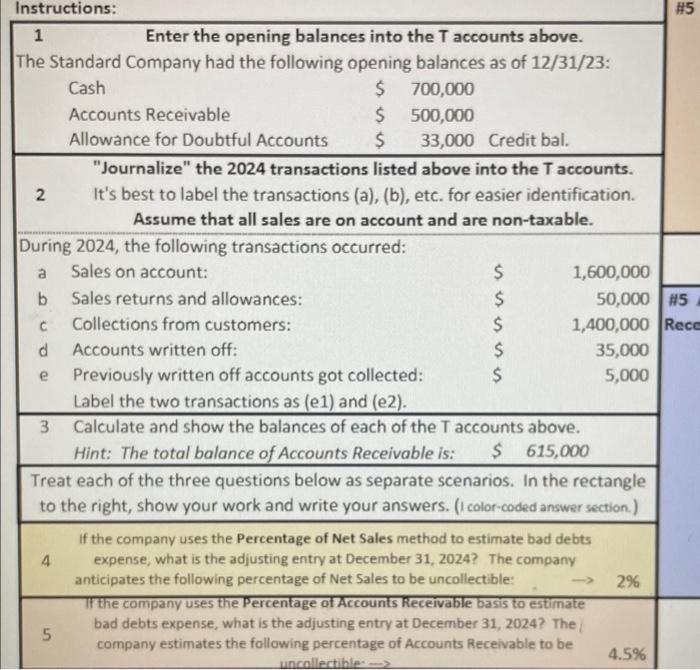

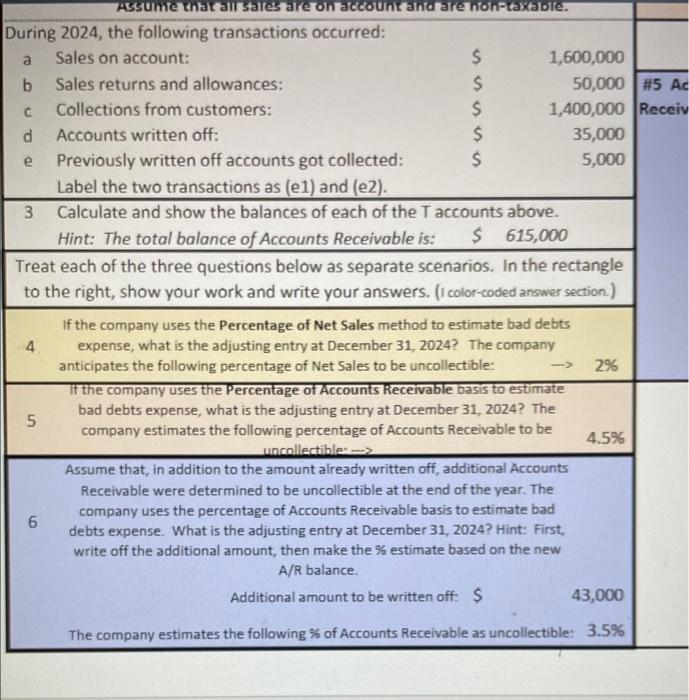

Instructions: 45 1 Enter the opening balances into the T accounts above. The Standard Company had the following opening balances as of 12/31/23: CashAccountsReceivable$700,000$500,000 Allowance for Doubtful Accounts \$33,000 Credit bal. "Journalize" the 2024 transactions listed above into the T accounts. 2 It's best to label the transactions (a), (b), etc. for easier identification. Assume that all sales are on account and are non-taxable. During 2024, the following transactions occurred: a Sales on account: b Sales returns and allowances: c Collections from customers: d Accounts written off: e Previously written off accounts got collected: Label the two transactions as (e1) and (e2). 3 Calculate and show the balances of each of the T accounts above. Hint: The total balance of Accounts Receivable is: $615,000 Treat each of the three questions below as separate scenarios. In the rectangle to the right, show your work and write your answers. (I color-coded answer section.) If the company uses the Percentage of Net Sales method to estimate bad debts 4 expense, what is the adjusting entry at December 31,2024 ? The company anticipates the following percentage of Net Sales to be uncollectible: 2% If the company uses the Percentage of Accounts Receivable basis to estimate bad debts expense, what is the adjusting entry at December 31, 2024? The / company estimates the following percentage of Accounts Receivable to be 4.5% During 2024, the following transactions occurred: a Sales on account: b Sales returns and allowances: c Collections from customers: d Accounts written off: e Previously written off accounts got collected: Label the two transactions as (e1) and (e2). 3 Calculate and show the balances of each of the T accounts above. Hint: The total balance of Accounts Receivable is: $615,000 Treat each of the three questions below as separate scenarios. In the rectangle to the right, show your work and write your answers. (I color-coded answer section.) If the company uses the Percentage of Net Sales method to estimate bad debts 4. expense, what is the adjusting entry at December 31,2024 ? The company anticipates the following percentage of Net Sales to be uncollectible: 2% If the company uses the Percentage of Accounts Receivable basis to estimate 5 bad debts expense, what is the adjusting entry at December 31, 2024? The company estimates the following percentage of Accounts Receivable to be Assume that, in addition to the amount already written off, additional Accounts Receivable were determined to be uncollectible at the end of the year. The 6 company uses the percentage of Accounts Receivable basis to estimate bad debts expense. What is the adjusting entry at December 31 , 2024? Hint: First, write off the additional amount, then make the % estimate based on the new A/R balance. Additional amount to be written off: S43,000 The company estimates the following % of Accounts Receivable as uncollectible: 3.5%