Answered step by step

Verified Expert Solution

Question

1 Approved Answer

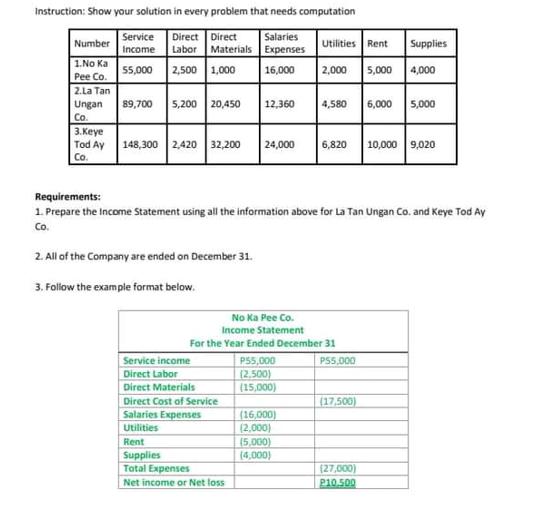

Instruction: Show your solution in every problem that needs computation Service Direct Direct Income Labor Materials Expenses Salaries 55,000 2,500 1,000 16,000 Number 1.No

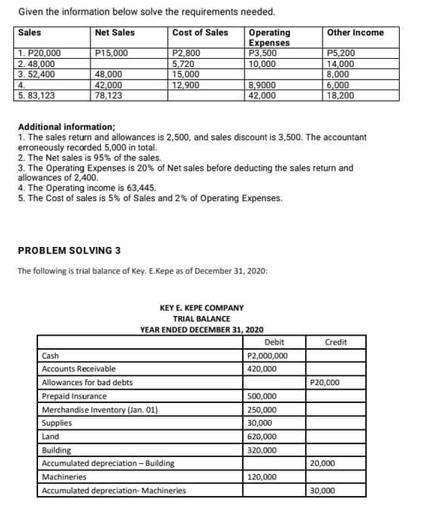

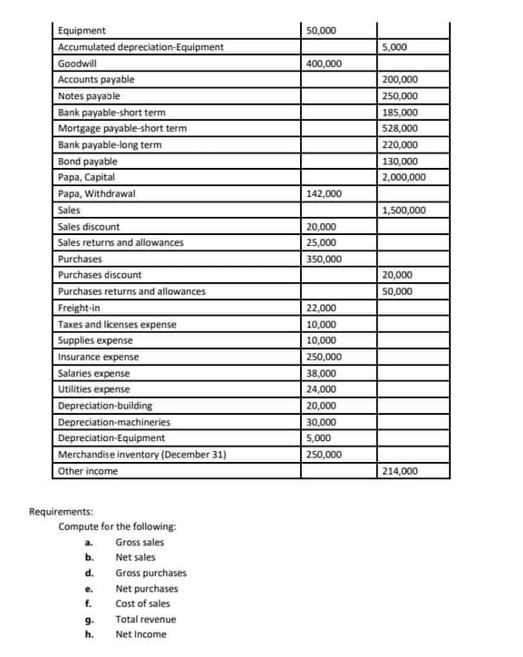

Instruction: Show your solution in every problem that needs computation Service Direct Direct Income Labor Materials Expenses Salaries 55,000 2,500 1,000 16,000 Number 1.No Ka Pee Co. 2.La Tan Ungan Co. 89,700 5,200 20,450 12,360 3.Keye Tod Ay 148,300 2,420 32,200 Co. 2. All of the Company are ended on December 31. 3. Follow the example format below. Service income Direct Labor Direct Materials 24,000 Direct Cost of Service Salaries Expenses Utilities Rent Supplies Total Expenses Net income or Net loss Requirements: 1. Prepare the Income Statement using all the information above for La Tan Ungan Co. and Keye Tod Ay Co. No Ka Pee Co. Income Statement For the Year Ended December 31 Utilities Rent 2,000 5,000 P55,000 (2.500) (15,000) (16,000) (2,000) (5,000) (4,000) 4,580 6,000 5,000 6,820 PS5,000 Supplies 4,000 (17,500) (27,000) P10.500 10,000 9,020 Given the information below solve the requirements needed. Sales Net Sales Cost of Sales P15,000 48,000 42,000 78,123 1. P20,000 2.48,000 3.52,400 4. 5.83,123 P2,800 5,720 15,000 12.900 Operating Expenses Cash Accounts Receivable Allowances for bad debts Prepaid Insurance P3,500 10,000 Additional information; 1. The sales return and allowances is 2,500, and sales discount is 3,500. The accountant erroneously recorded 5,000 in total. 2. The Net sales is 95% of the sales. 8.9000 42,000 3. The Operating Expenses is 20% of Net sales before deducting the sales return and allowances of 2,400. 4. The Operating income is 63,445. 5. The Cost of sales is 5% of Sales and 2% of Operating Expenses. Merchandise Inventory (Jan.01) Supplies Land PROBLEM SOLVING 3 The following is trial balance of Key. E.Kepe as of December 31, 2020; Building Accumulated depreciation-Building Machineries Accumulated depreciation Machineries KEY E. KEPE COMPANY TRIAL BALANCE YEAR ENDED DECEMBER 31, 2020 Debit P2,000,000 420,000 Other Income | P5,200 14,000 8,000 6,000 18.200 500,000 250,000 30,000 620,000 320,000 120,000 Credit P20,000 20,000 30,000 Equipment Accumulated depreciation-Equipment Goodwill Accounts payable Notes payable Bank payable-short term Mortgage payable-short termi Bank payable-long term Bond payable Papa, Capital Papa, Withdrawal Sales Sales discount Sales returns and allowances Purchases. Purchases discount Purchases returns and allowances Freight-in Taxes and licenses expense Supplies expense Insurance expense Salaries expense Utilities expense Depreciation building Depreciation-machineries Depreciation Equipment Merchandise inventory (December 31) Other income Requirements: Compute for the following: Gross sales Net sales Gross purchases a. b. d. e. f. 9. h. Net purchases Cost of sales Total revenue Net Income 50,000 400,000 142,000 20,000 25,000 350,000 22,000 10,000 10,000 250,000 38,000 24,000 20,000 30,000 5,000 250,000 5,000 200,000 250,000 185,000 528,000 220,000 130,000 2,000,000 1,500,000 20,000 50,000 214,000 PROBLEM SOLVING 4 Requirement: Prepare a Statement of Comprehensive income for Problem 2

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Problem 1 La Tan Ungan Co Income Statement For the Year Ended December 31 Service Income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started