Question

Instruction:- Fi rst, please read the project material provided carefully. Then answer the questions by using concepts and theories you have studied in the course.

Instruction:-

First, please read the project material provided carefully. Then answer the questions by using concepts and theories you have studied in the course. Your answers should be logical and in full sentences. Write your answers in your own words dont copy and paste. By phrasing things in your own words, you have to think about the content. This will help you to remember the information. To receive full marks, you must explain your answer fully as required and provide proper references if necessary. Please note, there are two parts to the Mid-term Project. Included in this section is the first part. The second part is a Discussion question.

1. You should provide your answers to questions in a separate Word document. You should use a cover page for your answer submission.

2. Whenever you use any formula to arrive at your answers, you need to write out the formula. For example: if you need to find out the Profit Margin, then you need to write out the profit margin formula first and then plug in the numbers to make the calculation: Profit margin = Net Income / Sales.

3. You should label your answers to questions clearly. Please set line spacing in your word processor to double spacing (2x).

4. Your answer document should be spelling/grammatical errors free. Make sure you include page numbers in your documents.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

This project is an individual assignment. Independent completion, without collaborating with other students is required.

This project is based on the course material covered to the mid-term point. It includes:

Chapter 1 - The goals and functions of financial management

Chapter 2 - Review of accounting

Chapter 3 - Financial analysis

Chapter 5 - Operating and financial leverage

Chapter 6 - Working capital and financing decisions

Mr. Entrepreneurs Story

Part 1

When Mr. Entrepreneur was in his twenties, he decided to start a business. Since he was from province of British Columbia, where there are a lot of timber available, he decided to get into furniture making business. After some research, he found out that furniture business has the following characteristics:

This business is very cyclical. When general economy is in good shape, the demand for furniture is strong and vice versa.

This business is very competitive. There are many furniture makers in the market.

This business is subject to various governmental regulations, including international trade, safety, and environmental regulations. They have an impact, sometimes beneficial, sometimes detrimental, on the industry.

Eventually Mr. Entrepreneur decided to go ahead and try his luck in the furniture making business specializing in baby furniture. The ABC Corporation was born and started operation on Jan 1st, 2018.

The initial company ownership structure: Mr. Entrepreneur invested all his inheritance in the company. He was the only shareholder of the company. The total number of common stock shares issued and outstanding were 100,000 shares.

Part 2

After two years of operation, Mr. Entrepreneur was contemplating to take the company public meaning he was considering selling some of his shares to public so that he could raise some capital to improve and expand his business into USA. For this purpose, he hired a brokerage firm (Mr. Broker) to conduct an initial feasibility study, trying to assess how feasible for him to carry out an IPO Initial public offering plan.

Mr. Brokers job involved the assessment of companys operation in the following areas:

The profitability of the company as compared with industry average

The efficiency of the company operation

The liquidity of the company

Debt utilization

It was Mr. Brokers job to come up an objective assessment of overall company performance as compared with the industry averages.

In addition, Mr. Broker was expected to provide guidance for pricing the share price to sell to the public. The rough estimation of the shares can be based on industry average P/E ratio and expected earnings of the company. To this end, the potential Earnings Per Share (EPS) growth rate was going to be similar to the average industry growth rate of 8%.

Part 3

Mr. Entrepreneur just hired a financial consultant (Ms. Consultant) trying to take advantage of some of the financial strategies in order to improve his company performance.

Ms. Consultant explained to Mr. Entrepreneur the magic effects of what is called Operating and Financial leverage. He told Mr. Entrepreneur that in order to increase the operating leverage Mr. Entrepreneur should invest in more capital assets purchasing more equipment and automating more of factory operations.

As for taking advantage of what is called financial leverage, Ms. Consultant suggested Mr. Entrepreneur to mix up his financing sources She suggested that Mr. Entrepreneur should use more debt in financing than in the past.

