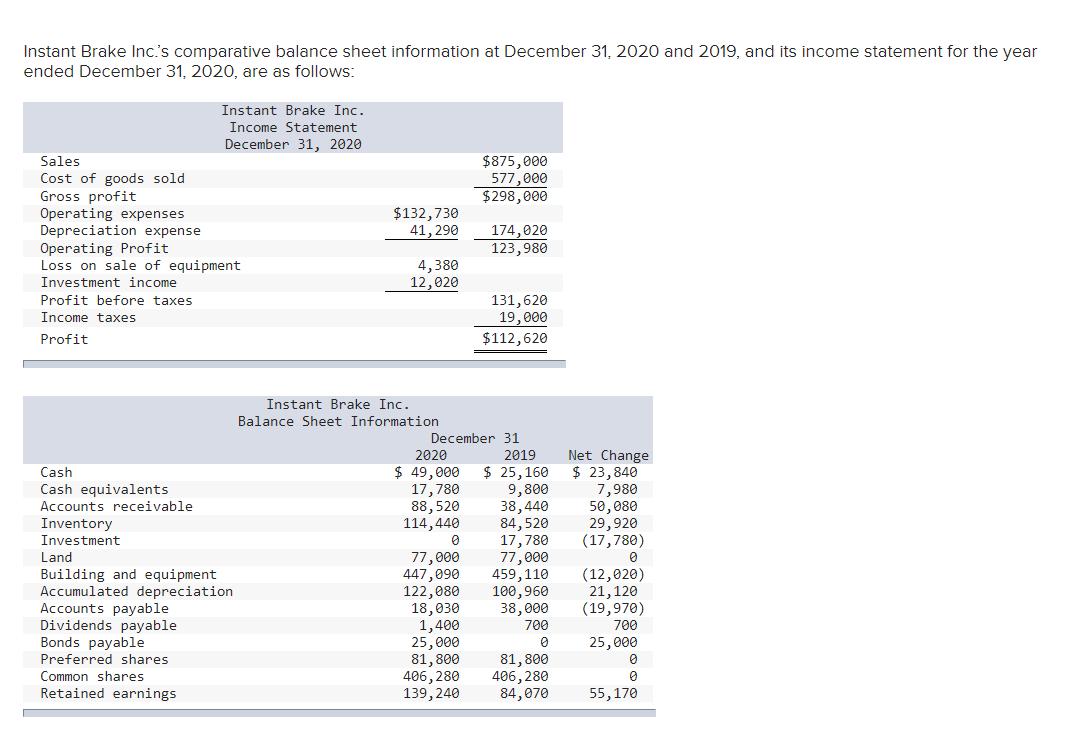

Instant Brake Inc's comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020,

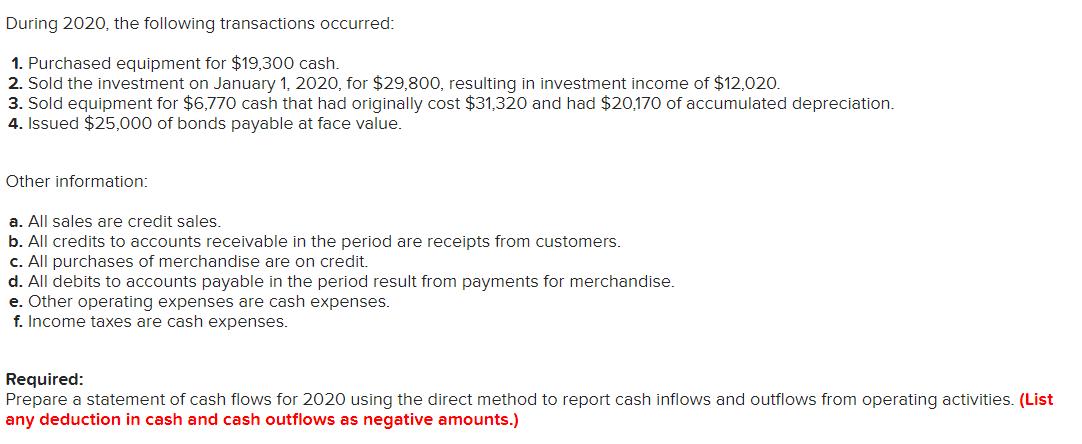

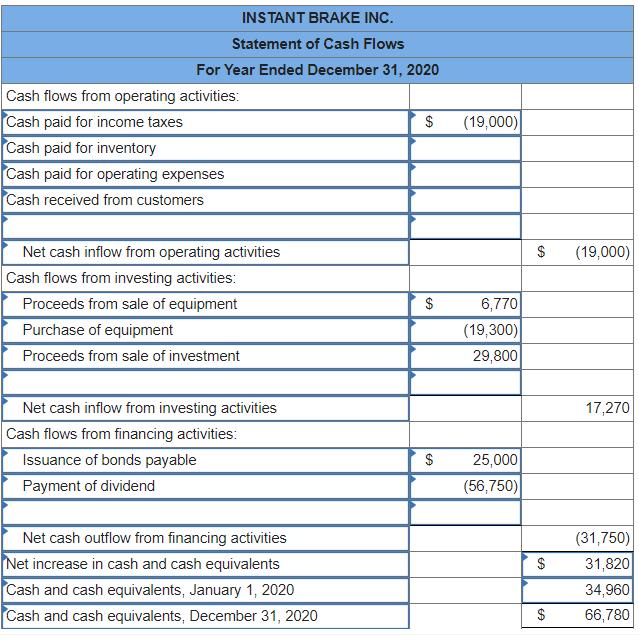

Instant Brake Inc's comparative balance sheet information at December 31, 2020 and 2019, and its income statement for the year ended December 31, 2020, are as follows: Instant Brake Inc. Income Statement December 31, 2020 $875,000 577,000 $298,000 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Operating Profit Loss on sale of equipment $132,730 41, 290 174,020 123,980 4,380 12,020 Investment income Profit before taxes 131,620 19,000 Income taxes Profit $112,620 Instant Brake Inc. Balance Sheet Information December 31 2020 $ 49,000 17,780 88,520 114,440 Net Change $ 23,840 7,980 50,080 29,920 (17,780) 2019 $ 25,160 9,800 38,440 84,520 17,780 77,000 459,110 100,960 38,000 Cash Cash equivalents Accounts receivable Inventory Investment Land Building and equipment Accumulated depreciation Accounts payable Dividends payable Bonds payable Preferred shares 77,000 447,090 122,080 18,030 1,400 25,000 81, 800 406,280 139,240 (12,020) 21,120 (19,970) 700 25,000 700 81,800 406,280 84,070 Common shares Retained earnings 55,170 During 2020, the following transactions occurred: 1. Purchased equipment for $19,300 cash. 2. Sold the investment on January 1, 2020, for $29,800, resulting in investment income of $12,020. 3. Sold equipment for $6,770 cash that had originally cost $31,320 and had $20,170 of accumulated depreciation. 