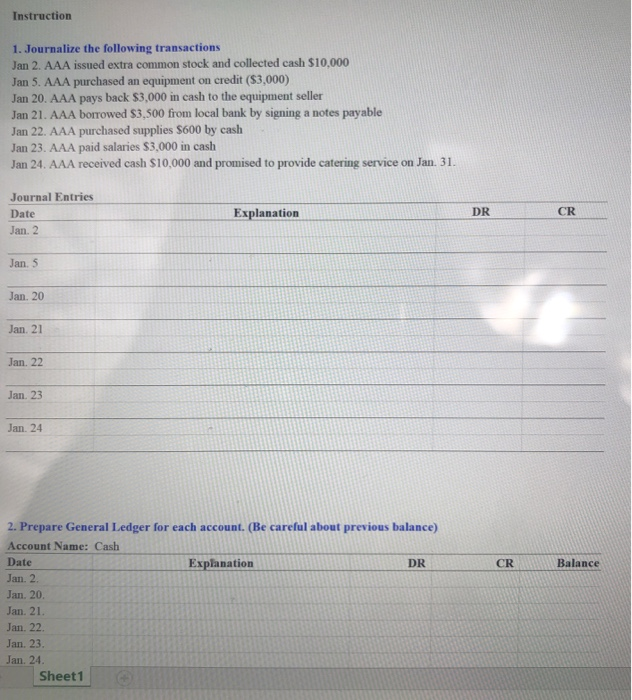

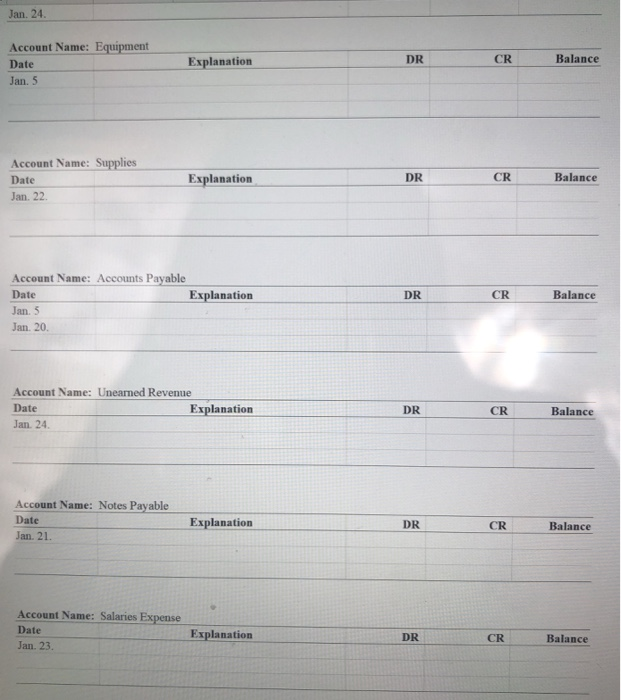

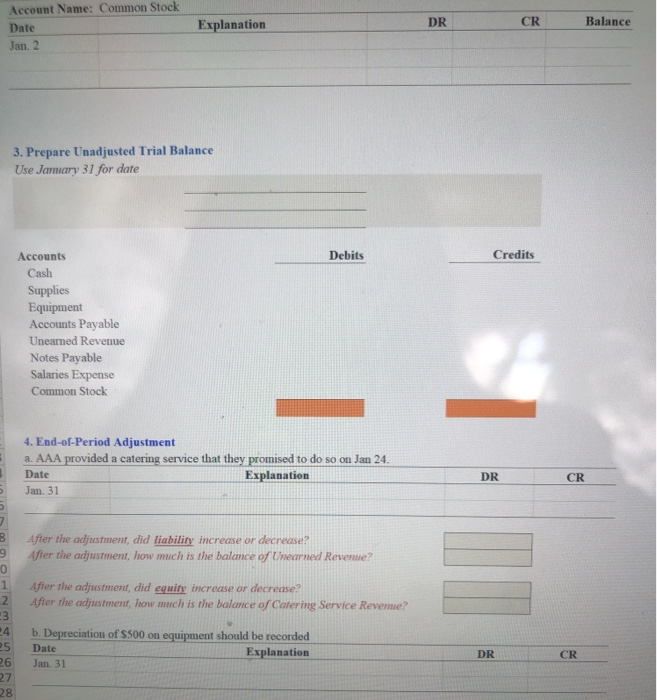

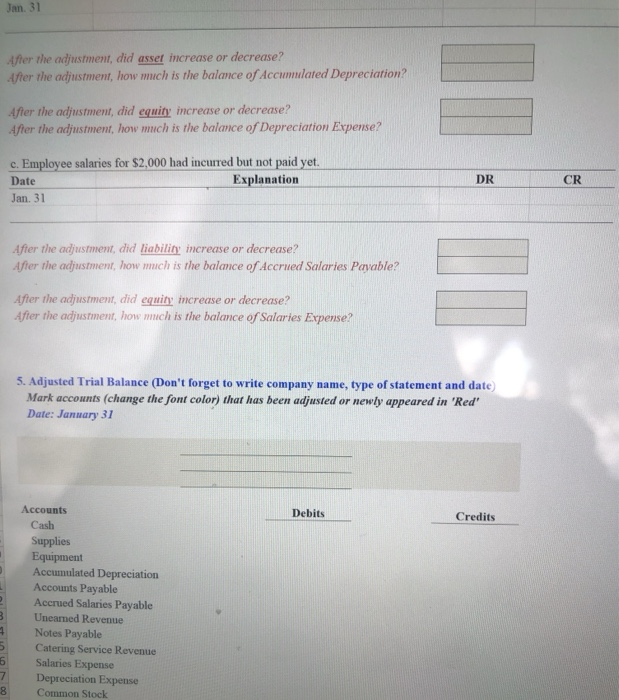

Instruction 1. Journalize the following transactions Jan 2. AAA issued extra common stock and collected cash $10,000 Jan 5. AAA purchased an equipment on credit ($3,000) Jan 20. AAA pays back $3,000 in cash to the equipment seller Jan 21. AAA borrowed $3,500 from local bank by signing a notes payable Jan 22. AAA purchased supplies $600 by cash Jan 23. AAA paid salaries $3,000 in cash Jan 24. AAA received cash $10,000 and promised to provide catering service on Jan. 31. Journal Entries Date Jan. 2 Explanation DR CR Jan. 5 Jan. 20 Jan. 21 Jan. 22 Jan. 23 Jan. 24 2. Prepare General Ledger for each account. (Be careful about previous balance) Account Name: Cash Date Jan. 2 Jan. 20. Jan. 21 Jan. 22 Jan. 23 Jan. 24 Explanation DR CRBalance Sheet 1 Jan. 24. Account Name: Equipment Date Jan. 5 Explanation DR CR Balance Account Name: Supplies Date Explanation DR CR Balance Jan. 22 Account Name: Accounts Payable Date Jan. 5 Jan. 20 Explanation DR CR Balance Account Name: Unearned Revenue Date Jan. 24 Explanation DR CR Balance Account Name: Notes Payable Date Jan. 21. Explanation DR CR Balance Account Name: Salaries Expense Date Jan. 23. Explanation DR CR Balance Account Name: Common Stock Date Jan. 2 Explanation DR CR Balance 3. Prepare Unadjusted Trial Balance Use Jamary 31 for date Accounts Debits Credits Cash Supplies Equipment Accounts