Answered step by step

Verified Expert Solution

Question

1 Approved Answer

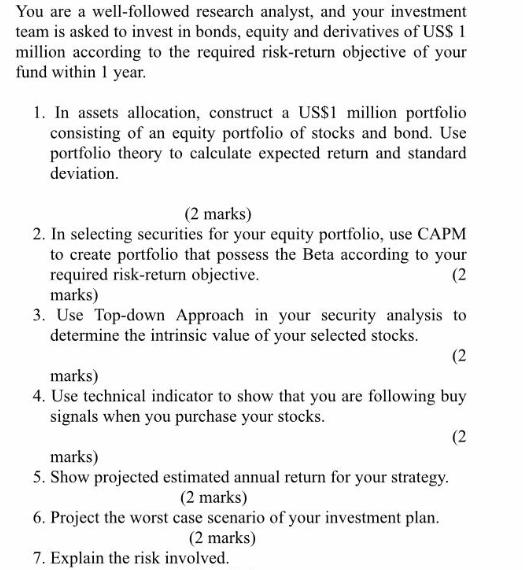

You are a well-followed research analyst, and your investment team is asked to invest in bonds, equity and derivatives of US$ 1 million according

You are a well-followed research analyst, and your investment team is asked to invest in bonds, equity and derivatives of US$ 1 million according to the required risk-return objective of your fund within 1 year. 1. In assets allocation, construct a US$1 million portfolio consisting of an equity portfolio of stocks and bond. Use portfolio theory to calculate expected return and standard deviation. (2 marks) 2. In selecting securities for your equity portfolio, use CAPM to create portfolio that possess the Beta according to your required risk-return objective. marks) 3. Use Top-down Approach in your security analysis to determine the intrinsic value of your selected stocks. (2 (2 marks) 4. Use technical indicator to show that you are following buy signals when you purchase your stocks. (2 marks) 5. Show projected estimated annual return for your strategy. (2 marks) 6. Project the worst case scenario of your investment plan. (2 marks) 7. Explain the risk involved.

Step by Step Solution

★★★★★

3.63 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

One risk associated with an investment is the ownership of the investment Equity derivatives allow t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started