Answered step by step

Verified Expert Solution

Question

1 Approved Answer

John Marshall is employed as a bank loan officer for First State Bank. He is comparing two companies that have applied for loans, and

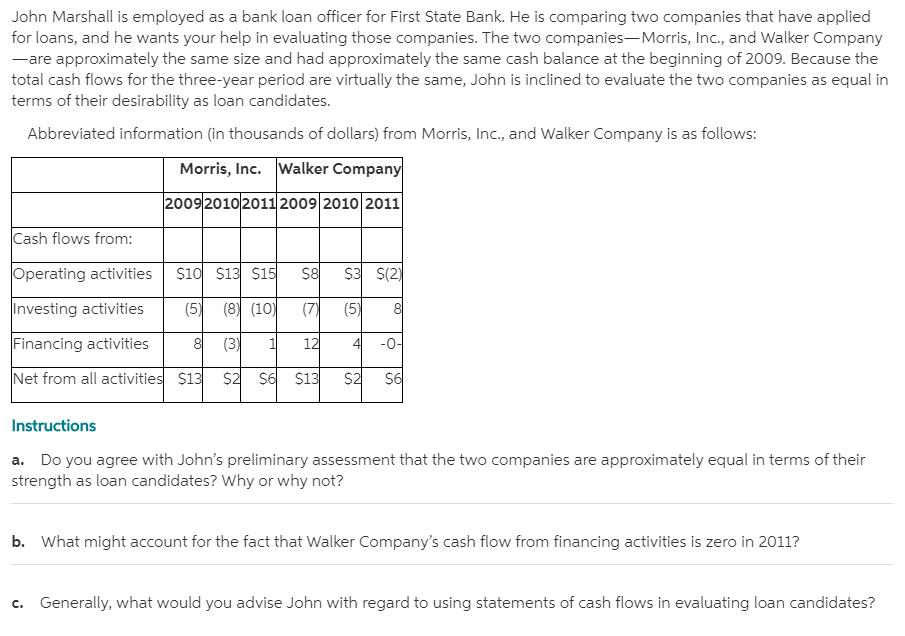

John Marshall is employed as a bank loan officer for First State Bank. He is comparing two companies that have applied for loans, and he wants your help in evaluating those companies. The two companies-Morris, Inc., and Walker Company -are approximately the same size and had approximately the same cash balance at the beginning of 2009. Because the total cash flows for the three-year period are virtually the same, John is inclined to evaluate the two companies as equal in terms of their desirability as loan candidates. Abbreviated information (in thousands of dollars) from Morris, Inc., and Walker Company is as follows: Morris, Inc. Walker Company 200920102011 2009 2010 2011 Cash flows from: Operating activities $10 $13 $15 $8 $3 S(2) Investing activities (5) (8) (10) (7) (5) 8 Financing activities 8| (3) 1 12 -0- Net from all activities $13 $2 s6 $13 $2 S6 Instructions a. Do you agree with John's preliminary assessment that the two companies are approximately equal in terms of their strength as loan candidates? Why or why not? b. What might account for the fact that Walker Company's cash flow from financing activities is zero in 2011? c. Generally, what would you advise John with regard to using statements of cash flows in evaluating loan candidates? 41

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started