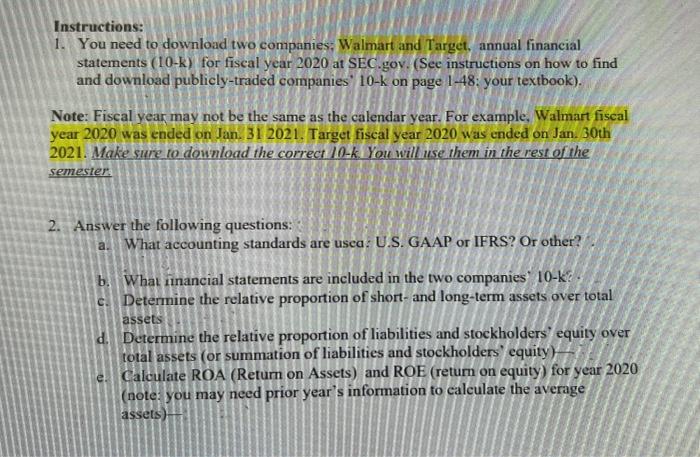

Instructions: 1. You need to download two companies, Walmart and Target, annual financial statements (10-k) for fiscal year 2020 at SEC.goy. (See instructions on how to find and download publicly-traded companies 10 - k on page 1-48; your textbook). Note: Fiscal year may not be the same as the calendar year. For example, Walmart fiscal year 2020 was ended on Jan. 31 2021. Target fiscal year 2020 was ended on Jan. 30 th 2021. Make sure to dounload the correct 10-k. You will use them in the rest of the semester: 2. Answer the following questions: a. What accounting standards are usea: U.S. GAAP or IFRS? Or other? b. What inancial statements are included in the two companies 10k ? c. Deternine the relative proportion of short-and long-term assets over total assets d. Determine the relative proportion of liabilities and stockholders/ equity over total assets (or summation of liabilities and stockholders equity) e. Calculate ROA (Return on Assets) and ROE (return on equity) for year 2020 (note: you may need prior year's information to calculate the average assets) Instructions: 1. You need to download two companies, Walmart and Target, annual financial statements (10-k) for fiscal year 2020 at SEC.goy. (See instructions on how to find and download publicly-traded companies 10 - k on page 1-48; your textbook). Note: Fiscal year may not be the same as the calendar year. For example, Walmart fiscal year 2020 was ended on Jan. 31 2021. Target fiscal year 2020 was ended on Jan. 30 th 2021. Make sure to dounload the correct 10-k. You will use them in the rest of the semester: 2. Answer the following questions: a. What accounting standards are usea: U.S. GAAP or IFRS? Or other? b. What inancial statements are included in the two companies 10k ? c. Deternine the relative proportion of short-and long-term assets over total assets d. Determine the relative proportion of liabilities and stockholders/ equity over total assets (or summation of liabilities and stockholders equity) e. Calculate ROA (Return on Assets) and ROE (return on equity) for year 2020 (note: you may need prior year's information to calculate the average assets)