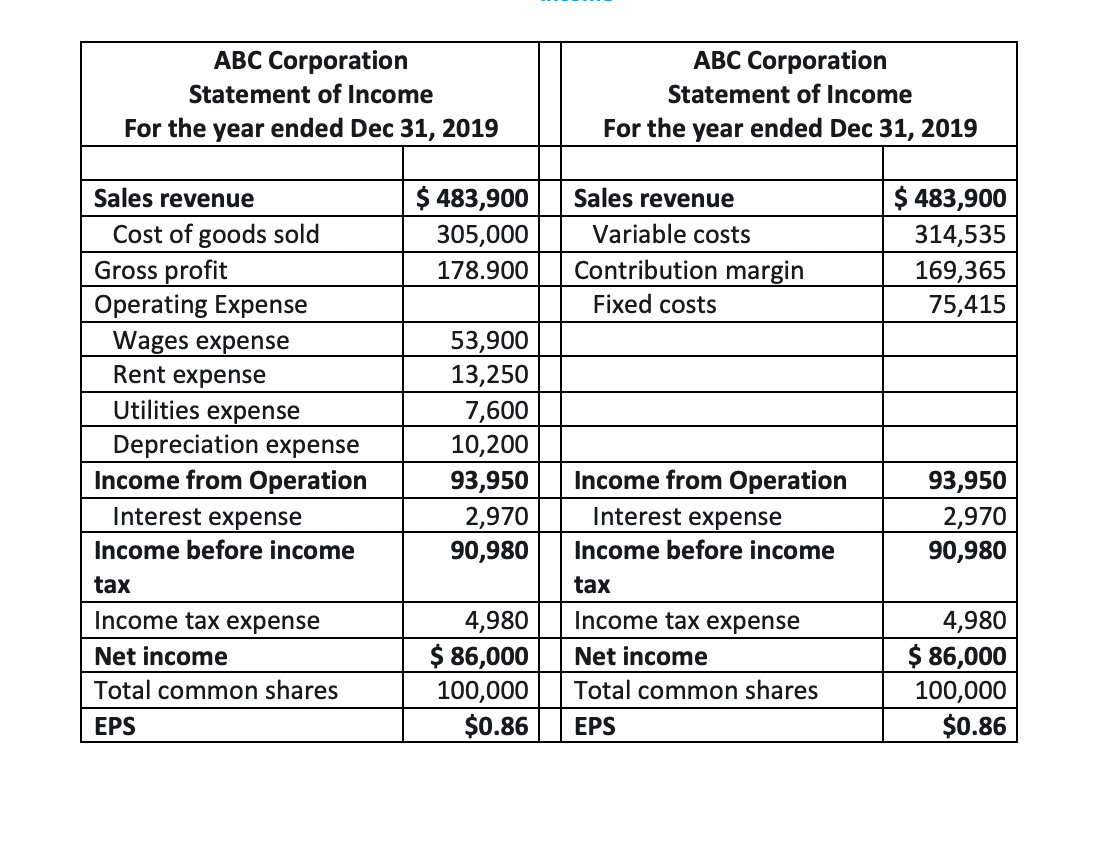

Ms. Consultant calculated companys DOL and DFL. The numbers were:

DOL = Contribution Margin/Operating Income= 169,36593,950=1.82

DFL= Operating Income/Earning before tax= 93,95090,980=1.03

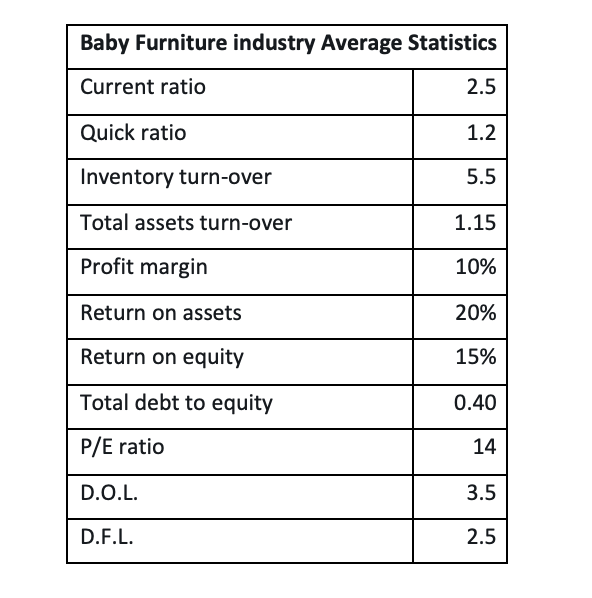

Ms. Consultant commented on these numbers and told Mr. Entrepreneur that his company was a little bit on the conservative side with respect in using operating and financial leverage, as compared with industry average. The industry average numbers for DOL and DFL are 3.5 and 2.5 respectively. She consequently made a number of suggestions to Mr. Entrepreneur:

Mr. Entrepreneur should make more investment in the company capital assets, purchasing more modern equipment to improve its productivity.

