Answered step by step

Verified Expert Solution

Question

1 Approved Answer

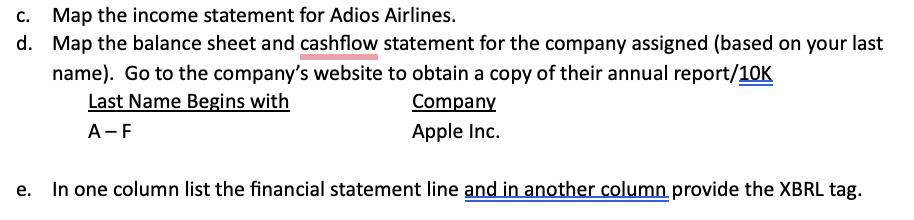

Instructions: a. Create a word document with three tables (income statement, balance sheet and cashflow statement). b. Use the USGAAP taxonomy available through FASB for

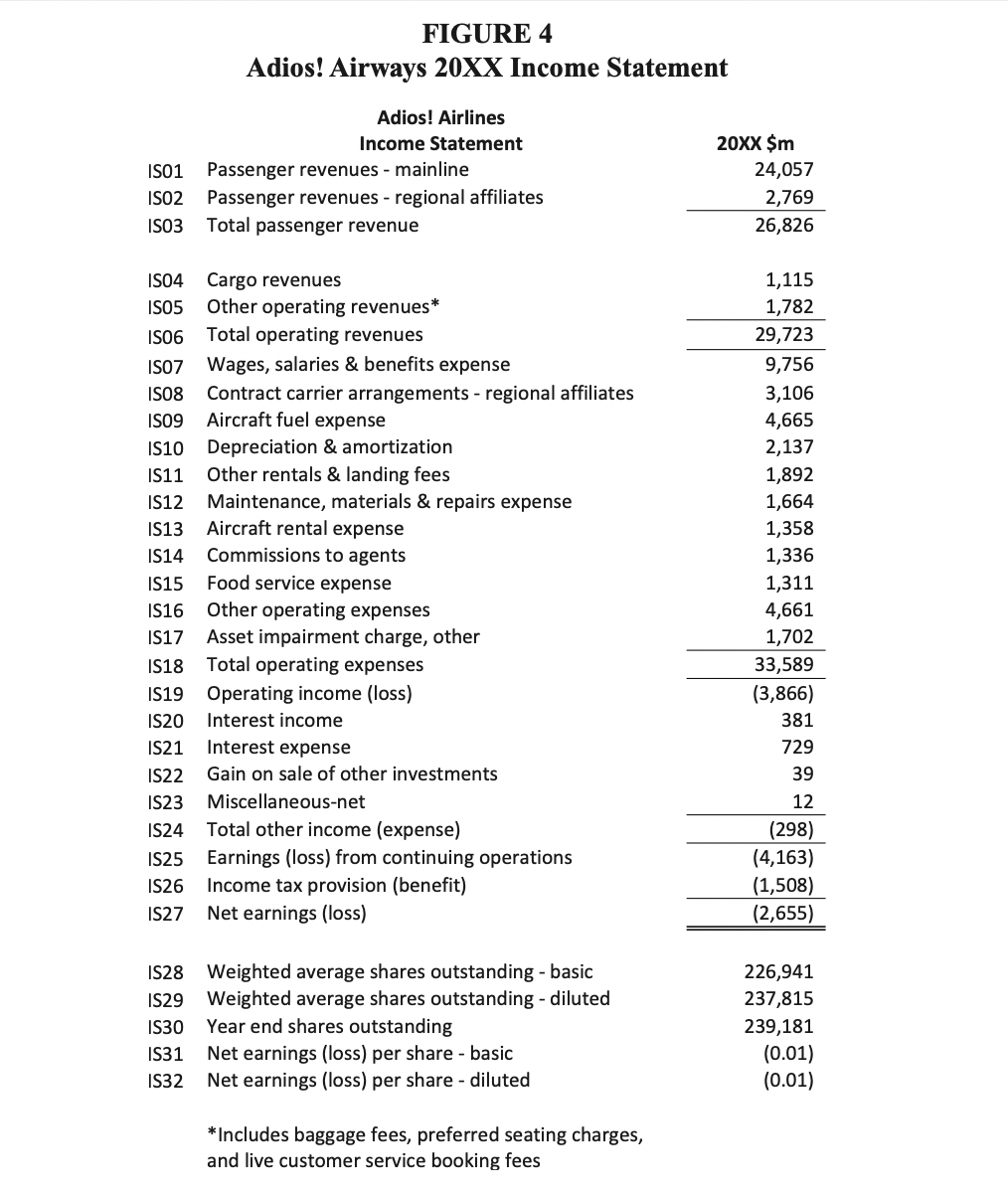

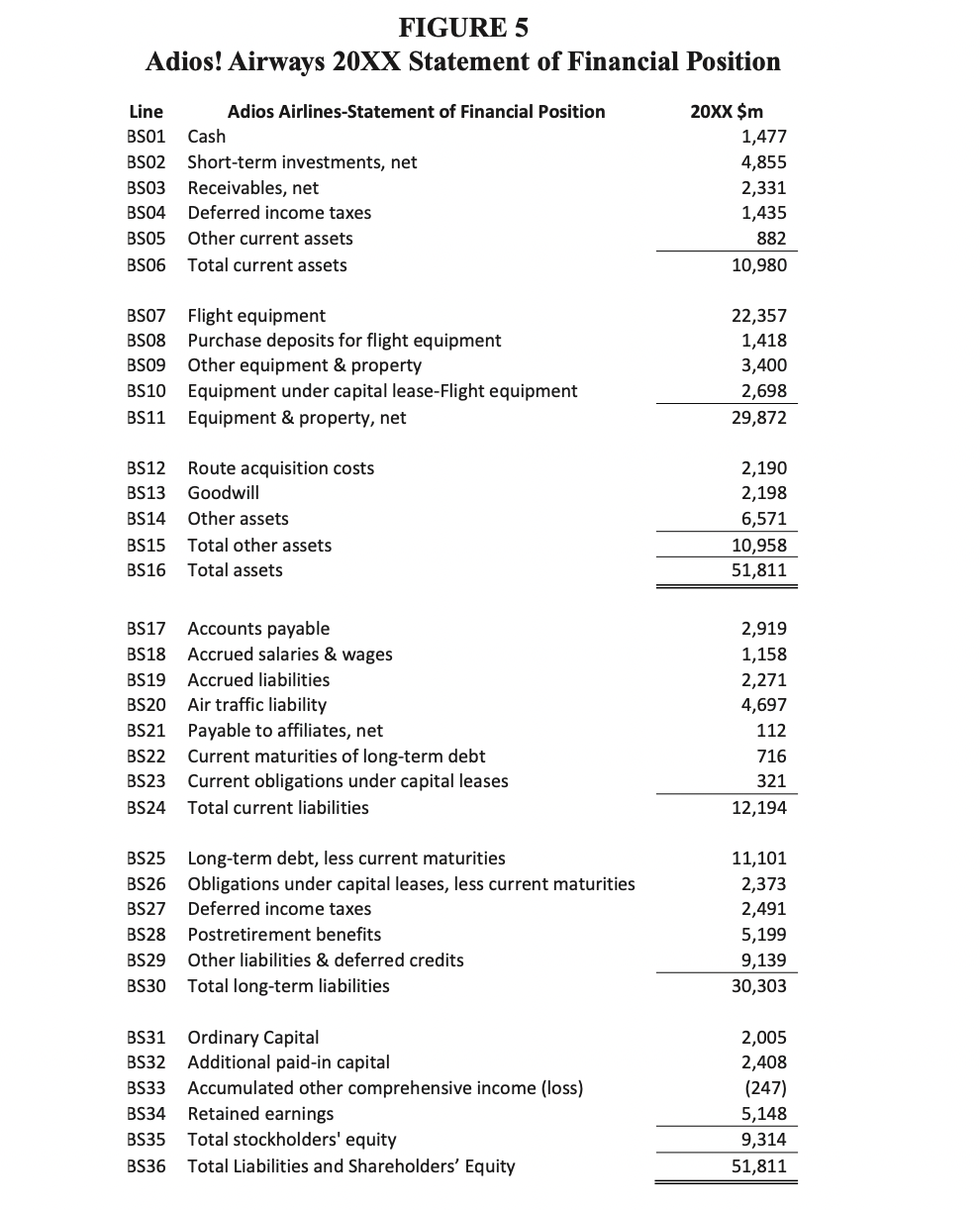

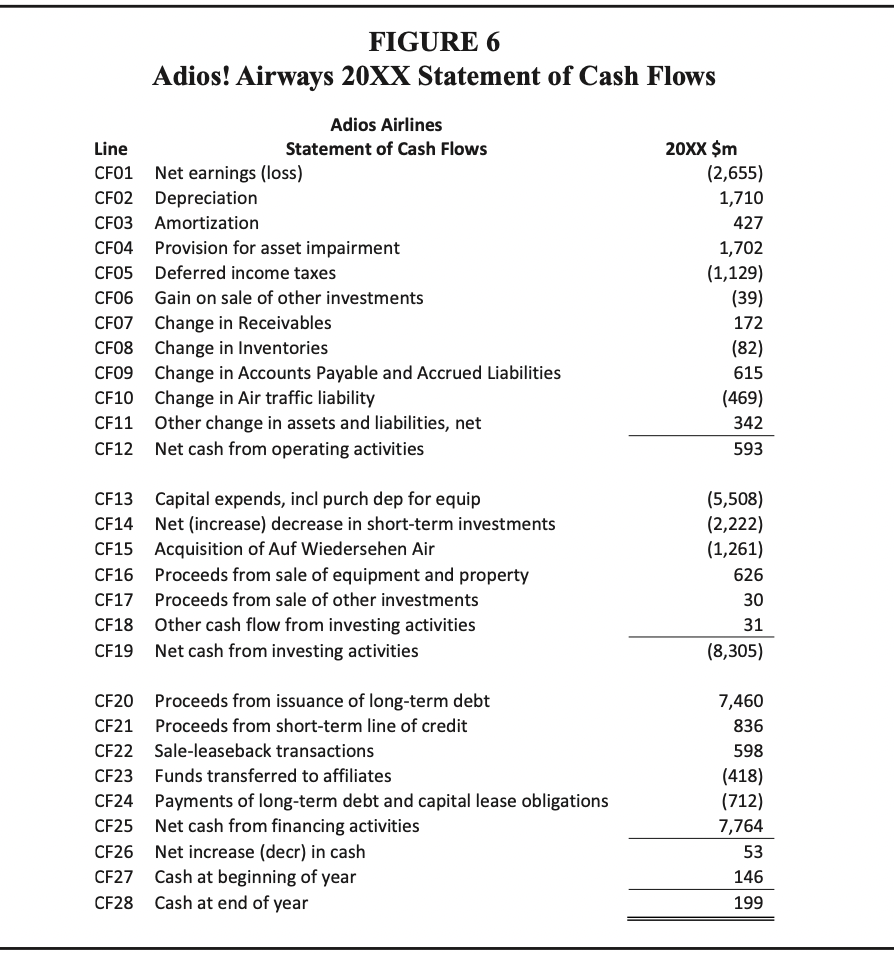

Instructions: a. Create a word document with three tables (income statement, balance sheet and cashflow statement). b. Use the USGAAP taxonomy available through FASB for steps c and d c. Map the income statement for Adios Airlines. d. Map the balance sheet and cashflow statement for the company assigned (based on your last name). Go to the company's website to obtain a copy of their annual report/10K Last Name Begins with AF Company Apple Inc. e. In one column list the financial statement line and in another column provide the XBRL tag. FIGURE 6 Adios! Airways 20XX Statement of Cash Flows \begin{tabular}{|c|c|c|} \hline Line & \begin{tabular}{c} Adios Airlines \\ Statement of Cash Flows \end{tabular} & 20xx$m \\ \hline CF01 & Net earnings (loss) & (2,655) \\ \hline CF02 & Depreciation & 1,710 \\ \hline CF03 & Amortization & 427 \\ \hline CF04 & Provision for asset impairment & 1,702 \\ \hline CF05 & Deferred income taxes & (1,129) \\ \hline CF06 & Gain on sale of other investments & (39) \\ \hline CF07 & Change in Receivables & 172 \\ \hline CF08 & Change in Inventories & (82) \\ \hline CF09 & Change in Accounts Payable and Accrued Liabilities & 615 \\ \hline CF10 & Change in Air traffic liability & (469) \\ \hline CF11 & Other change in assets and liabilities, net & 342 \\ \hline CF12 & Net cash from operating activities & 593 \\ \hline CF13 & Capital expends, incl purch dep for equip & (5,508) \\ \hline CF14 & Net (increase) decrease in short-term investments & (2,222) \\ \hline CF15 & Acquisition of Auf Wiedersehen Air & (1,261) \\ \hline CF16 & Proceeds from sale of equipment and property & 626 \\ \hline CF17 & Proceeds from sale of other investments & 30 \\ \hline CF18 & Other cash flow from investing activities & 31 \\ \hline CF19 & Net cash from investing activities & (8,305) \\ \hline CF20 & Proceeds from