4. Issued $25,000 of bonds payable at face value. Other information: a. All sales are credit sales. b. All credits to accounts receivable in the period are receipts from customers. c. All purchases of merchandise are on credit. d. All debits to accounts payable in the period result from payments for merchandise. e. Other operating expenses are cash expenses. f. Income taxes are cash expenses. Required: Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities. (List any deduction in cash and cash outflows as negative amounts.) INSTANT BRAKE INC. Statement of Cash Flows For Year Ended December 31, 2020 Cash flows from operating activities: Cash paid for income taxes Cash paid for inventory Cash paid for operating expenses Cash received from customers $ (19,000) Net cash inflow from operating activities $ (19,000) Cash flows from investing activities: Proceeds from sale of equipment $ 6,770 Purchase of equipment (19,300) Proceeds from sale of investment 29,800 Net cash inflow from investing activities 17,270 Cash flows from financing activities: Issuance of bonds payable $ 25,000 Payment of dividend (56,750) Net cash outflow from financing activities (31,750) Net increase in cash and cash equivalents Cash and cash equivalents, January 1, 2020 Cash and cash equivalents, December 31, 2020 31,820 34,960 $ 66,780

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

TUESDAY 1 Dividend Paid 56780 lostard Brake lbe Stafement ef Cash Flow C...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started