Mr. Entrepreneur should use more debt to finance his capital assets acquisition in order to take better advantage of financial leverage it offers.

Mr. Entrepreneur felt good about what Ms. Consultant suggested and planned to implement some new asset acquisition and financing plans.

Part 4

Thanks to recent buoyant economic growth, the demand for Mr. Entrepreneurs baby furniture had been strong and business had been very good with a big backlog of orders.

However, Mr. Entrepreneur noticed that very often he did not have enough cash to cover all the bills due. He was a little puzzled by the situation. Mr. Entrepreneur asked his accountant to explain to him what was going on.

Mr. Accountant explained: because there is a cash gap between inventory holding period, account receivable collection period and account payable period, the company without sufficient financing will face short-term cash crunch. To solve this problem, the company needs to secure adequate external financing.

After hearing Mr. Accountants explanation, Mr. Entrepreneur felt much relaxed. To him, if lack of financing was indeed the problem, then he could easily solve this problem by talking to his bankers to arrange for some loans and credit lines for the company all short-term financing vehicles.

Mr. Accountant knew there should be more factors to be considered in terms of financing. But since he had limited financing training, he couldnt elaborate on what those other factors were. This was very frustrating to him.

Questions: (Total marks 65)

1)Considering the characteristics of the business Mr. Entrepreneur wanted to enter, in your opinion, what organization form his business should be taken? (Sole proprietorship? Partnership? Or corporation?) Provide at least three reasons to back up your choice. (4 marks - 1 mark for the choice and 1 mark for each reason)