issuance of long-term debt & 7,460 \\ \hline CF21 & Proceeds from short-term line of credit & 836 \\ \hline CF22 & Sale-leaseback transactions & 598 \\ \hline CF23 & Funds transferred to affiliates & (418) \\ \hline CF24 & Payments of long-term debt and capital lease obligations & (712) \\ \hline CF25 & Net cash from financing activities & 7,764 \\ \hline CF26 & Net increase (decr) in cash & 53 \\ \hline CF27 & Cash at beginning of year & 146 \\ \hline CF28 & Cash at end of year & 199 \\ \hline \end{tabular} FIGURE 5 Adios! Airways 20XX Statement of Financial Position \begin{tabular}{|c|c|c|} \hline Line & Adios Airlines-Statement of Financial Position & 20xx$m \\ \hline BS01 & Cash & 1,477 \\ \hline BSO2 & Short-term investments, net & 4,855 \\ \hline BS03 & Receivables, net & 2,331 \\ \hline BS04 & Deferred income taxes & 1,435 \\ \hline BS05 & Other current assets & 882 \\ \hline BS06 & Total current assets & 10,980 \\ \hline BS07 & Flight equipment & 22,357 \\ \hline BS08 & Purchase deposits for flight equipment & 1,418 \\ \hline BS09 & Other equipment \& property & 3,400 \\ \hline BS10 & Equipment under capital lease-Flight equipment & 2,698 \\ \hline BS11 & Equipment \& property, net & 29,872 \\ \hline BS12 & Route acquisition costs & 2,190 \\ \hline BS13 & Goodwill & 2,198 \\ \hline BS14 & Other assets & 6,571 \\ \hline BS15 & Total other assets & 10,958 \\ \hline BS16 & Total assets & 51,811 \\ \hline BS17 & Accounts payable & 2,919 \\ \hline BS18 & Accrued salaries \& wages & 1,158 \\ \hline BS19 & Accrued liabilities & 2,271 \\ \hline BS20 & Air traffic liability & 4,697 \\ \hline BS21 & Payable to affiliates, net & 112 \\ \hline BS22 & Current maturities of long-term debt & 716 \\ \hline BS23 & Current obligations under capital leases & 321 \\ \hline BS24 & Total current liabilities & 12,194 \\ \hline BS25 & Long-term debt, less current maturities & 11,101 \\ \hline BS26 & Obligations under capital leases, less current maturities & 2,373 \\ \hline BS27 & Deferred income taxes & 2,491 \\ \hline BS28 & Postretirement benefits & 5,199 \\ \hline BS29 & Other liabilities \& deferred credits & 9,139 \\ \hline BS30 & Total long-term liabilities & 30,303 \\ \hline BS31 & Ordinary Capital & 2,005 \\ \hline BS32 & Additional