Answered step by step

Verified Expert Solution

Question

1 Approved Answer

?Instead of the cost of debt financing at 8% as is presented below, assume that debt financing would cost 15%. Also assume (as is presented

?Instead of the cost of debt financing at 8% as is presented below, assume that debt financing would cost 15%. Also assume (as is presented below) that the healthcare organization is a for-profit and therefore pays taxes at a 40% rate.

Find the Return on Equity (ROE) for the 50% stock/50% debt capital structure only. (Otherwise said, redo the analysis here for the righthand column while assuming an increase in the interest rate on the debt up from 8% to 15% and be sure to account for taxes.)

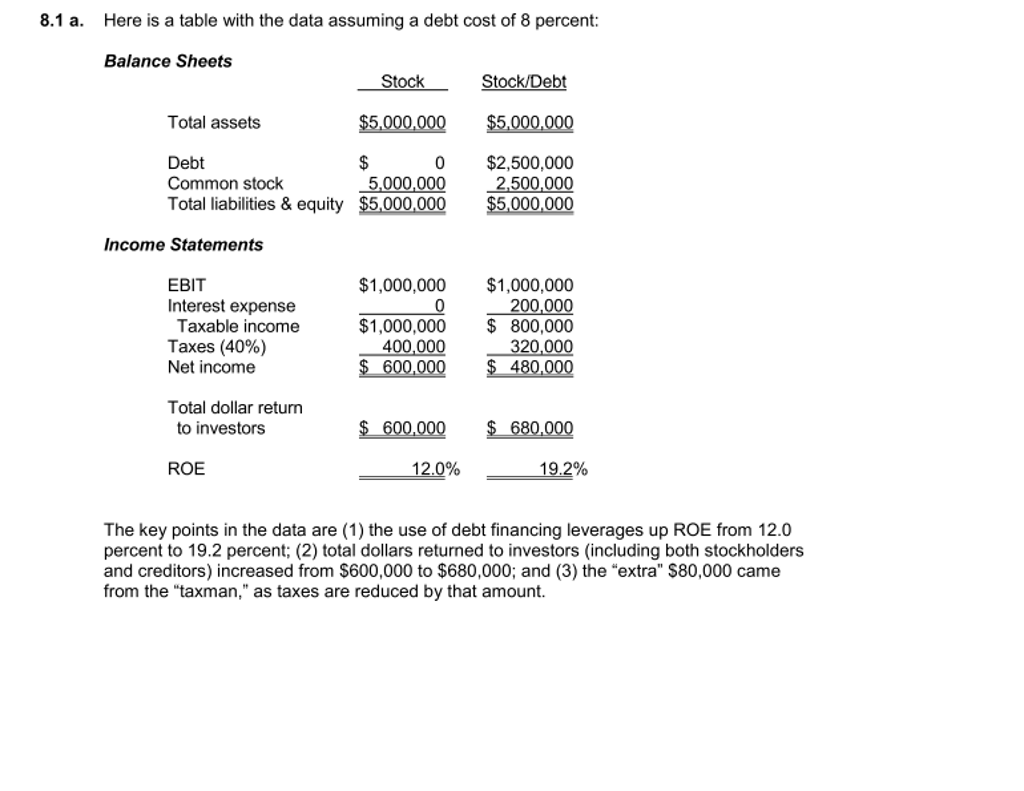

8.1 a. Here is a table with the data assuming a debt cost of 8 percent: Balance Sheets Stock Stock/Debt Total assets $5,000,000 $5,000,000 Debt Common stock 0 $2,500,000 2,500,000 Total liabilities & equity $5,000,000 $5,000,000 5,000,000 Income Statements EBIT Interest expense $1,000,000 $1,000,000 Taxable income Taxes (40%) Net income 200 800,000 320,000 48 $1,000,000 400,000 Total dollar return to investors ROE The key points in the data are (1) the use of debt financing leverages up ROE from 12.0 percent to 19.2 percent; (2) total dollars returned to investors (including both stockholders and creditors) increased from $600,000 to $680,000; and (3) the "extra" $80,000 came from the "taxman," as taxes are reduced by that amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started