Answered step by step

Verified Expert Solution

Question

1 Approved Answer

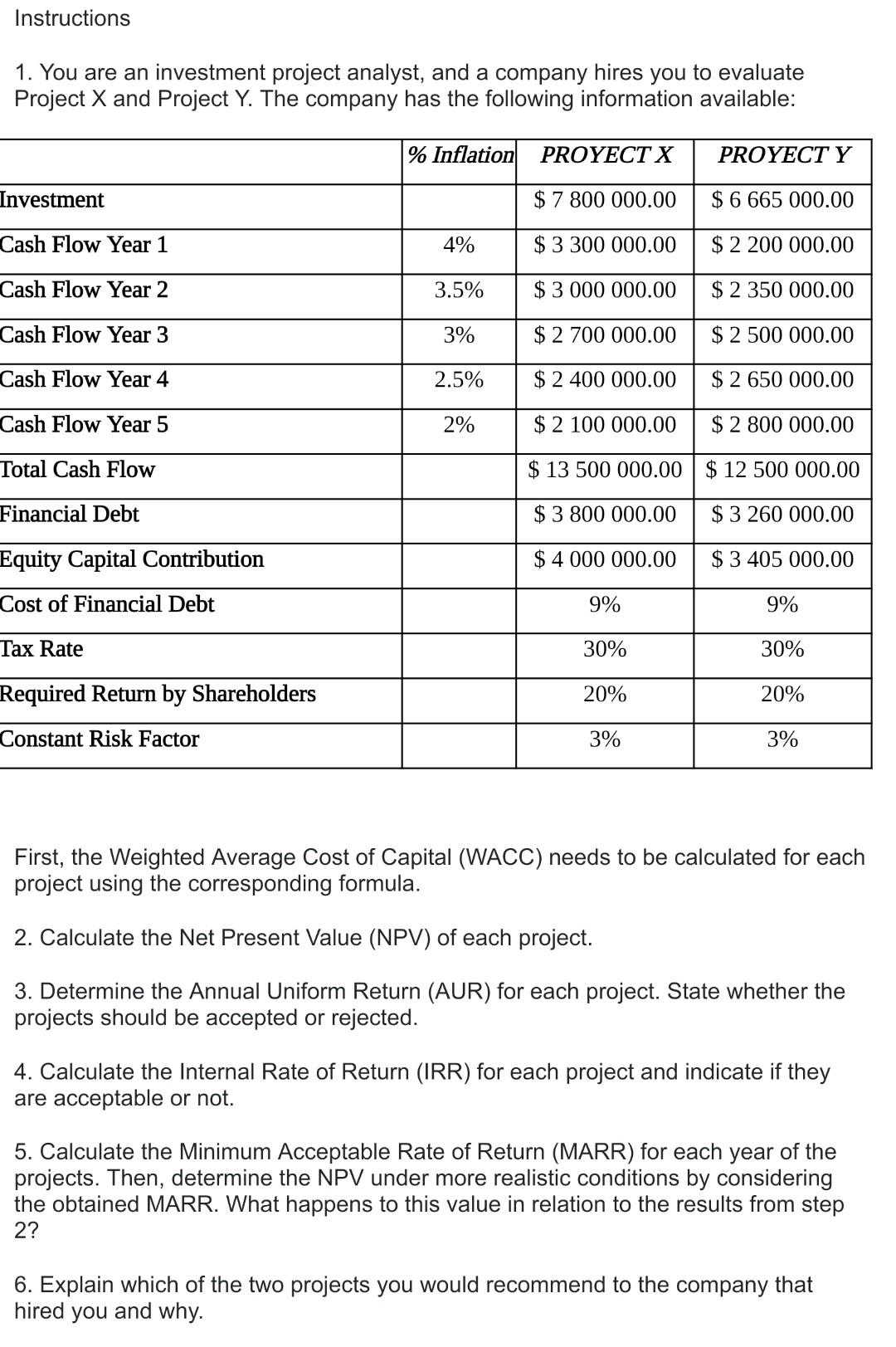

Instructions 1. You are an investment project analyst, and a company hires you to evaluate Project X and Project Y. The company has the following

Instructions 1. You are an investment project analyst, and a company hires you to evaluate Project X and Project Y. The company has the following information available: First, the Weighted Average Cost of Capital (WACC) needs to be calculated for each project using the corresponding formula. 2. Calculate the Net Present Value (NPV) of each project. 3. Determine the Annual Uniform Return (AUR) for each project. State whether the projects should be accepted or rejected. 4. Calculate the Internal Rate of Return (IRR) for each project and indicate if they are acceptable or not. 5. Calculate the Minimum Acceptable Rate of Return (MARR) for each year of the projects. Then, determine the NPV under more realistic conditions by considering the obtained MARR. What happens to this value in relation to the results from step 2? 6. Explain which of the two projects you would recommend to the company that hired you and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started