paid-in capital & 2,408 \\ \hline BS33 & Accumulated other comprehensive income (loss) & (247) \\ \hline BS34 & Retained earnings & 5,148 \\ \hline BS35 & Total stockholders' equity & 9,314 \\ \hline BS36 & Total Liabilities and Shareholders' Equity & 51,811 \\ \hline \end{tabular} FIGITRF, 4 Instructions: a. Create a word document with three tables (income statement, balance sheet and cashflow statement). b. Use the USGAAP taxonomy available through FASB for steps c and d c. Map the income statement for Adios Airlines. d. Map the balance sheet and cashflow statement for the company assigned (based on your last name). Go to the company's website to obtain a copy of their annual report/10K Last Name Begins with AF Company Apple Inc. e. In one column list the financial statement line and in another column provide the XBRL tag. FIGURE 6 Adios! Airways 20XX Statement of Cash Flows \begin{tabular}{|c|c|c|} \hline Line & \begin{tabular}{c} Adios Airlines \\ Statement of Cash Flows \end{tabular} & 20xx$m \\ \hline CF01 & Net earnings (loss) & (2,655) \\ \hline CF02 & Depreciation & 1,710 \\ \hline CF03 & Amortization & 427 \\ \hline CF04 & Provision for asset impairment & 1,702 \\ \hline CF05 & Deferred income taxes & (1,129) \\ \hline CF06 & Gain on sale of other investments & (39) \\ \hline CF07 & Change in Receivables & 172 \\ \hline CF08 & Change in Inventories & (82) \\ \hline CF09 & Change in Accounts Payable and Accrued Liabilities & 615 \\ \hline CF10 & Change in Air traffic liability & (469) \\ \hline CF11 & Other change in assets and liabilities, net & 342 \\ \hline CF12 & Net cash from operating activities & 593 \\ \hline CF13 & Capital expends, incl purch dep for equip & (5,508) \\ \hline CF14 & Net (increase) decrease in short-term investments & (2,222) \\ \hline CF15 & Acquisition of Auf Wiedersehen Air & (1,261) \\ \hline CF16 & Proceeds from sale of equipment and property & 626 \\ \hline CF17 & Proceeds from sale of other investments & 30 \\ \hline CF18 & Other cash flow from investing activities & 31 \\ \hline CF19 & Net cash from investing activities & (8,305) \\ \hline CF20 & Proceeds from issuance of long-term debt & 7,460 \\ \hline CF21 & Proceeds from short-term line of credit & 836 \\ \hline CF22 & Sale-leaseback transactions & 598 \\ \hline CF23 & Funds transferred to affiliates & (418) \\ \hline CF24 & Payments of long-term debt and capital lease obligations & (712) \\ \hline CF25 & Net cash from financing activities & 7,764 \\ \hline CF26 & Net increase (decr) in cash & 53 \\ \hline CF27 & Cash at beginning of year & 146 \\ \hline CF28 & Cash at end of year & 199 \\ \hline \end{tabular} FIGURE 5 Adios! Airways 20XX Statement of Financial Position \begin{tabular}{|c|c|c|} \hline Line & Adios Airlines-Statement of Financial Position & 20xx$m \\ \hline BS01 & Cash & 1,477 \\ \hline BSO2 & Short-term investments, net & 4,855 \\ \hline BS03 & Receivables, net & 2,331 \\ \hline BS04 & Deferred income taxes & 1,435 \\ \hline BS05 & Other current assets & 882 \\ \hline BS06 & Total current assets & 10,980 \\ \hline BS07 & Flight equipment & 22,357 \\ \hline BS08 & Purchase deposits for flight equipment & 1,418 \\ \hline BS09 & Other equipment \& property & 3,400 \\ \hline BS10 & Equipment under capital lease-Flight equipment & 2,698 \\ \hline BS11 & Equipment \& property, net & 29,872 \\ \hline BS12 & Route acquisition costs & 2,190 \\ \hline BS13 & Goodwill & 2,198 \\ \hline BS14 & Other assets & 6,571 \\ \hline BS15 & Total other assets & 10,958 \\ \hline BS16 & Total assets & 51,811 \\ \hline BS17 & Accounts payable & 2,919 \\ \hline BS18 & Accrued salaries \& wages & 1,158 \\ \hline BS19 & Accrued liabilities & 2,271 \\ \hline BS20 & Air traffic liability & 4,697 \\ \hline BS21 & Payable to affiliates, net & 112 \\ \hline BS22 & Current maturities of long-term debt & 716 \\ \hline BS23 & Current obligations under capital leases & 321 \\ \hline BS24 & Total current liabilities & 12,194 \\ \hline BS25 & Long-term debt, less current maturities & 11,101 \\ \hline BS26 & Obligations under capital leases, less current maturities & 2,373 \\ \hline BS27 & Deferred income taxes & 2,491 \\ \hline BS28 & Postretirement benefits & 5,199 \\ \hline BS29 & Other liabilities \& deferred credits & 9,139 \\ \hline BS30 & Total long-term liabilities & 30,303 \\ \hline BS31 & Ordinary Capital & 2,005 \\ \hline BS32 & Additional paid-in capital & 2,408 \\ \hline BS33 & Accumulated other comprehensive income (loss) & (247) \\ \hline BS34 & Retained earnings & 5,148 \\ \hline BS35 & Total stockholders' equity & 9,314 \\ \hline BS36 & Total Liabilities and Shareholders' Equity & 51,811 \\ \hline \end{tabular} FIGITRF, 4