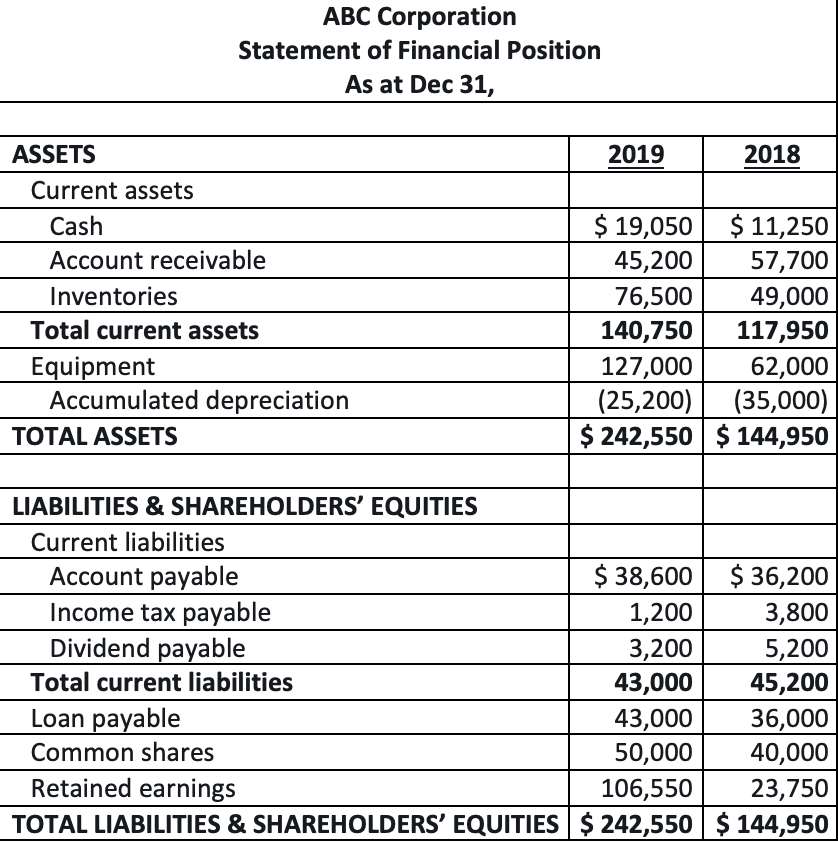

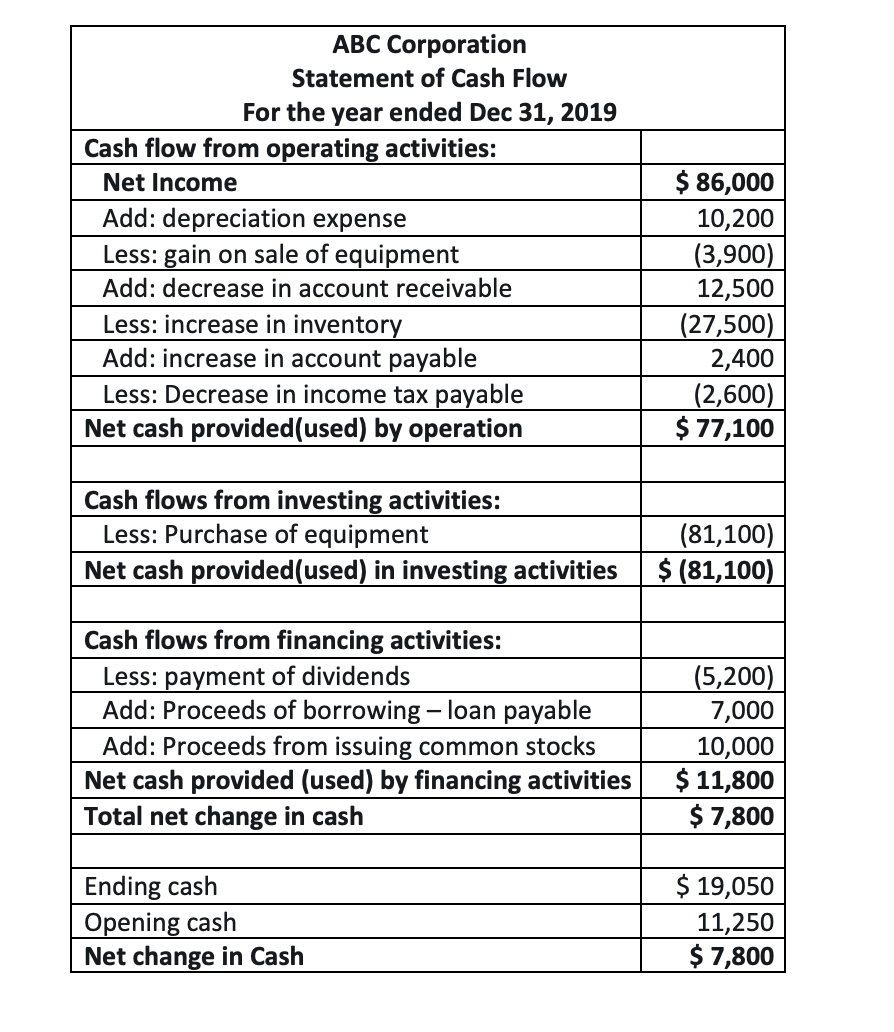

2)Referring to the statement of Cash Flow (table 3), from a cash flow point of view, what area did company generate the majority of its cash? (3 marks) What does this information suggest about company operation? (2 marks)

3)What are the major limitations of Income Statement and Statement of Financial Position? What can you suggest minimizing these limitations? (5 Marks)