Payable Unearned Revenue Notes Payable Salaries Expense Common Stock 4. End-of-Period Adjustment service that th to do so on Jan 24 Date Jan. 31 Explanation DR CR B Afer the adjustment, did liability increase or decrease? After the adjustment, how much is the balance of Unean 0 fter the adjustment, did eguity increase or decrease? 2 After the adjustment, how much is the balance of Catering Service Revenme? 3 4 b. Depreciation of $500 on equipment should be recorded 5 Date 6 Jan. 31 27 28 Explanation DR CR Jan. 31 After the adjustment, did asset increase or decrease? fher the adjustment, how much is the balance of Accumilated Depreciation? Afier the adjustment, did equity increase or decrease After the adjustment, how much is the balance of Depreciation Expense? c. Employee salaries for $2,000 had incurred but not paid yet. Date Jan. 31 Explanation DR CR After the adjustment, did liability increase or decrease? Afer the adustment, how nuch is the balance of Accrued Salaries Pavable? After the adjustment, did equity increase or decrease? fter the adjustment, how mch is the balance of Salaries Expense? 5. Adjusted Trial Balance (Don't forget to write company name, type of statement and date Mark accounts (change the font color) that has been adjusted or newly appeared in 'Red' Date: January 31 Accounts Debits Credits Cash Supplies Equipment Accumulated Depreciation Accounts Payable Accrued Salaries Payable Notes Payable 5 Catering Service Revenue 6 Salaries Expense 7 Depreciation Expense Common Stock