Instructions: a. Create a word document with three tables (income statement, balance sheet and cashflow statement). b. Use the USGAAP taxonomy available through FASB for steps c and d c. Map the income statement for Adios Airlines. d. Map the balance sheet and cashflow statement for the company assigned (based on your last name). Go to the company's website to obtain a copy of their annual report/10K Last Name Begins with AF Company Apple Inc. e. In one column list the financial statement line and in another column provide the XBRL tag. FIGURE 6 Adios! Airways 20XX Statement of Cash Flows \begin{tabular}{|c|c|c|} \hline Line & \begin{tabular}{c} Adios Airlines \\ Statement of Cash Flows \end{tabular} & 20xx$m \\ \hline CF01 & Net earnings (loss) & (2,655) \\ \hline CF02 & Depreciation & 1,710 \\ \hline CF03 & Amortization & 427 \\ \hline CF04 & Provision for asset impairment & 1,702 \\ \hline CF05 & Deferred income taxes & (1,129) \\ \hline CF06 & Gain on sale of other investments & (39) \\ \hline CF07 & Change in Receivables & 172 \\ \hline CF08 & Change in Inventories & (82) \\ \hline CF09 & Change in Accounts Payable and Accrued Liabilities & 615 \\ \hline CF10 & Change in Air traffic liability & (469) \\ \hline CF11 & Other change in assets and liabilities, net & 342 \\ \hline CF12 & Net cash from operating activities & 593 \\ \hline CF13 & Capital expends, incl purch dep for equip & (5,508) \\ \hline CF14 & Net (increase) decrease in short-term investments & (2,222) \\ \hline CF15 & Acquisition of Auf Wiedersehen Air & (1,261) \\ \hline CF16 & Proceeds from sale of equipment and property & 626 \\ \hline CF17 & Proceeds from sale of other investments & 30 \\ \hline CF18 & Other cash flow from investing activities & 31 \\ \hline CF19 & Net cash from investing activities & (8,305) \\ \hline CF20 & Proceeds from issuance of long-term debt & 7,460 \\ \hline CF21 & Proceeds from short-term line of credit & 836 \\ \hline CF22 & Sale-leaseback transactions & 598 \\ \hline CF23 & Funds transferred to affiliates & (418) \\ \hline CF24 & Payments of