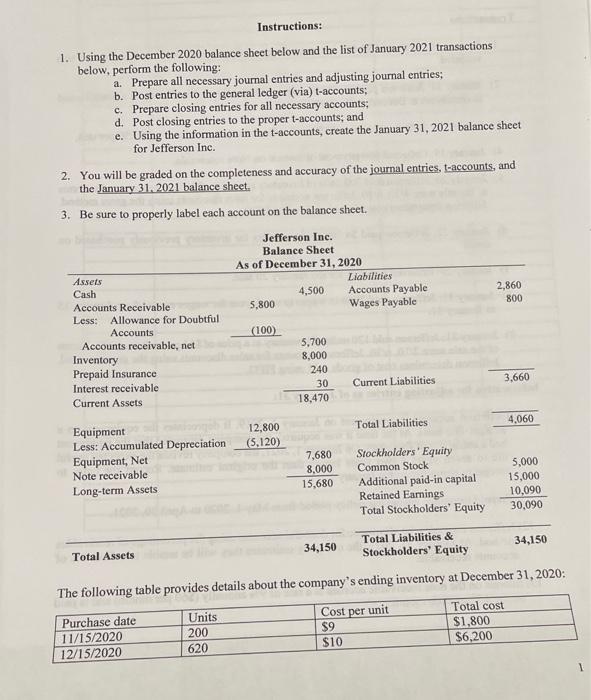

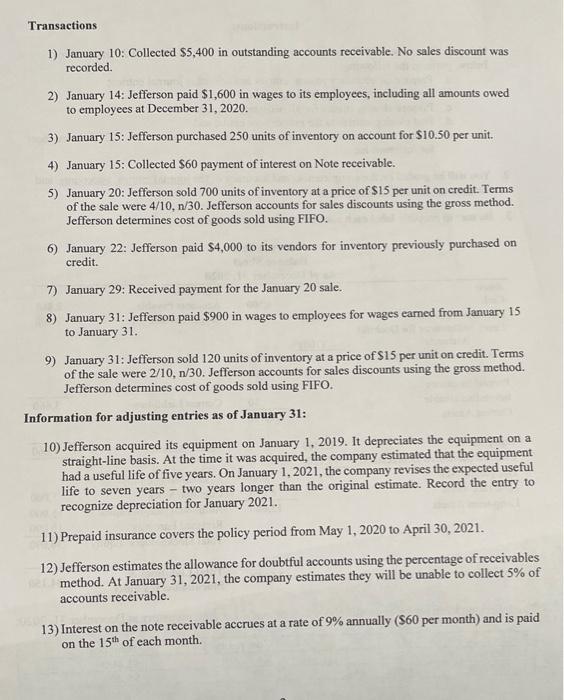

Instructions: 1. Using the December 2020 balance sheet below and the list of January 2021 transactions below, perform the following: a. Prepare all necessary journal entries and adjusting journal entries; b. Post entries to the general ledger (via) t-accounts; c. Prepare closing entries for all necessary accounts; d. Post closing entries to the proper t-accounts; and e. Using the information in the t-accounts, create the January 31, 2021 balance sheet for Jefferson Inc. 2. You will be graded on the completeness and accuracy of the journal entries. I-accounts, and the January 31, 2021 balance sheet. 3. Be sure to properly label each account on the balance sheet. Jefferson Inc. Balance Sheet As of December 31, 2020 Liabilities 4,500 Accounts Payable 5,800 Wages Payable 2,860 800 (100) Assets Cash Accounts Receivable Less: Allowance for Doubtful Accounts Accounts receivable, net Inventory Prepaid Insurance Interest receivable Current Assets 5,700 8,000 240 30 18,470 Current Liabilities 3,660 Total Liabilities 4,060 12,800 (5.120) Equipment Less: Accumulated Depreciation Equipment, Net Note receivable Long-term Assets 7,680 8.000 15,680 Stockholders' Equity Common Stock Additional paid-in capital Retained Earings Total Stockholders' Equity 5.000 15,000 10,090 30.090 Total Liabilities & Total Assets 34,150 34,150 Stockholders' Equity The following table provides details about the company's ending inventory at December 31, 2020: Purchase date 11/15/2020 12/15/2020 Units 200 620 Cost per unit $9 $10 Total cost $1,800 $6,200 1 Transactions 1) January 10: Collected $5,400 in outstanding accounts receivable. No sales discount was recorded. 2) January 14: Jefferson paid $1,600 in wages to its employees, including all amounts owed to employees at December 31, 2020. 3) January 15: Jefferson purchased 250 units of inventory on account for $10.50 per unit. 4) January 15: Collected $60 payment of interest on Note receivable. 5) January 20: Jefferson sold 700 units of inventory at a price of $15 per unit on credit. Terms of the sale were 4/10. n/30. Jefferson accounts for sales discounts using the gross method. Jefferson determines cost of goods sold using FIFO. 6) January 22: Jefferson paid $4,000 to its vendors for inventory previously purchased on credit. 7) January 29: Received payment for the January 20 sale. 8) January 31: Jefferson paid $900 in wages to employees for wages earned from January 15 to January 31. 9) January 31: Jefferson sold 120 units of inventory at a price of $15 per unit on credit. Terms of the sale were 2/10,n/30. Jefferson accounts for sales discounts using the gross method. Jefferson determines cost of goods sold using FIFO. Information for adjusting entries as of January 31: 10) Jefferson acquired its equipment on January 1, 2019. It depreciates the equipment on a straight-line basis. At the time it was acquired, the company estimated that the equipment had a useful life of five years. On January 1, 2021, the company revises the expected useful life to seven years - two years longer than the original estimate. Record the entry to recognize depreciation for January 2021. 11) Prepaid insurance covers the policy period from May 1, 2020 to April 30, 2021. 12) Jefferson estimates the allowance for doubtful accounts using the percentage of receivables method. At January 31, 2021, the company estimates they will be unable to collect 5% of accounts receivable. 13) Interest on the note receivable accrues at a rate of 9% annually (S60 per month) and is paid on the 15th of each month