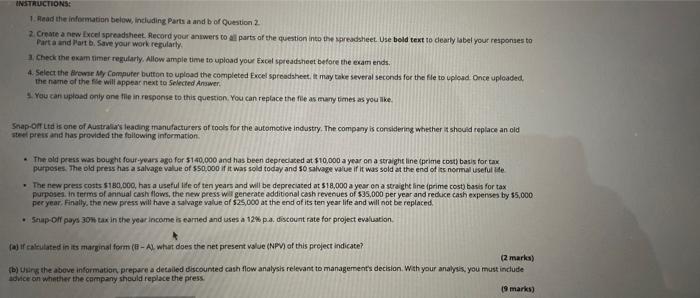

INSTRUCTIONS: 1. Read the information below, including Parts a and b of Question 2 2. Create a new Excel spreadsheet. Record your answers to all parts of the question into the spreadsheet. Use bold text to dearly label your responses to Parta and Part b. Save your work regularly 1. Check the exam timer regularly. Allow ample time to upload your Excel spreadsheet before the examends 4. Select the Browse My Computer button to upload the completed Excel spreadsheet. It may take several seconds for the file to upload Once uploaded the name of the file will appear next to Selected Answer You can upload only one fille in response to this question. You can replace the file as many times as you like. Snap-Off Ltd is one of Australia's leading manufacturers of tools for the automotive industry. The company is considering whether it should replace an old steel press and has provided the following information The old press was bought four years ago for $140,000 and has been depreciated at $10,000 a year on a straight line (prime cost) basis for tax purposes. The old press has a salvage value of $50,000 if it was sold today and So salvage value if it was sold at the end of its normal useful de The new press costs $180,000, has a useful life of ten years and will be depreciated at $18.000 a year on a straight line prime cost) basis for tax purposes in terms of annual cash flows, the new press wii generate additional cash revenues of $35,000 per year and reduce cash expenses by $5,000 per year. Finally, the new press will have a salvage value of $25,000 at the end of its ten year life and will not be replaced. Snap off pays 30% tax in the year income is eamed and uses a 12% pa, discount rate for project evaluation (acalculated in its marginal form (-A). what does the net present value (NPV) of this project indicate! (2 marks) (b) Ung the above information prepare a detailed discounted cash flow analysis relevant to managements decision with your analysis, you must include advice on whether the company should replace the press 19 marks) INSTRUCTIONS: 1. Read the information below, including Parts a and b of Question 2 2. Create a new Excel spreadsheet. Record your answers to all parts of the question into the spreadsheet. Use bold text to dearly label your responses to Parta and Part b. Save your work regularly 1. Check the exam timer regularly. Allow ample time to upload your Excel spreadsheet before the examends 4. Select the Browse My Computer button to upload the completed Excel spreadsheet. It may take several seconds for the file to upload Once uploaded the name of the file will appear next to Selected Answer You can upload only one fille in response to this question. You can replace the file as many times as you like. Snap-Off Ltd is one of Australia's leading manufacturers of tools for the automotive industry. The company is considering whether it should replace an old steel press and has provided the following information The old press was bought four years ago for $140,000 and has been depreciated at $10,000 a year on a straight line (prime cost) basis for tax purposes. The old press has a salvage value of $50,000 if it was sold today and So salvage value if it was sold at the end of its normal useful de The new press costs $180,000, has a useful life of ten years and will be depreciated at $18.000 a year on a straight line prime cost) basis for tax purposes in terms of annual cash flows, the new press wii generate additional cash revenues of $35,000 per year and reduce cash expenses by $5,000 per year. Finally, the new press will have a salvage value of $25,000 at the end of its ten year life and will not be replaced. Snap off pays 30% tax in the year income is eamed and uses a 12% pa, discount rate for project evaluation (acalculated in its marginal form (-A). what does the net present value (NPV) of this project indicate! (2 marks) (b) Ung the above information prepare a detailed discounted cash flow analysis relevant to managements decision with your analysis, you must include advice on whether the company should replace the press 19 marks)