long-term debt and capital lease obligations & (712) \\ \hline CF25 & Net cash from financing activities & 7,764 \\ \hline CF26 & Net increase (decr) in cash & 53 \\ \hline CF27 & Cash at beginning of year & 146 \\ \hline CF28 & Cash at end of year & 199 \\ \hline \end{tabular} FIGURE 5 Adios! Airways 20XX Statement of Financial Position \begin{tabular}{|c|c|c|} \hline Line & Adios Airlines-Statement of Financial Position & 20xx$m \\ \hline BS01 & Cash & 1,477 \\ \hline BSO2 & Short-term investments, net & 4,855 \\ \hline BS03 & Receivables, net & 2,331 \\ \hline BS04 & Deferred income taxes & 1,435 \\ \hline BS05 & Other current assets & 882 \\ \hline BS06 & Total current assets & 10,980 \\ \hline BS07 & Flight equipment & 22,357 \\ \hline BS08 & Purchase deposits for flight equipment & 1,418 \\ \hline BS09 & Other equipment \& property & 3,400 \\ \hline BS10 & Equipment under capital lease-Flight equipment & 2,698 \\ \hline BS11 & Equipment \& property, net & 29,872 \\ \hline BS12 & Route acquisition costs & 2,190 \\ \hline BS13 & Goodwill & 2,198 \\ \hline BS14 & Other assets & 6,571 \\ \hline BS15 & Total other assets & 10,958 \\ \hline BS16 & Total assets & 51,811 \\ \hline BS17 & Accounts payable & 2,919 \\ \hline BS18 & Accrued salaries \& wages & 1,158 \\ \hline BS19 & Accrued liabilities & 2,271 \\ \hline BS20 & Air traffic liability & 4,697 \\ \hline BS21 & Payable to affiliates, net & 112 \\ \hline BS22 & Current maturities of long-term debt & 716 \\ \hline BS23 & Current obligations under capital leases & 321 \\ \hline BS24 & Total current liabilities & 12,194 \\ \hline BS25 & Long-term debt, less current maturities & 11,101 \\ \hline BS26 & Obligations under capital leases, less current maturities & 2,373 \\ \hline BS27 & Deferred income taxes & 2,491 \\ \hline BS28 & Postretirement benefits & 5,199 \\ \hline BS29 & Other liabilities \& deferred credits & 9,139 \\ \hline BS30 & Total long-term liabilities & 30,303 \\ \hline BS31 & Ordinary Capital & 2,005 \\ \hline BS32 & Additional paid-in capital & 2,408 \\ \hline BS33 & Accumulated other comprehensive income (loss) & (247) \\ \hline BS34 & Retained earnings & 5,148 \\ \hline BS35 & Total stockholders' equity & 9,314 \\ \hline BS36 & Total Liabilities and