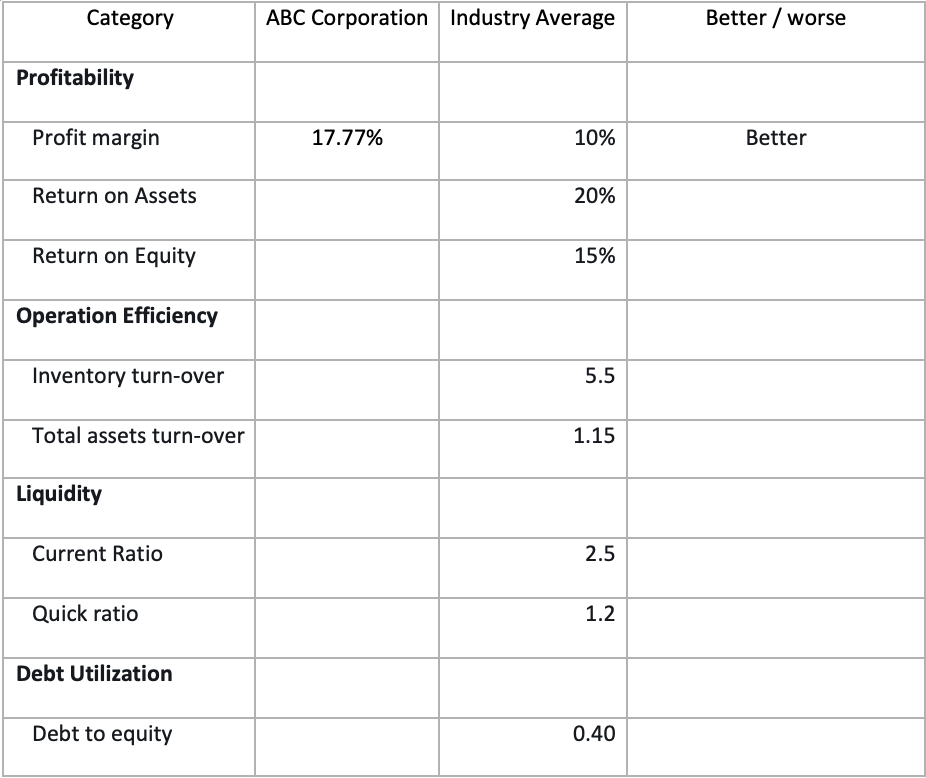

4)In your opinion, how has Mr. Entrepreneur been doing with his business in terms of profitability, operational efficiency, liquidity, and debt utilization? Use the template below and data from Table 1 and Table 2 to answer your questions. (16 marks - 2 marks for each ratio, show calculation):

Show the formula you use and calculate the ratios and then complete the table above:

Example:

Profit margin= Net Income/Sales= 86,000483,900=0.1777=17.77%

5)Finance managers often use what is called Trend Analysis to analyze company performance over time. What is the Trend Analysis? (3 marks) How are we going to perform a Trend Analysis for Mr. Entrepreneurs company? (3 marks)

6)What is the DuPont Model? (3 marks) Using DuPont model, comment on how to improve companys return on equity (ROE) (3 marks).

7)Ms. Consultant has suggested Mr. Entrepreneur to increase capital investment in equipment and tools in order to take advantage of operating leverage effect. Also, she has suggested increasing amount of debt in total financing in order to utilize financial leverage effect. Do you agree or disagree with her suggestions? (2 marks), and why? (3 marks)? What are the factors you need to consider in order to implement her suggestion properly? (3 marks).

8)Ms. Consultant calculated DOL and DFL numbers for Mr. Entrepreneur. What do DOL = 1.82 and DFL = 1.03 mean? (4 marks-2 marks for each answer).

9)Why, in your opinion, did Mr. Entrepreneur face period of short-term cash crunch in his operation despite the fact his business was doing really well? (3 marks) Theoretically speaking, what financing choices did Mr. Entrepreneur have? (3 marks)

10)Mr. Entrepreneur had trouble to understand what permanent current assets are. Explain to Mr. Entrepreneur what permanent current assets are and make sure use an example in your explanation. (5 Marks)

Table 1 Statement of Financial Position

Table 2-1 Statement of Income Table 2-2 Contribution Margin Statement of Income

Table -3 Statement of Cash Flow

Table 4 Industry Statistics

ABC Corporation Statement of Financial Position As at Dec 31, \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Baby Furniture industry Average Statistics } \\ \hline Current ratio & 2.5 \\ \hline Quick ratio & 1.2 \\ \hline Inventory turn-over & 5.5 \\ \hline Total assets turn-over & 1.15 \\ \hline Profit margin & 10% \\ \hline Return on assets & 20% \\ \hline Return on equity & 15% \\ \hline Total debt to equity & 0.40 \\ \hline P/E ratio & 14 \\ \hline D.O.L. & 3.5 \\ \hline D.F.L. & 2.5 \\ \hline \end{tabular} ABC Corporation Statement of Financial Position As at Dec 31, \begin{tabular}{|l|r|} \hline \multicolumn{2}{|c|}{ Baby Furniture industry Average Statistics } \\ \hline Current ratio & 2.5 \\ \hline Quick ratio & 1.2 \\ \hline Inventory turn-over & 5.5 \\ \hline Total assets turn-over & 1.15 \\ \hline Profit margin & 10% \\ \hline Return on assets & 20% \\ \hline Return on equity & 15% \\ \hline Total debt to equity & 0.40 \\ \hline P/E ratio & 14 \\ \hline D.O.L. & 3.5 \\ \hline D.F.L. & 2.5 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started