Shareholders' Equity & 51,811 \\ \hline \end{tabular} FIGITRF, 4 Instructions: a. Create a word document with three tables (income statement, balance sheet and cashflow statement). b. Use the USGAAP taxonomy available through FASB for steps c and d c. Map the income statement for Adios Airlines. d. Map the balance sheet and cashflow statement for the company assigned (based on your last name). Go to the company's website to obtain a copy of their annual report/10K Last Name Begins with AF Company Apple Inc. e. In one column list the financial statement line and in another column provide the XBRL tag. FIGURE 6 Adios! Airways 20XX Statement of Cash Flows \begin{tabular}{|c|c|c|} \hline Line & \begin{tabular}{c} Adios Airlines \\ Statement of Cash Flows \end{tabular} & 20xx$m \\ \hline CF01 & Net earnings (loss) & (2,655) \\ \hline CF02 & Depreciation & 1,710 \\ \hline CF03 & Amortization & 427 \\ \hline CF04 & Provision for asset impairment & 1,702 \\ \hline CF05 & Deferred income taxes & (1,129) \\ \hline CF06 & Gain on sale of other investments & (39) \\ \hline CF07 & Change in Receivables & 172 \\ \hline CF08 & Change in Inventories & (82) \\ \hline CF09 & Change in Accounts Payable and Accrued Liabilities & 615 \\ \hline CF10 & Change in Air traffic liability & (469) \\ \hline CF11 & Other change in assets and liabilities, net & 342 \\ \hline CF12 & Net cash from operating activities & 593 \\ \hline CF13 & Capital expends, incl purch dep for equip & (5,508) \\ \hline CF14 & Net (increase) decrease in short-term investments & (2,222) \\ \hline CF15 & Acquisition of Auf Wiedersehen Air & (1,261) \\ \hline CF16 & Proceeds from sale of equipment and property & 626 \\ \hline CF17 & Proceeds from sale of other investments & 30 \\ \hline CF18 & Other cash flow from investing activities & 31 \\ \hline CF19 & Net cash from investing activities & (8,305) \\ \hline CF20 & Proceeds from issuance of long-term debt & 7,460 \\ \hline CF21 & Proceeds from short-term line of credit & 836 \\ \hline CF22 & Sale-leaseback transactions & 598 \\ \hline CF23 & Funds transferred to affiliates & (418) \\ \hline CF24 & Payments of long-term debt and capital lease obligations & (712) \\ \hline CF25 & Net cash from financing activities & 7,764 \\ \hline CF26 & Net increase (decr) in cash & 53 \\ \hline CF27 & Cash at beginning of year & 146 \\ \hline CF28 & Cash at end of year & 199 \\ \hline \end{tabular} FIGURE 5 Adios! Airways 20XX Statement of Financial Position \begin{tabular}{|c|c|c|} \hline Line & Adios Airlines-Statement of Financial Position & 20xx$m \\ \hline BS01 & Cash & 1,477 \\ \hline BSO2 & Short-term investments, net & 4,855 \\ \hline BS03 & Receivables, net & 2,331 \\ \hline BS04 & Deferred income taxes & 1,435 \\ \hline BS05 & Other current assets & 882 \\ \hline BS06 & Total current assets & 10,980 \\ \hline BS07 & Flight equipment & 22,357 \\ \hline BS08 & Purchase deposits for flight equipment & 1,418 \\ \hline BS09 & Other equipment \& property & 3,400 \\ \hline BS10 & Equipment under capital lease-Flight equipment & 2,698 \\ \hline BS11 & Equipment \& property, net & 29,872 \\ \hline BS12 & Route acquisition costs & 2,190 \\ \hline BS13 & Goodwill & 2,198 \\ \hline BS14 & Other assets & 6,571 \\ \hline BS15 & Total other assets & 10,958 \\ \hline BS16 & Total assets & 51,811 \\ \hline BS17 & Accounts payable & 2,919 \\ \hline BS18 & Accrued salaries \& wages & 1,158 \\ \hline BS19 & Accrued liabilities & 2,271 \\ \hline BS20 & Air traffic liability & 4,697 \\ \hline BS21 & Payable to affiliates, net & 112 \\ \hline BS22 & Current maturities of long-term debt & 716 \\ \hline BS23 & Current obligations under capital leases & 321 \\ \hline BS24 & Total current liabilities & 12,194 \\ \hline BS25 & Long-term debt, less current maturities & 11,101 \\ \hline BS26 & Obligations under capital leases, less current maturities & 2,373 \\ \hline BS27 & Deferred income taxes & 2,491 \\ \hline BS28 & Postretirement benefits & 5,199 \\ \hline BS29 & Other liabilities \& deferred credits & 9,139 \\ \hline BS30 & Total long-term liabilities & 30,303 \\ \hline BS31 & Ordinary Capital & 2,005 \\ \hline BS32 & Additional paid-in capital & 2,408 \\ \hline BS33 & Accumulated other comprehensive income (loss) & (247) \\ \hline BS34 & Retained earnings & 5,148 \\ \hline BS35 & Total stockholders' equity & 9,314 \\ \hline BS36 & Total Liabilities and Shareholders' Equity & 51,811 \\ \hline \end{tabular} FIGITRF, 4 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started